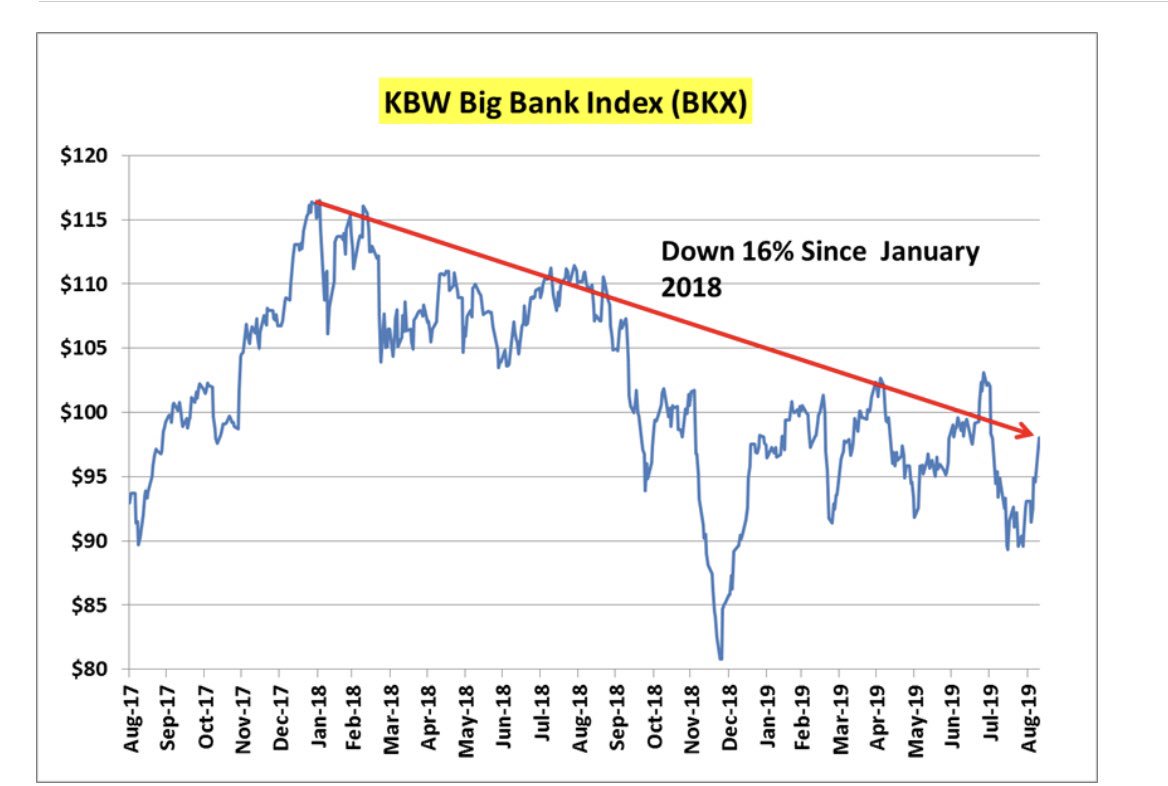

#LateCycle

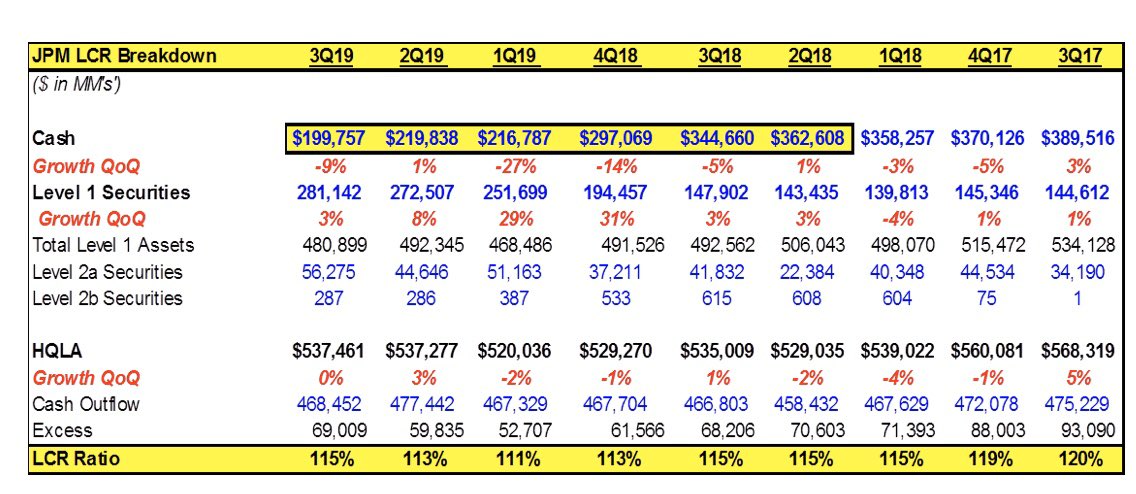

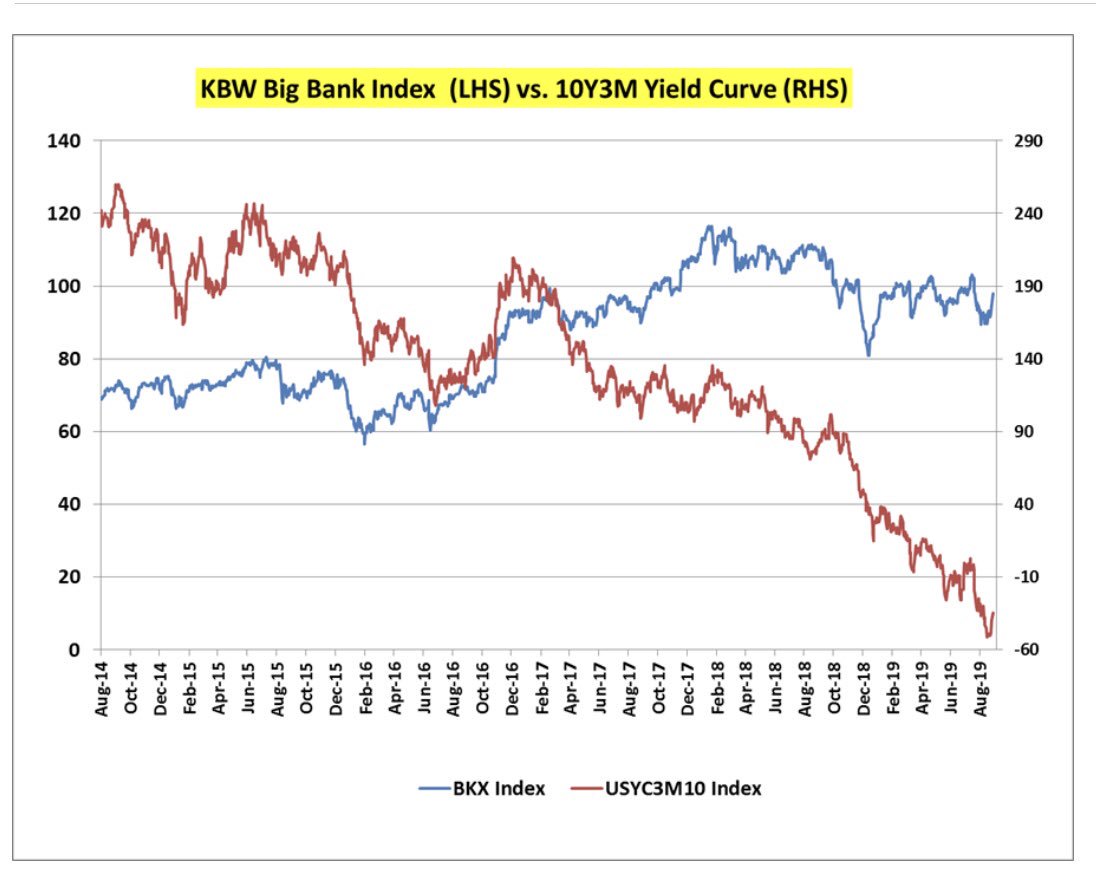

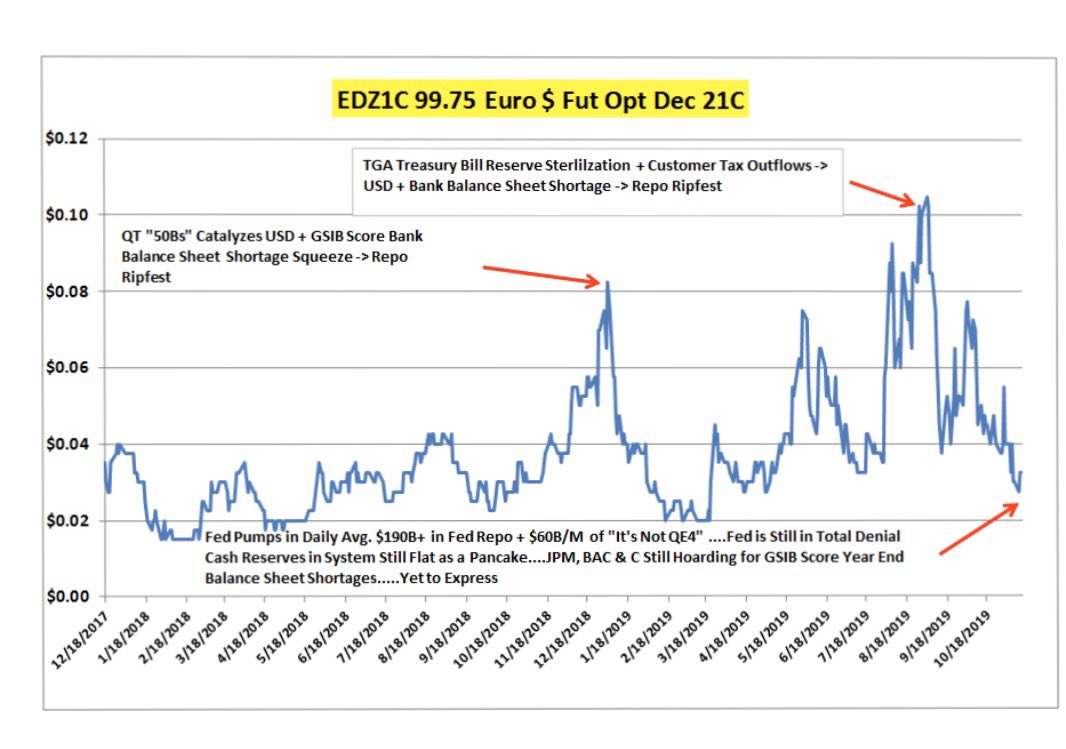

#BalanceSheet #GSIBSurcharge

bloomberg.com/news/articles/…

@RaoulGMI @MacroMorning @GS_CapSF

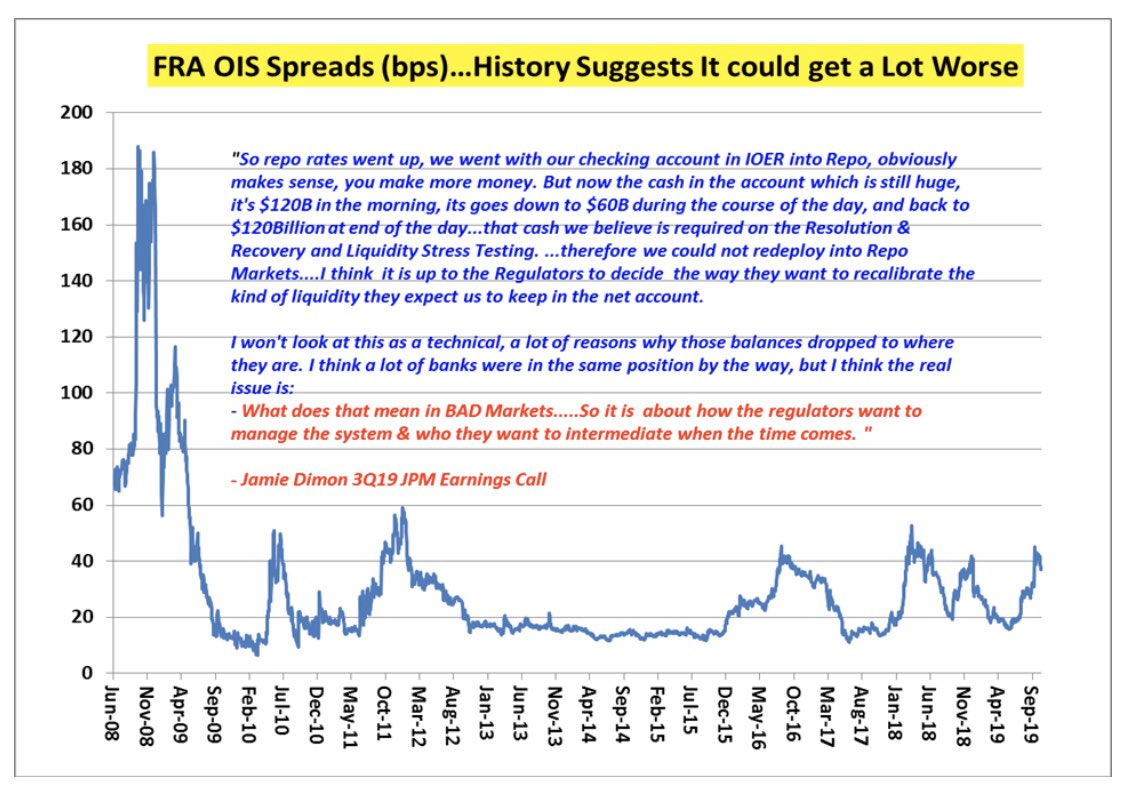

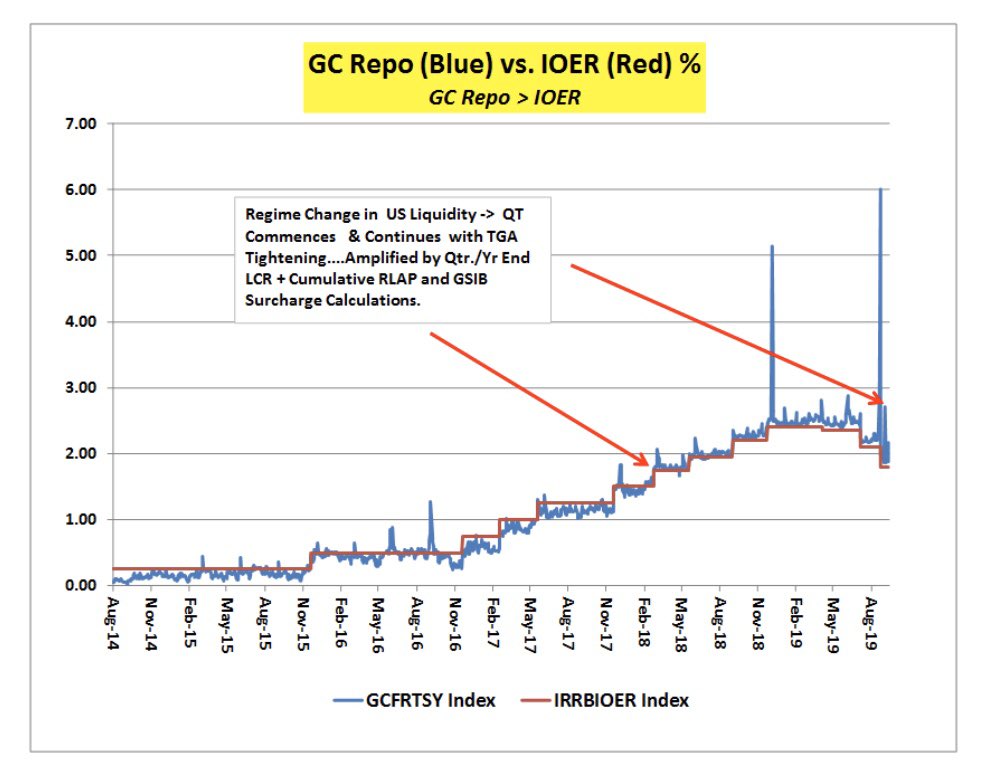

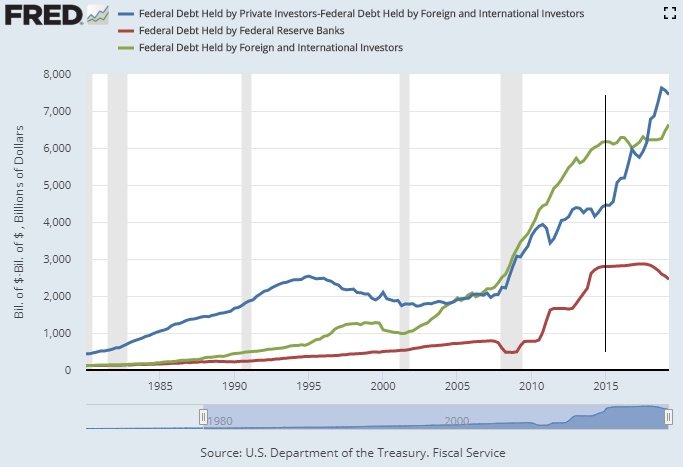

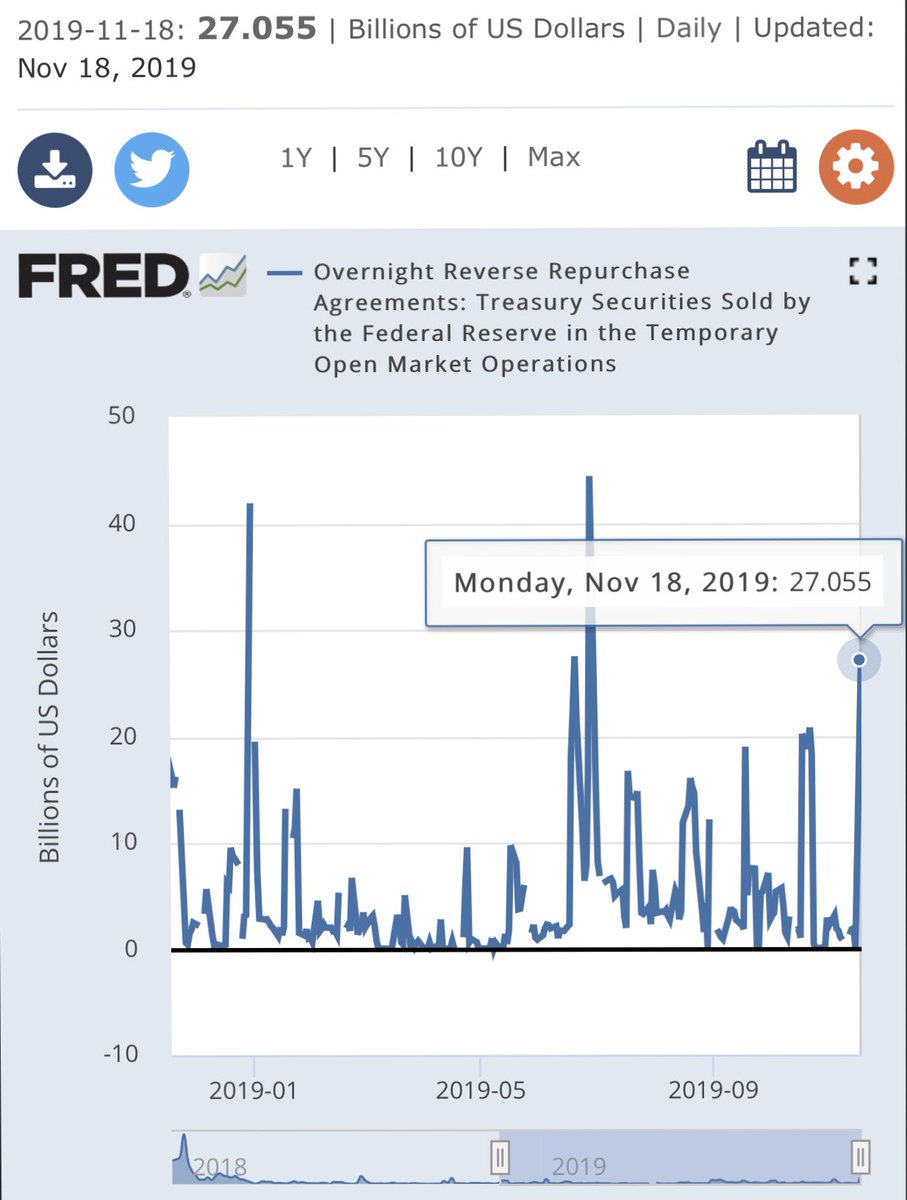

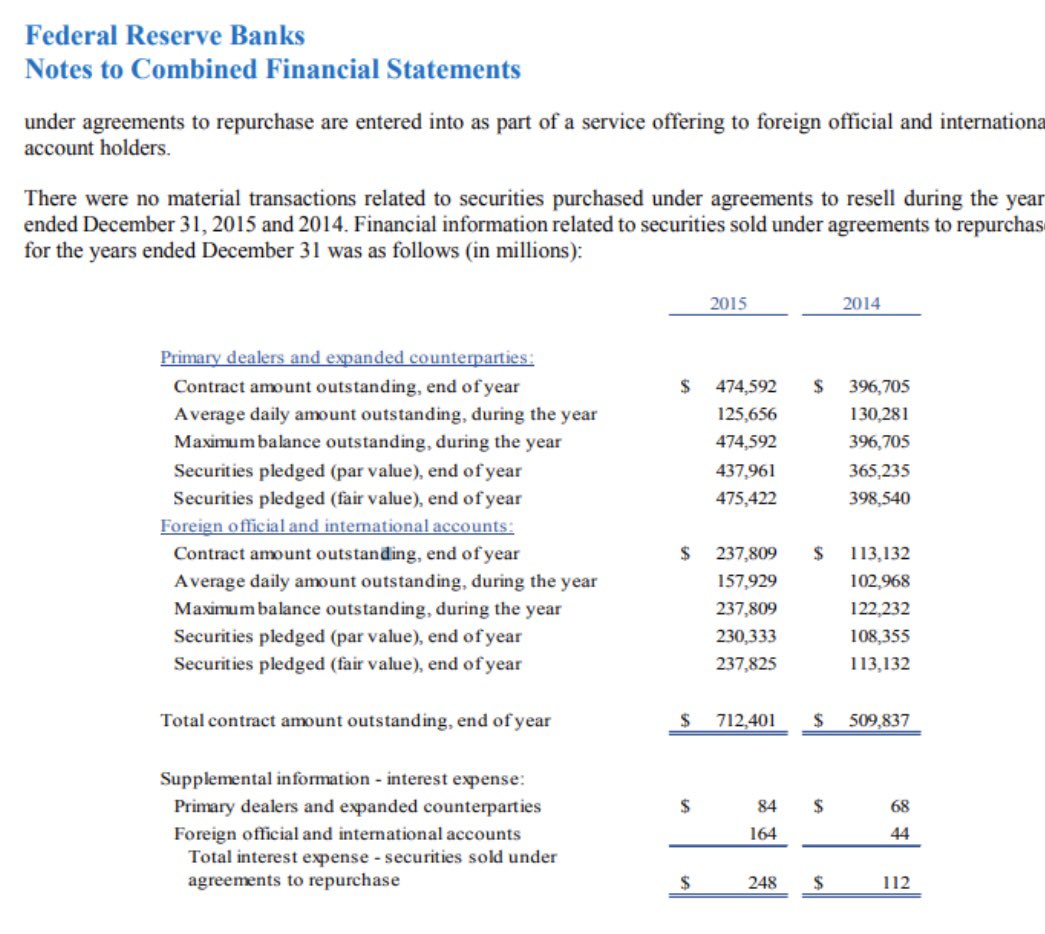

Fed RRP Usage now spiking way over & above normal usage spike from GSE P&I cash that normally comes in mid month. (See chart). They can’t even print QE w/o slashing IOER to ZIRP. @RaoulGMI @MacroMorning

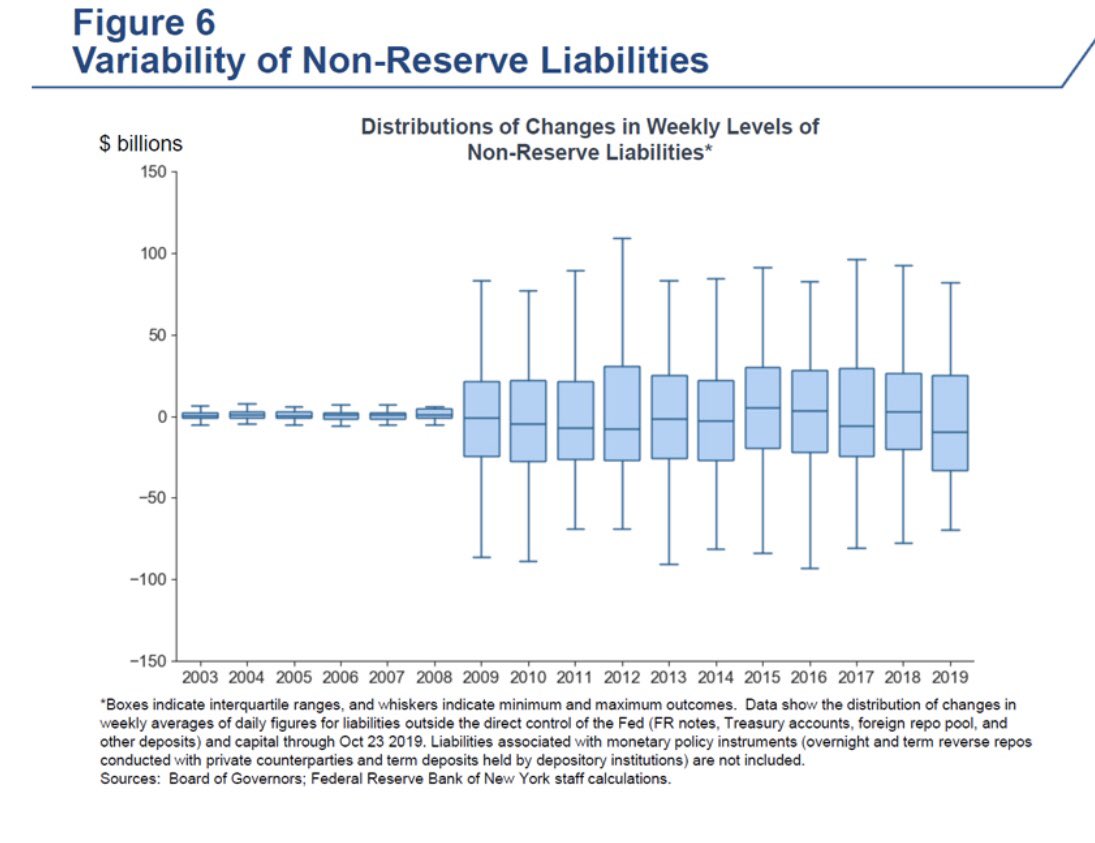

“One potential effect in Reverse Repo usage is to drain reserves from banking system, in effect acting as headwind to efforts by Fed to bolster reserves & stabilize short end.”

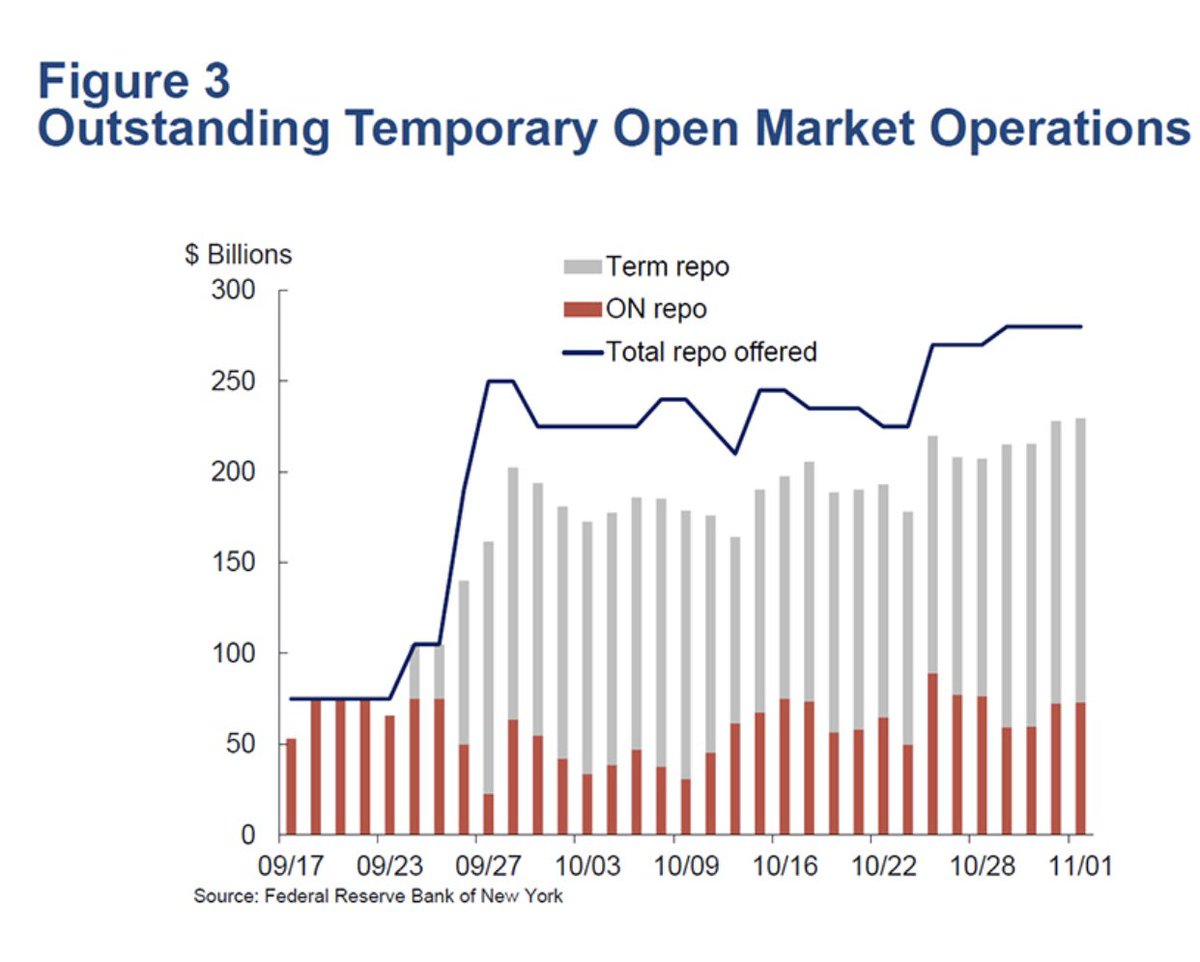

newyorkfed.org/medialibrary/m…

City National Of NJ: 11/1/19

Resolute Bank, OH: 10/25/19

Louisa Bank, KY: 10/25/19

Enloe State Bank, TX: 5/31/19

“But this is the Opposite - Taking Cash Out of the System Effectively Countering the Move to Bolster Reserves. @RaoulGMI @MacroMorning @GHBurnsCFA

google.com/amp/s/www.bloo…

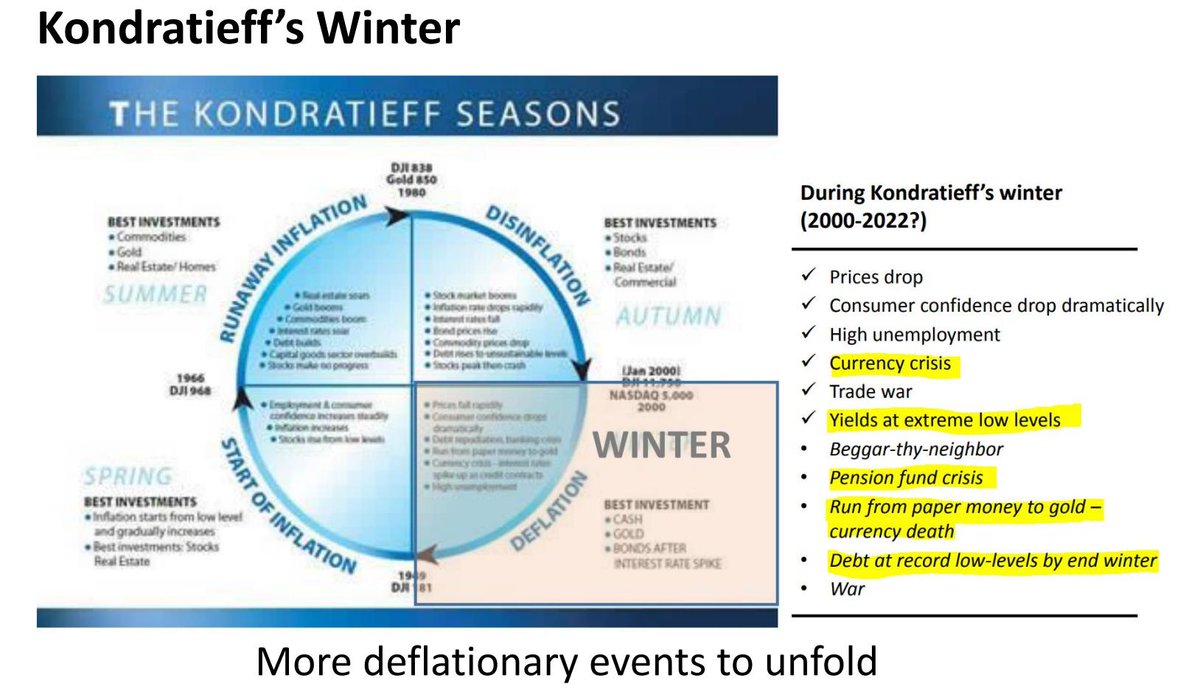

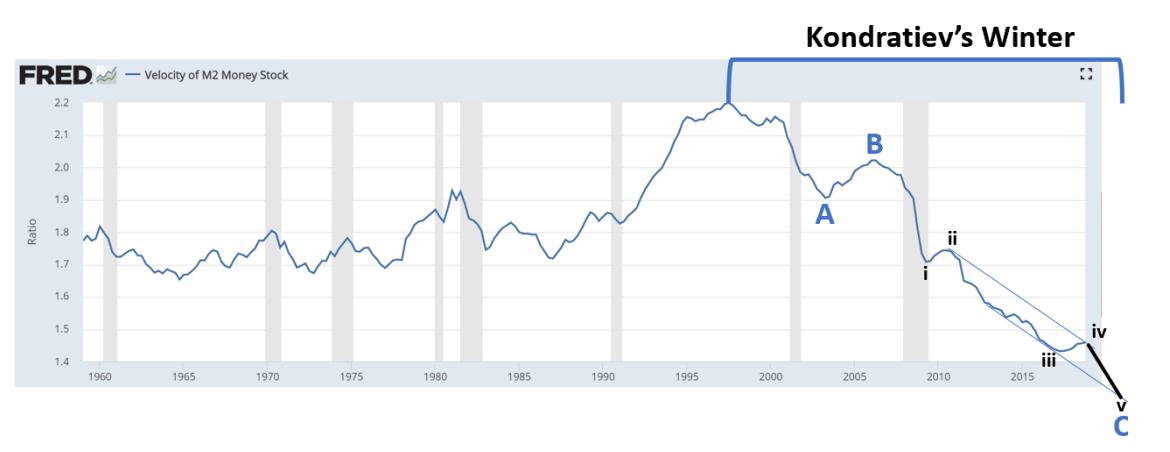

“It’s Not QE” & It’s Not Working.

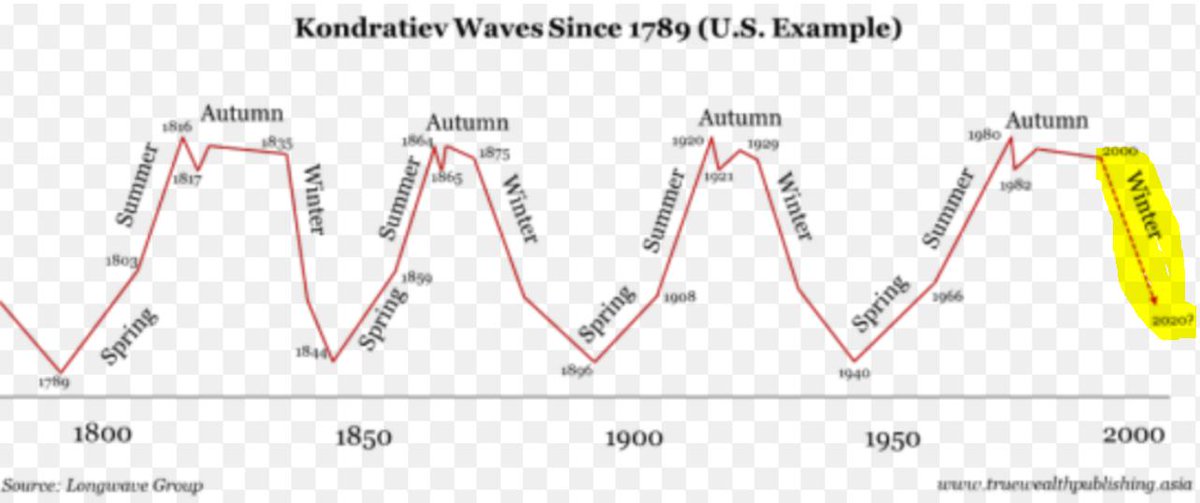

#QE4 #PrintingPress

@RaoulGMI

Praying for sponsored Repo for year end GSIB scores to net out?

Good luck Levered Hedge Funds.