They figured out, Oil Demand is inelastic. People have to buy no matter what price. It’s the most dense form of energy.

1% cut in Oil production would lead to 8% rise in price.

But if prices are too high, then people start saving energy and demand falls.

Not just this year, but sustainably for a long time.

So bringing a lot of production offline , you wouldn’t sell much.

You need Max(volume x marginal Profit/ unit)

The cartel would decide an optimum level of production - so as to maximize the profit of the group.

In 1970s Texas oil fields and later 80s 90s Dutch and English North Sea oil wells were drying

But if you are a member of the cartel, and everyone else reduces production, and you sneakily produce 5-10% more than your quota ... you benefit the high price, while others reduce production.

Cheating is very profitable

If everyone cooperates, you all make good money.

If I cheat, but others cooperate, I make higher profit.

If everyone cheats, everyone produces more then oil prices crash. No one makes big money.

Here Saudi Arabia played the role of enforcer or Big Brother.

OPEC controlled 40% of global oil production.

Saudi controlled 12% (30% of OPEC)

If Saudi felt anyone is cheating, it would open the taps, and pump a lot more.

This was the way to enforce discipline.

Because they had the luxury not to drill for oil, as they had small population and large oil reserves.

If price is too low, just store the commodity (what’s better than let it stay under ground) and pump out when it’s valuable

If international trade was in US dollars then everyone needs reserves of USD for buying oil

Nixon and Kissinger also ensured that Surplus from oil would remain in USD and invested in US debt.

This was rise of #PetroDollars

Why couldn’t they cease drilling?

Because they consumed more than what they produced. And lot of production was private companies wanting to maximize profits for next quarter.

Briefly Russians tried to break it, but in 1985 with US support, Saudis flooded the market with oil, that hastened the collapse of USSR. (Atleast a major contributor)

In 1991 gulf war saw oil price spiral higher and recession in US

After Asian financial crisis in 1997, global demand plummeted, this time Saudi continued pumping and in 1998 low oil prices lead Russia defaulting on its debt.

US develops a technology called Hydraulic Fracturing (fracking) which can drill out oil from places where earlier it wasn’t possible.

Canada has tar sands, from where it can drill out oil.

In the last 6 years US is self sufficient in oil

These are wildcatter businessmen who have drilled using experimentation, and their learning curve has seen Marginal Cost of production drop to ~40$/bbl from 60+

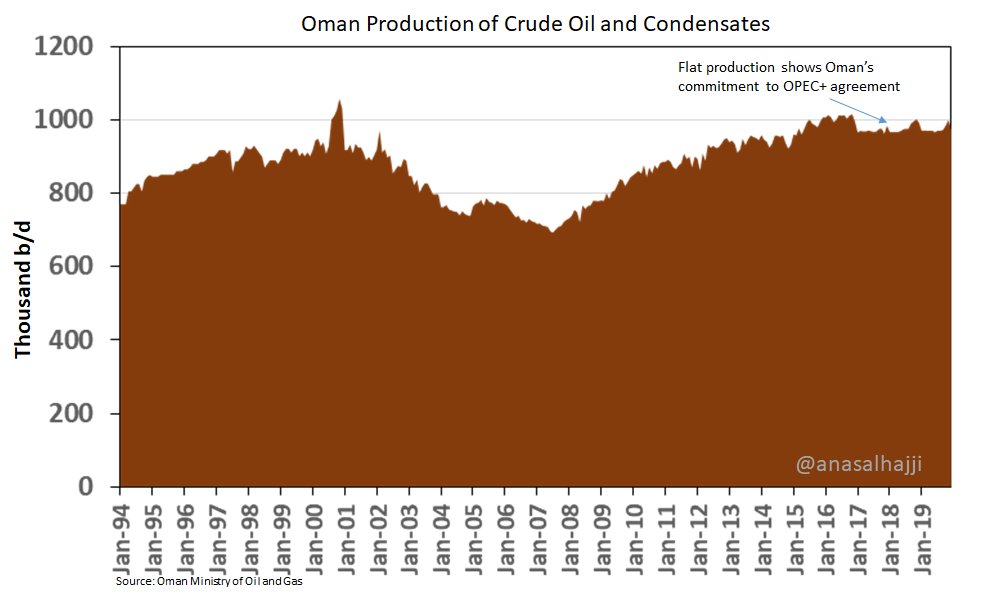

Again the OPEC got Russia to join them to form OPEC+

Cartel is bigger, controlled and got back prices to 60-80 $/bbl

China is also getting big on electric vehicles to reduce urban pollution.

Buy OPEC+ is the new bigger cartel and prices are managed.

With whole cities in lockdown, people working from home, kids attending classes online, less people driving or consuming goods.

Oil demand crashes.

OPEC+ meets, and want to cut production but can’t reach an agreement.

Saudi wants 1.5mln barrels a day cut.

Russia wants 0.6 to 1mln a day.

(World consumption is 90-100bbl day, US is biggest producer and consumer at 18)

This would hurt other oil producers.

(USA and Russia being the biggest)

Now this was the movie so far.

What happens next?

But they have been comfortably borrowing a lot more money from global investor

But they do have other exports (defense goods, agri products, engineering capital goods)

And tourism.

Also has a floating currency.

I too went to Russia (Moscow and St. Petersburg) on vacation.

Non of the shale drillers are too big to save.

Lot of them are financed by High Yield bonds and loans.

Even if they default, investors have been through crisis before.

Employees fired is a common thing.

If one driller goes bust

New firm takes over bankrupt firm and drills again.

Saudi raised the stakes, forcing others to spend more (or borrow to continue drilling) - profits would come when prices might rise in the future

Who can survive pain longer wins.

But here - it’s not so sure that as soon as this period of low prices is done, some one flips off a switch and others can’t start drilling.

But in USA capitalism works.

File chapter 11, get fresh capital and new management.

Same employees can start drilling.

Lower oil prices hits smaller exporters - Nigeria, Mexico, Malaysia

Hits global trade (double whammy due to corona virus)

This makes nominal growth lower and people are used to the rut.

Let’s see who emerges a winner.

<out>