The dealers are barely making bids. This includes US Treasuries and European sovereign bond markets are collapsing … see next.

(1/4)

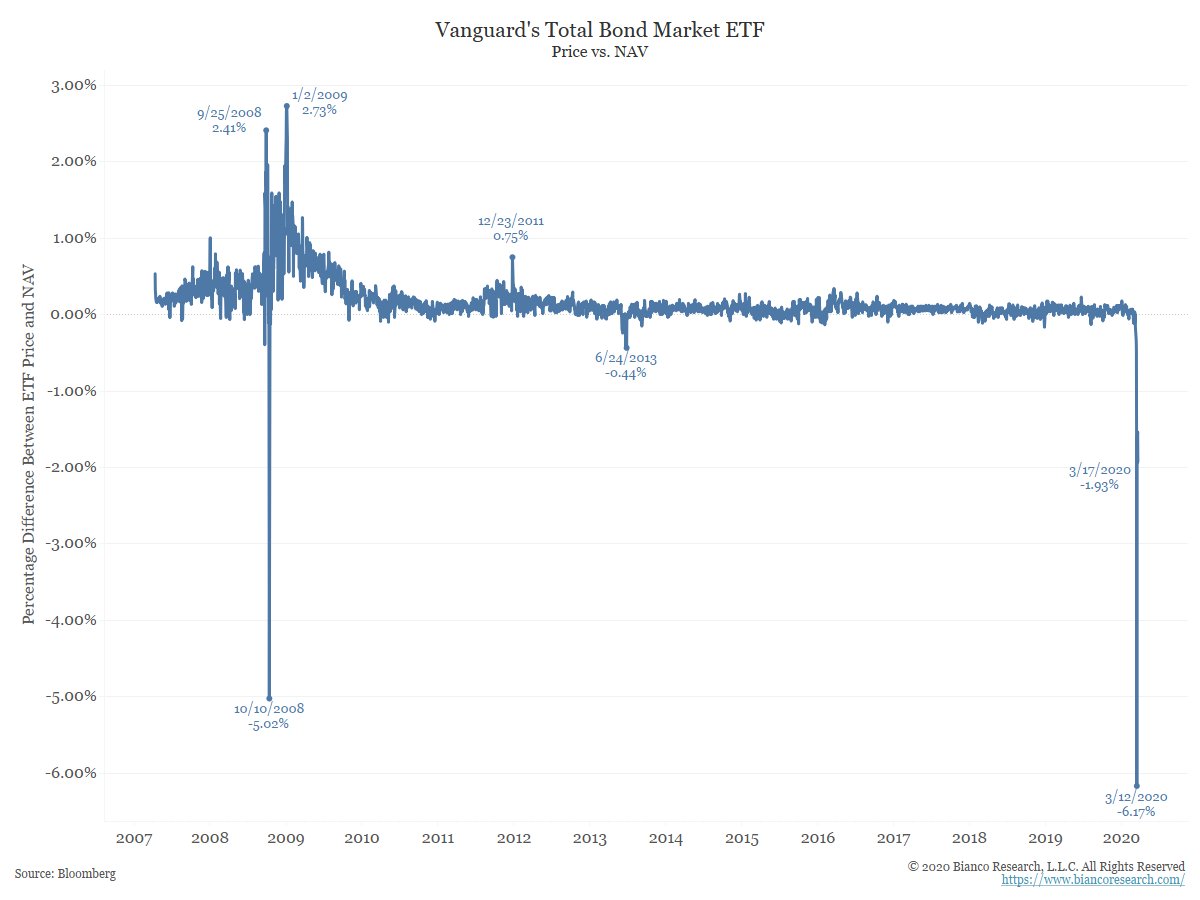

The NAV discount today is bigger than the worst day in 2008 (Oct 10). The bond market was so bad back then that TARP was announced the next day.

(3/4)

The only place you can find bond market liquidity is telling you they think fair value is a lot lower. Someone is comfortable with selling this fund 6% below its fair value ... probably because they think this is "true" fair value."

(4/4)