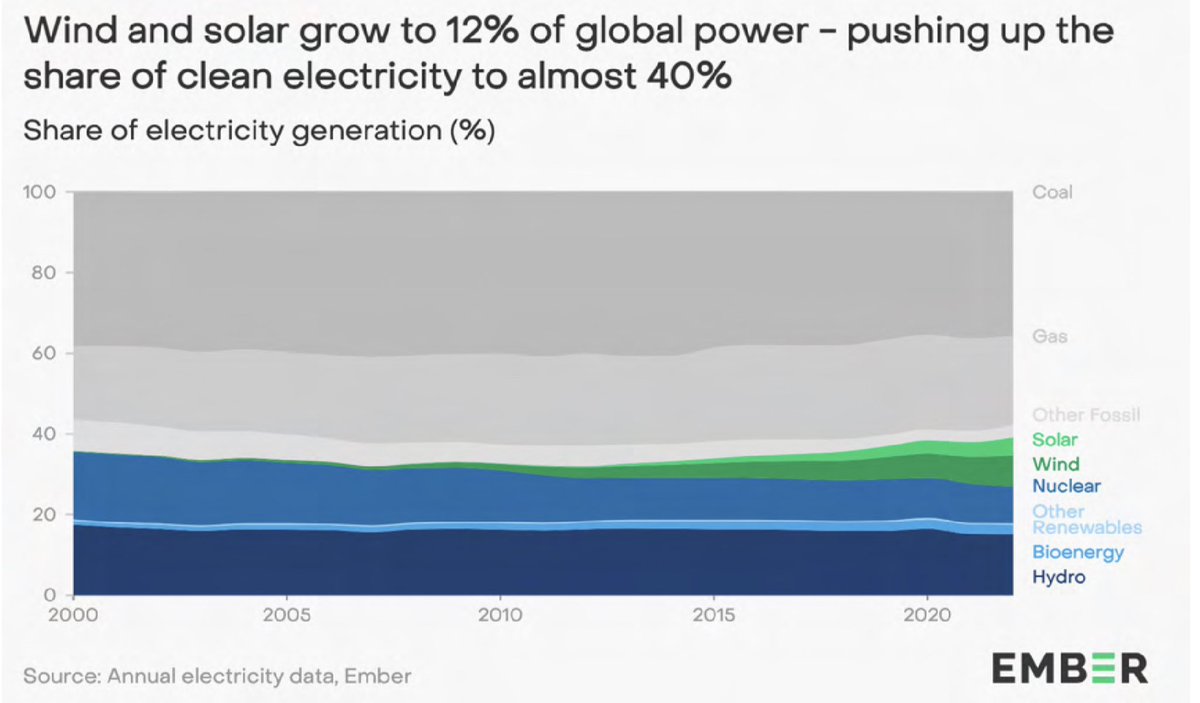

Research Report of the Week: The #Global #Electricity Review from Ember which is full of incredible information on what is going on in the world of electricity, #renewables etc

ember-climate.org/insights/resea…

ember-climate.org/insights/resea…

4. #Coal generation rose by 108 TWh (+1.1%) year on year, reaching a record high generation of 10,186 TWh with #india seeing the biggest growth (92TWh or 7% annual growth)

5. Global #gas generation declined slightly by 0.2% (-12 TWh) in 2022 compared to the previous year.

6. Global #nuclear electricity generation fell by 4.7% from 2,739 TWh in 2021 to 2,611 TWh in 2022, thanks mainly to problems in French nuclear and closures in Germany. This means that nuclear production last year was 10% lower than a decade ago.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter