Why did #Bitcoin crash by -8% within 1 hour? Here's what happened with #MtGox and the #US government wallets 👇👇🧵

Sub to our TG for the latest: t.me/matrixportupda…

Sub to our TG for the latest: t.me/matrixportupda…

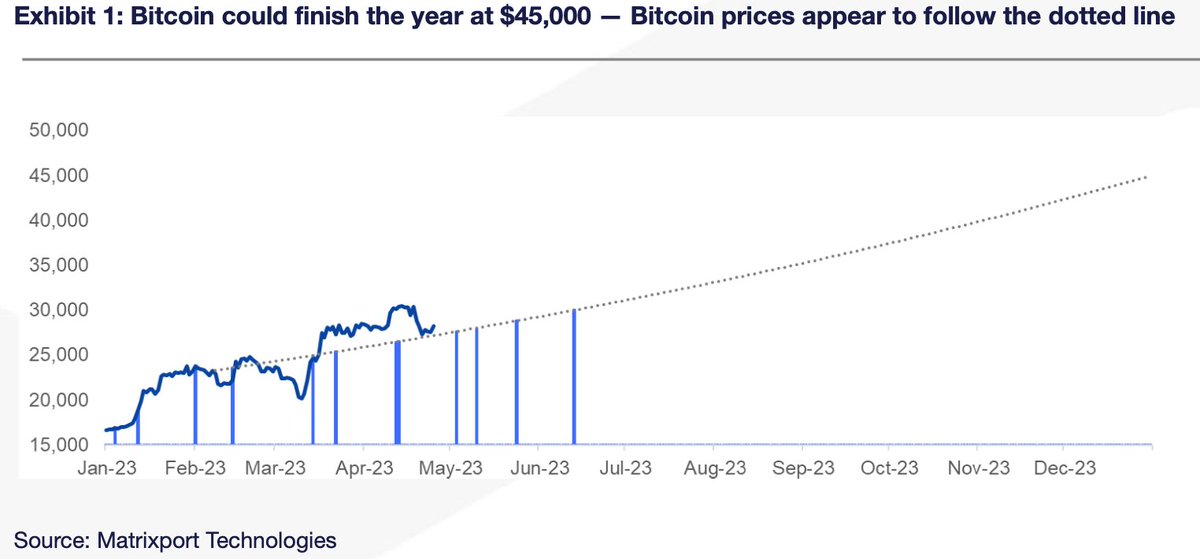

1/10: #Bitcoin crashed -8% in minutes on news that "wallets belonging to #MtGox and #US government are making transactions."

2/10: Our analysis suggests this won't have a big impact. The market is aware of eventual #Bitcoin distribution from these wallets.

3/10: We recommend buying any major dip around this news. False rumors were already reported and debunked, staying informed is key.

4/10: #MtGox to distribute $1.7B in cash, 141,000 #BTC, and 142,000 BCH to 10,000 global creditors as part of rehabilitation plan starting March 10.

5/10: #MtGox was once the world’s largest #crypto exchange, peaking at 70% of total #Bitcoin trading volume before filing for bankruptcy in 2014.

6/10: #MtGox hack resulted in 850,000 stolen #Bitcoin valued at $500M then, $17.8B today. Only 200,000 #BTC has since been recovered.

7/10: After a 7.5-year legal battle, a rehabilitation plan was drawn up in 2021 for #MtGox.

8/10: Since not all stolen #BTC could be recovered, only a fraction of the original amount held by creditors will be compensated.

9/10: All creditors will receive a base payment with options to receive the remainder of their deserved funds through bank remittance, #crypto, or fund transfer service.

10/10: #MtGox payouts at today’s #Bitcoin price level of $22,000 mean customers can reclaim their stolen #Bitcoin after 9 years with a 3,900% increase in value.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter