1. The Indian Foreign Exchange Management Act compliance under Reserve Bank of India which is the Central Bank. The Act requires certain compliance for which there is a vigilance agency Enforcement Directorate @dir_ed which also investigates money laundering

India has traditionally prohibited foreign companies from various sectors (see coca cola)

There was talk in 2000 to open it up but met with huge opposition

There were huge protests in 2012 when Congress tried to open it up. @MamataOfficial left the government coalition due to this issue.

ndtv.com/cheat-sheet/bj…

timesofindia.indiatimes.com/india/Mamata-B…

Now the FDI Policy is very complicated and covers many sectors, routes, terms and conditions, dos and donts, limit of foreign participation etc.

en.m.wikipedia.org/wiki/Foreign_d…

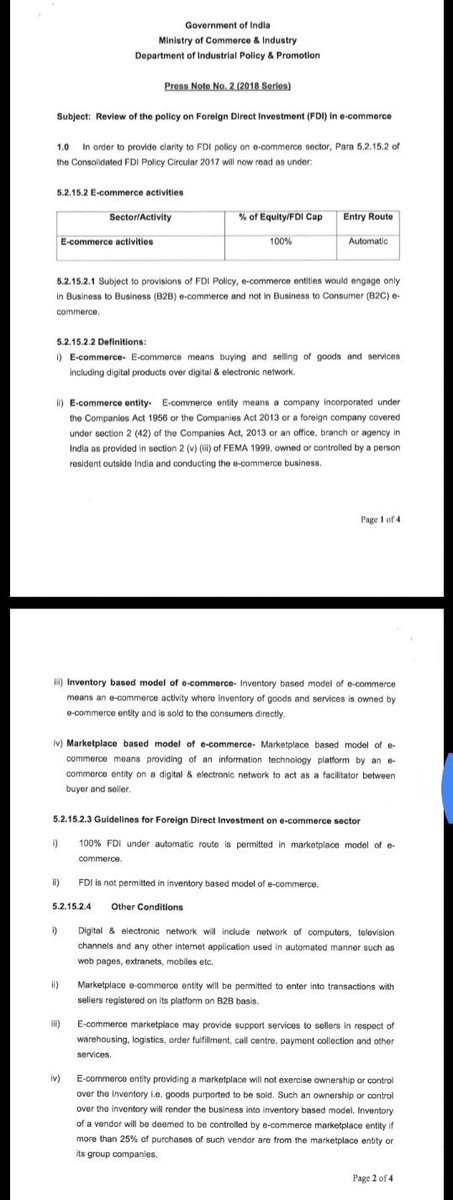

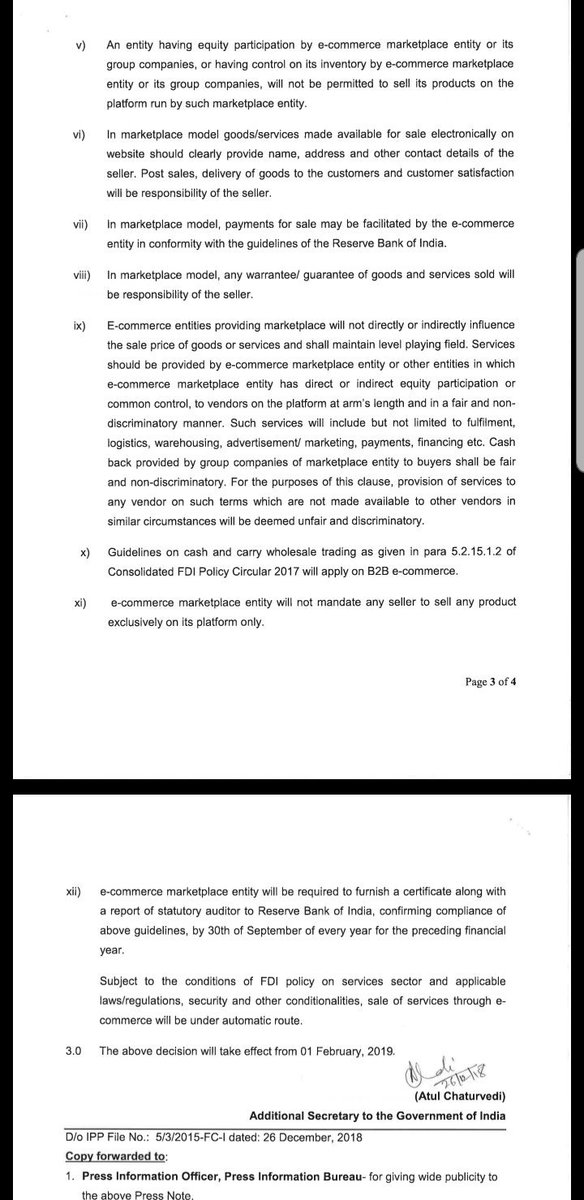

For B2B they allow 100% FDI

google.com/amp/s/www.theh…

Thereby, only when the question of foreign players came in, government defined rules for foreign investments. No rules for Indian companies.

Snapdeal - started as a coupons site in 2010 followed Ebay model.

Alongwith them hundreds of "startups" jumped on the ecommerce wagon from 2011 seeing cheap FDI.

Flipkart was doing retail

vccircle.com/flipkart-raise…

google.com/amp/s/yourstor…

To attain GMV targets, they raised funds, not to invest in technology or expansion, but to do deep discounting.

This is circa 2011-2013 when general public believed this discounting will stop soon

The ED was forced to open investigations on Flipkart who was doing retail with FDI.

m.economictimes.com/tech/internet/…

This probe came to light when in 2012 Anand Sharma the then commerce & industry ministry informed the Parliament about ED's scanner on Flipkart."

Myntra was later bought by FK

m.economictimes.com/industry/servi…

All news reports buried. Files burned. This is 2014 when people were giving the government time to settle in.

financialexpress.com/archive/ecomme…

Amazon now enters the market.

Till now their presence in India was limited through Junglee which they bought in 1998.

The loose laws and enforcement was an attraction for Amazon.

cnet.com/news/amazon-to…

Mom and pops were now worried about the uncontrolled discount funding of Amazon

Amazon, Snapdeal, Jabong, Myntra and dozens of companies are funding discounts through FDI in their marketplace.

Billions of dollars

That is when @ashwani_mahajan of @swadeshimanch starting raising the discourse that Marketplace is not mentioned in Indias FDI policy which means it cannot run with FDI.

This has been summarised in this link

newsbytesapp.com/timeline/Busin…

So they did the best that any government does, a cover up.

Before the coverup lets focus on Flipkart and Amazon retail part

Amazon is now playing a dual role in USA as a retailer and a platform something which is now being talked about. We call this a hybrid marketplace.

Now this the difference between Indian and USA hybrid marketplace model.

Amazon USA can issue Bill of Sale of goods to Consumers. Amz India cannot (FDI)

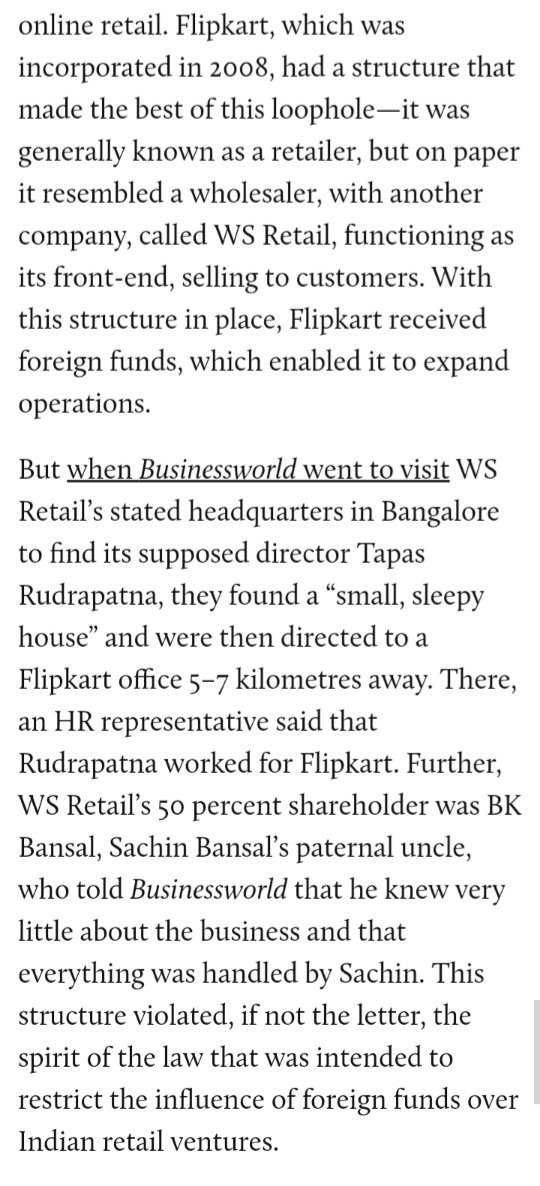

caravanmagazine.in/vantage/flipka…

Amazon saw this as an opportunity and used this "jugaad" to enter the market forbidden to Walmart, Metro, and competitors.

en.m.wikipedia.org/wiki/Jugaad

While this JV seems to be compliance, the....

forbes.com/sites/sarithar…

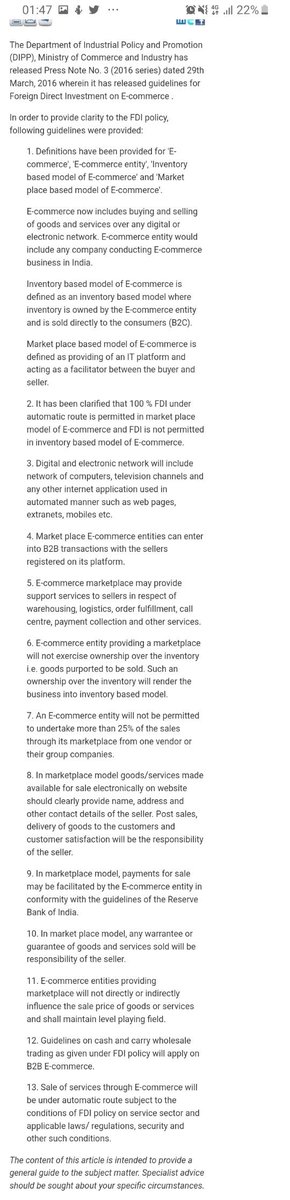

In a nutshell, the entire gig was "clarified" to be "legal"

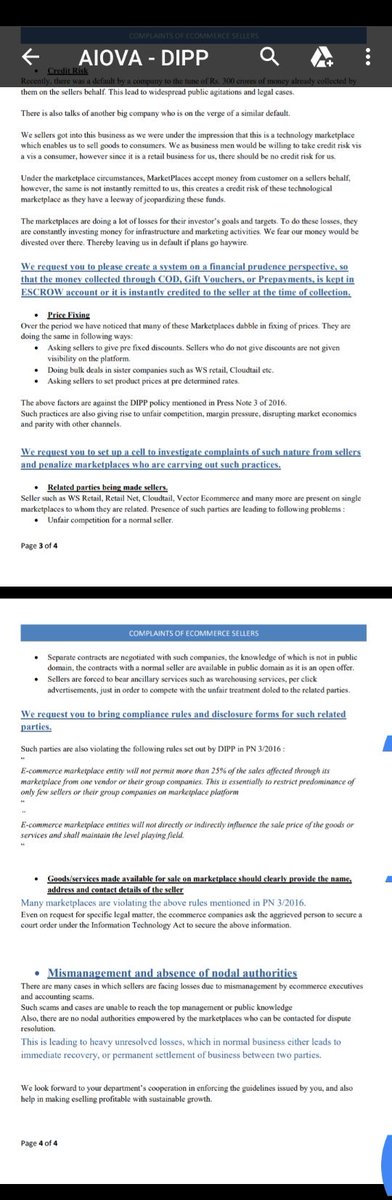

"The websites have been indulging in malpractices by giving unreasonable discounts. This is predatory pricing. The government instead of punishing them has rewarded them with this move,"

m.economictimes.com/industry/servi…

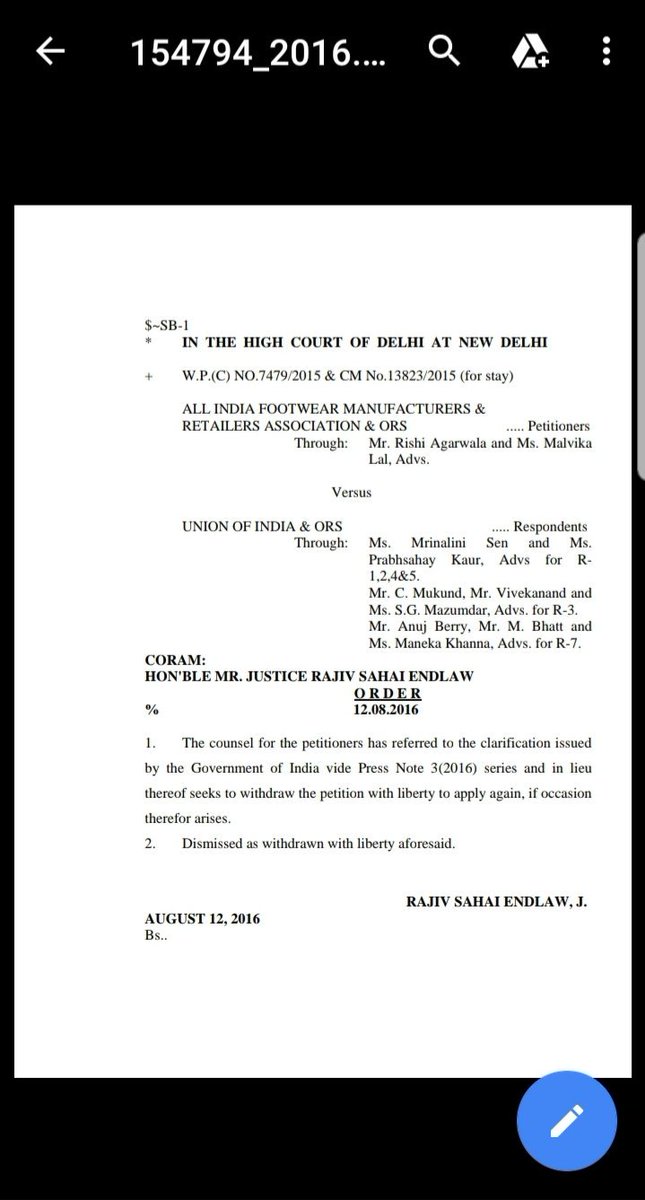

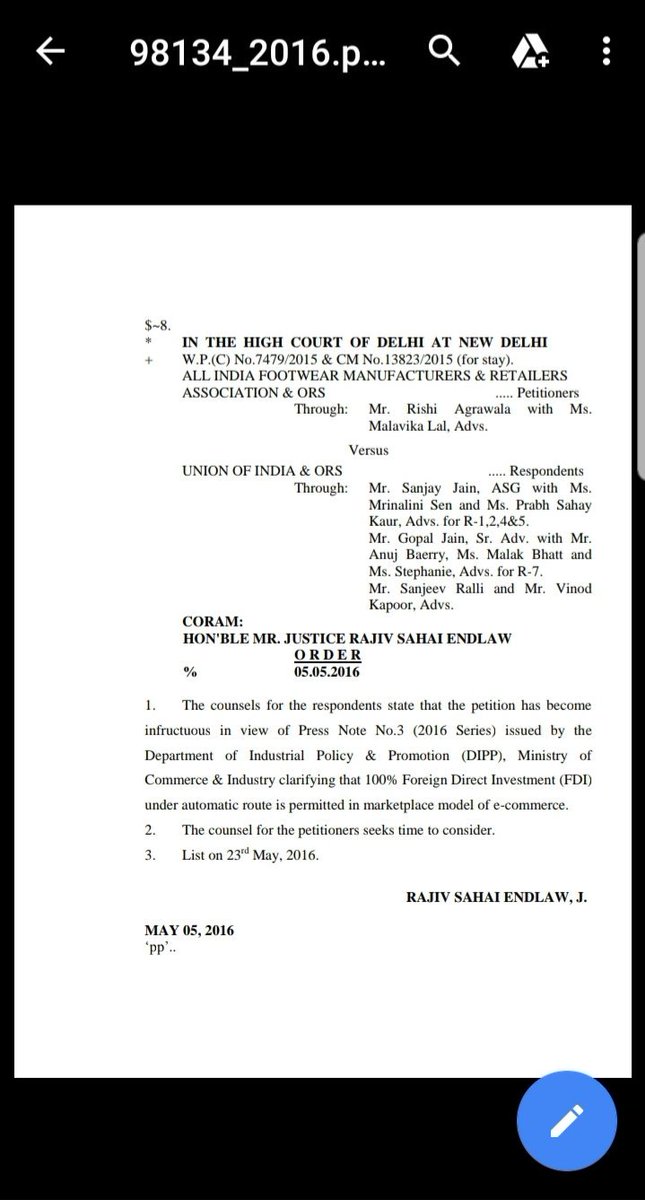

While @ashwani_mahajan was unhappy with the move, @TEAMCAIT and other litigators were satisfied. They withdrew their case in May 2016(very imp)

Because this Press Note 3 was just words. It was just a press release of a government decision. It was still not a law or ratified under existing laws.

The terms and conditions were so vague and monitoring of the same was not defined.

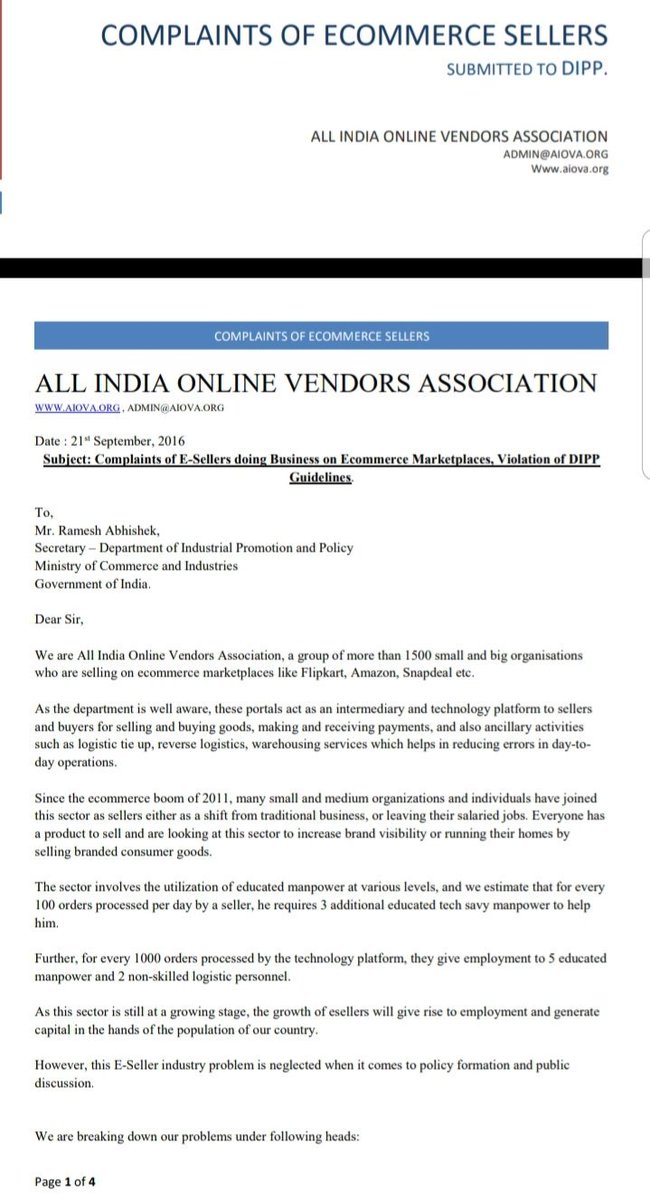

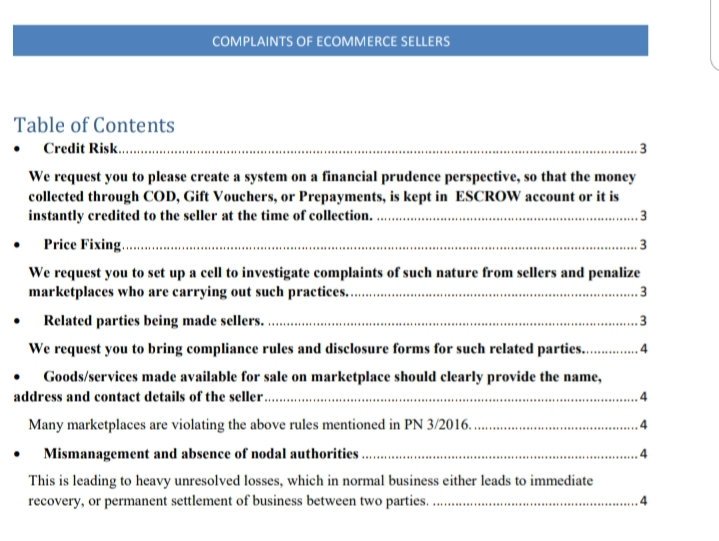

Whenever our letter would end up with @DIPPGOI we would get a reply that they have issued Press Note 3 which has to be implemented by @RBI and investigated by @dir_ed

Now this is funny.

After the letter, we waited for response. In the end, we were given a sweet reply to talk to @RBI

We sought details of whom to contact in RBI, this revealed the cover up

On relentlessly pursuing @rabhishek1982 for months on twitter, RBI notified it under FEMA Act in Feb 2017.

DIPP headed by @rabhishek1982 under @nsitharaman did nothing.

Whenever we used to complaint regarding malpractices or sellers issues, we were shown Press Note 3. Once when we showed that the concerned marketplace has no FDI, please help, they said BYE!

Flipkart made multiple shell companies to comply 25% rule. Other rules uncomplied.

They called it a "tweak"

livemint.com/Companies/3kuo…

thirdeyesight.in/articles/amazo…

This all worked benefits for Amazon and Flipkart.

Snapdeal lost the plot and faced turmoil.

Our woes were going to deaf ears of @rabhishek1982 and @nsitharaman

The former even publicly claimed discounts were being given by "sellers" and not Marketplace.

bgr.in/news/online-di…

Flipkart received huge funding from Softbank in 2017 followed by being "bought out" by Walmart in 2018.

m.economictimes.com/industry/servi…

In may 2018 walmart "purchased" flipkart and again the 2014 sentiment of a global giant united all parties like @swadeshimanch @TEAMCAIT etc

Walmart deal was approved by @CCI_India in a shady manner. And Walmart could now take advantage of this set up

There were litigation, public outcry, media statements every day.

Somehow @TEAMCAIT petition was disposed off due to jurisdiction.

Again a cover up by government this time through @rabhishek1982 under @sureshpprabhu

But this takes care of PIL of @pranavsachdeva_ which gets disposed off in March.

m.economictimes.com/small-biz/star…

However it was just a "clarification".

"Clarification" was "clarified" by a press release of @DIPPGOI

RBI made this into a law, but again, a cover up.

livemint.com/industry/retai…

financialexpress.com/industry/sme/a…

While Cloudtail was away, their products were being sold by new sellers who cropped up overnight with same catalog.

m.economictimes.com/industry/servi…

Instead they plan to open more shell companies.

Amid all the global hues, cries, tear shedding, business went on as usual and government was able to again cover up.

telecom.economictimes.indiatimes.com/news/ed-invest…

India made a law - sorry there is not law.

You can be - only if your .com is FDI funded by even $1

I dont know if thats suffient - it is deficient at mass proportions

in the right direction - HaHaHa *slow clap*

Amazon can also do it overnight. Just need a front man willing to sign whereever Amazon says. We have 1.5 Billion people

retail.economictimes.indiatimes.com/news/e-commerc…

Any action on them becomes a diplomatic situation.

EU, @linamkhan , us have said and done everything.

But governments are being controlled by them

economictimes.indiatimes.com/industry/servi…

thehindubusinessline.com/economy/policy…

Not sure if @realDonaldTrump would implement the same in USA.

It requires a tight legislation.

But that doesnt fall under @CimGOI or @DIPPGOI nor is the scope limited to FDI.

The government is not interested in going to the direction.

Anyway, we would like to end by wishing @rabhishek1982 a happy upcoming retirement and thank you for unblocking us. THE END