A. It. began with the #Corvid19 = ⬇️ demand.

nytimes.com/2020/03/02/bus…

B. V. much like the rhyme there was an old woman who swallowed a fly, shell, and a host of other holiday spin offs, the⬇️ demand, would have resulted in a price crash. See #oilprice metrics.

investopedia.com/articles/inves…

eia.gov/beta/states/da…

The @CMEGroup extensive resources as well.

#Putin refuses to ⬇️prod-->the last time there was no action, in 2014, prices fell to their < $30, leading prices to eventually fall below $30 a barrel. 1/x.

nytimes.com/2014/11/28/bus…

"#SaudiArabia may also have wished to cement its position as the world’s top oil exporter, analysts added..."

ft.com/content/59dcba…

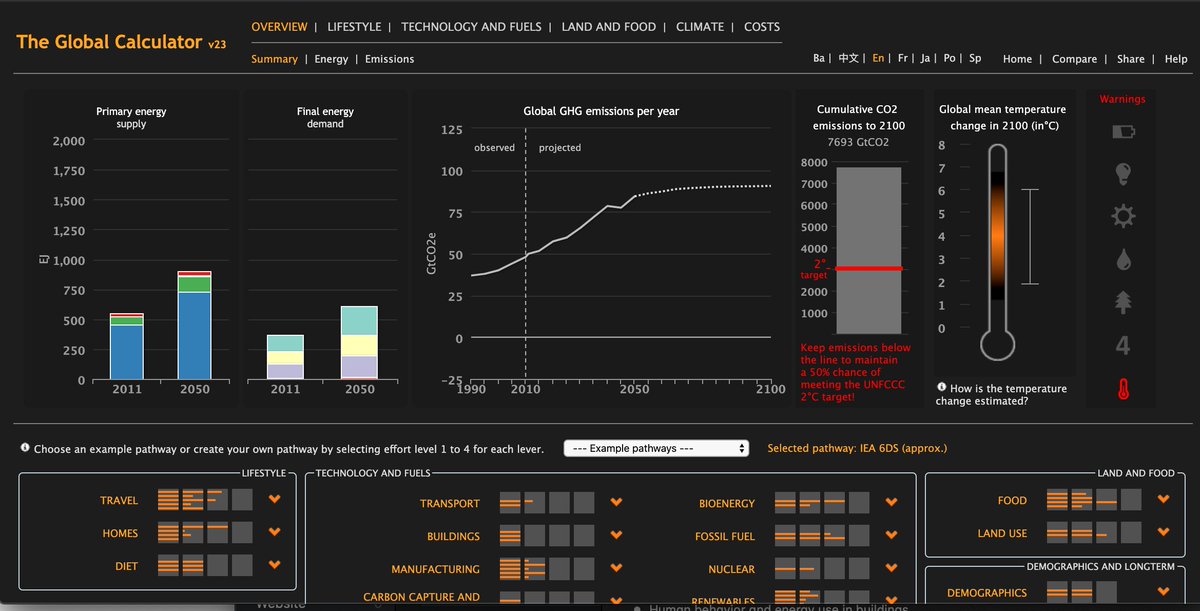

To learn more about ways global #energy consumption trends, see this tool from #Github #NarwhalLife #Developer #STEAM

tool.globalcalculator.org/globcalc.html?…

gisanddata.maps.arcgis.com/apps/opsdashbo…