In preparation for my slot on #SquawkBox yesterday, I sent the guys a few slides as a synopsis of my last, detailed subscriber report for the discussion.

I called it #Pyromania. Feel free to take a look

1/x

#macro #bonds #commodities #dollar #inflation #centralbanks #fiscal

I called it #Pyromania. Feel free to take a look

1/x

#macro #bonds #commodities #dollar #inflation #centralbanks #fiscal

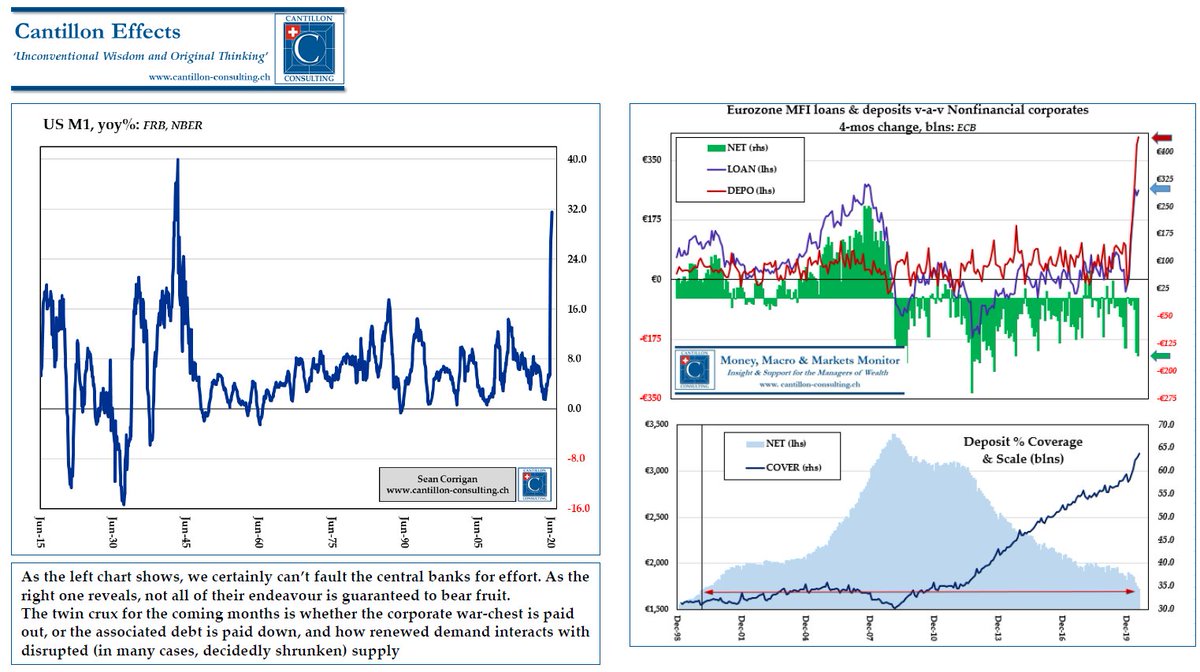

Is it possible to overkill an act of overkill? #JeromePowell & #JanetYellen seem set to let us find out.

2/x

2/x

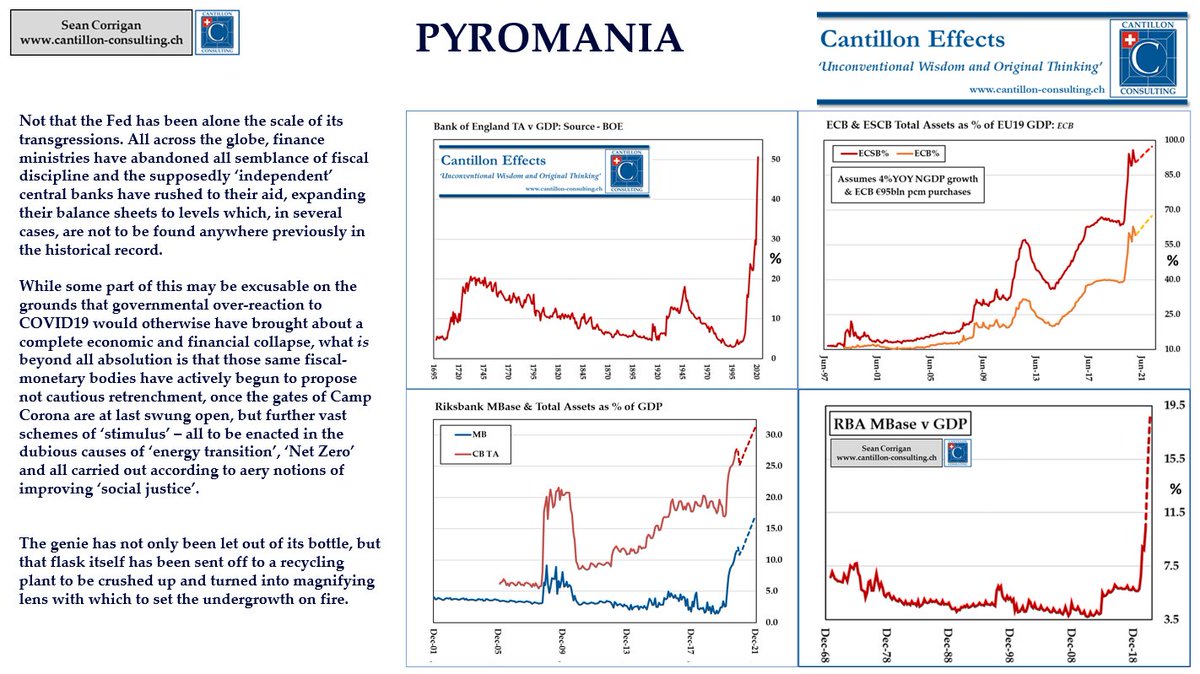

Not that they're alone in their folly, of course. The #ECB is outodoing them handsomely, while the #bankofengland is breaking records stretching back to its founding, 327 years ago.

#centralbanks

3/x

#centralbanks

3/x

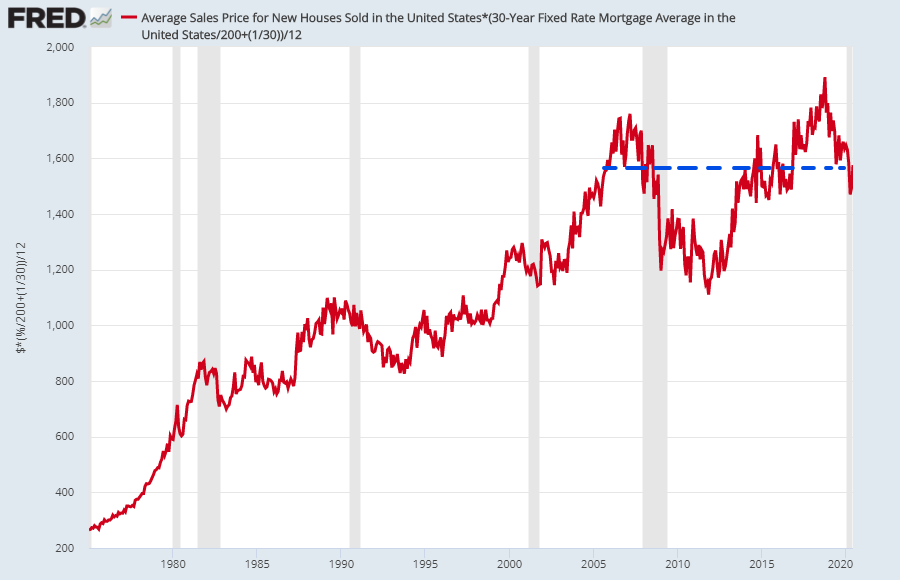

Given all this, it's hardly surprising that #commodity prices are now rising smartly. #Lockdown may be acting as a fire blanket in some parts of the house to which you've been confined, but it hasn't stopped the flames licking at the beams elsewhere in the building.

4/x

4/x

Having been heavily involved the last time people were talking of #Supercycles, it does raise the hackles to hear the word, but no-one can deny that governments are again doing their best to frustrate entrepreneurial and technological progress in supplying #commodities

5/x

5/x

It might contain a whiff of cherry-picking but, since last Spring's crash, even #grains have outperformed most #equities, nor has #Growth managed to retain its lead over the whole basket. As for #bonds...

6/x

6/x

...the old 'certificates of confiscation' are rapidly becoming less attractive to anyone not forced by regulation to buy them or led by economic misreading to print money to acquire them.

#fixedincome #COT

7/x

#fixedincome #COT

7/x

#RiskOn is certainly the guiding spirit at present. As for you buyers of some $750 billion of #bond #ETFs & Mutual funds this past 10 months? Tough break!

8/x

8/x

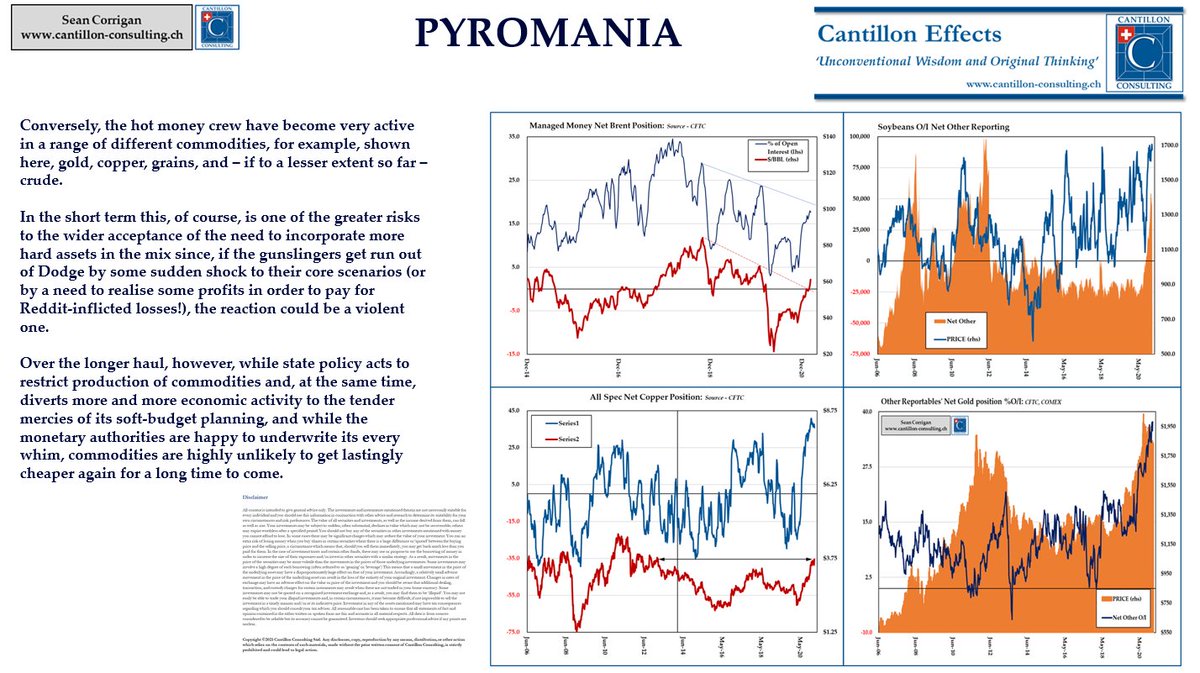

The main caution is that a lot of hot money has already poured into what was previously the most unloved of asset classes. But, then, if no-one was buying, prices wouldn't be rising, would they?

#macro #commodities #hardassets #inflation #centralbanks

9/x

#macro #commodities #hardassets #inflation #centralbanks

9/x

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh