As we head into the U.S. #election, there will continue to be a lot of noise that may lead to near-term #market #volatility, particularly since (as we’ve long argued) #markets appear to be able to only focus on one thing at a time!

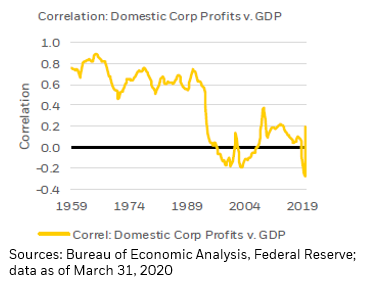

Still, at times like this it’s crucial to focus on more consequential factors that will drive #markets in the years ahead: in this case, the powerful combination of @federalreserve #monetarypolicy and #fiscal rescue measures intended to keep the #economic engine on track.

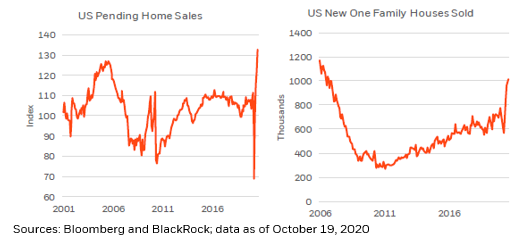

So, while many will continue to be skeptical of the sustainability of this #economic recovery, we’ve been impressed by its strength, particularly in the #interest-rate-sensitive segments of the #economy, like #housing, which is going through the roof!

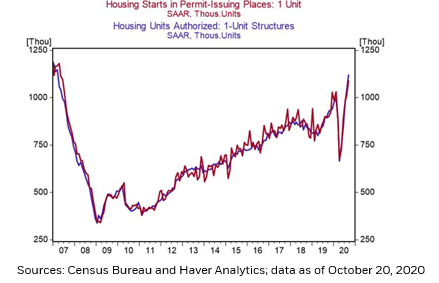

Indeed, on Tuesday we saw both single-family #housing starts and #building permits move higher, led by an 8.5% increase in starts in Sept. and a 7.8% gain in permits, and with #permits higher than starts again that bodes well for further increases in the months ahead.

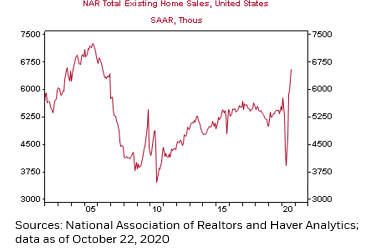

Added to this, existing #home sales spiked 9.4% higher in Sept., increasing for the fourth consecutive month, to 6.54M, with the single-family #housing segment up more than 20% over the year; the multi-family part of the market has looked weaker.

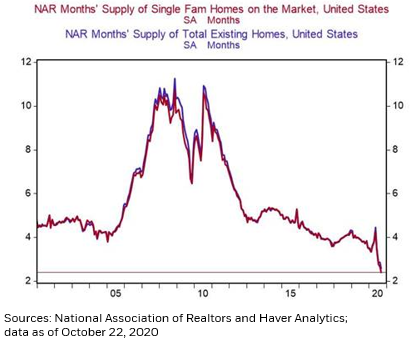

Fascinatingly, this surge in demand for #housing has met incredibly low #inventory levels, and of course extraordinarily low #mortgage rates, which has resulted in an impressive near 15% gain in median sales #prices year-over-year in Sept.

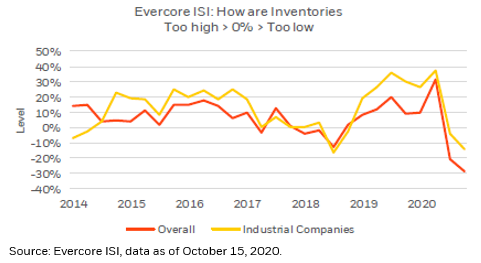

Finally, while #housing is clearly one area that is displaying remarkable strength, the #inventory story displayed there is also present in other #sectors of the #economy.

Indeed, as #retail sales surge, both retail and #industrial sector #inventories appear low, suggesting that if aggregate #demand can be maintained the #economic recovery likely has solid legs into 2021.

• • •

Missing some Tweet in this thread? You can try to

force a refresh