The turn of the calendar year invites the temptation to prognosticate regarding the course of the year ahead for the #economy and for #markets, and not being immune to that impulse, here are our views on the “11 themes to consider as we look toward 2021:” bit.ly/386mb0r

In preview, one key theme is that 2021’s nominal #GDP growth is likely to surprise many skeptics with its strength. The sources of upside surprise can be found in: 1) the new #fiscal #stimulus combined with structural budget #deficits…

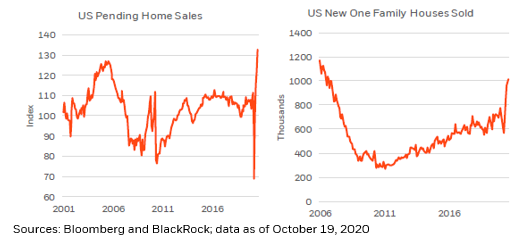

And in 2) the @federalreserve’s ongoing asset purchases and 3) the impressive #economic momentum that is still broadly underestimated, as a post-election, and #pandemic-recovering world can catalyze 2020/21’s monetized #stimulus (more than 15% of GDP) into impressive NGDP growth.

We expect some handwringing about the larger #Fed balance sheet, the greater U.S. #debt burden and #fiscal budget #deficits, but in our view, it’s about getting #economic growth back on track. In the face of compounded growth, budget imbalances can fade in significance.

We think the #USD is likely to moderate lower and that #inflation is likely to move higher by mid-2021, before receding somewhat by year end, but unlike many, we don’t foresee extreme #currency or inflation moves on the horizon.

The fact is that rate #policy differentials still favor the #USD over other large trading partners’ #currencies, and data also suggests that #inflation has a stronger relationship with #demographic curves than with currency movements over time.

Moreover, we think there are longstanding structural reasons for why those who have been warning of excessively higher levels of #inflation will continue to be wrong.

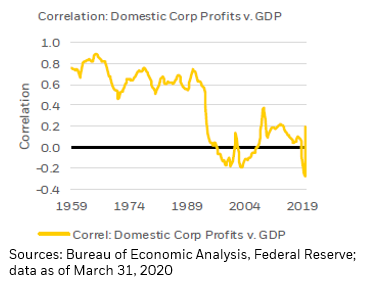

Namely, over recent decades the shift away from #goods production/consumption and toward a greater #economic focus on #services has profoundly influenced virtually every aspect of #economic life, from #employment, #wages, income, consumption, #investment and price #inflation.

Goods-sector #inflation has really been #deflation over at least the past two decades: Over that time goods prices in the #CPI report were down at an average year-over-year rate of -0.02% in the core goods index and were down -0.31% annually over the past five years.

When this evolving composition of the #economy is considered alongside the broadly #disinflationary impact of productivity-enhancing #technologies and the critical trend of #population #aging, we see why there’s a remarkable degree of price stability.

• • •

Missing some Tweet in this thread? You can try to

force a refresh