Do you believe #markets are #cyclical in nature?

Do you think #history #rhymes, if not #repeats?

Do you agree #greed and #fear are two main forces in the market?

If answer of above Q's is yes then following tweets will solidify ur view if its a no then they will change ur view.

Do you think #history #rhymes, if not #repeats?

Do you agree #greed and #fear are two main forces in the market?

If answer of above Q's is yes then following tweets will solidify ur view if its a no then they will change ur view.

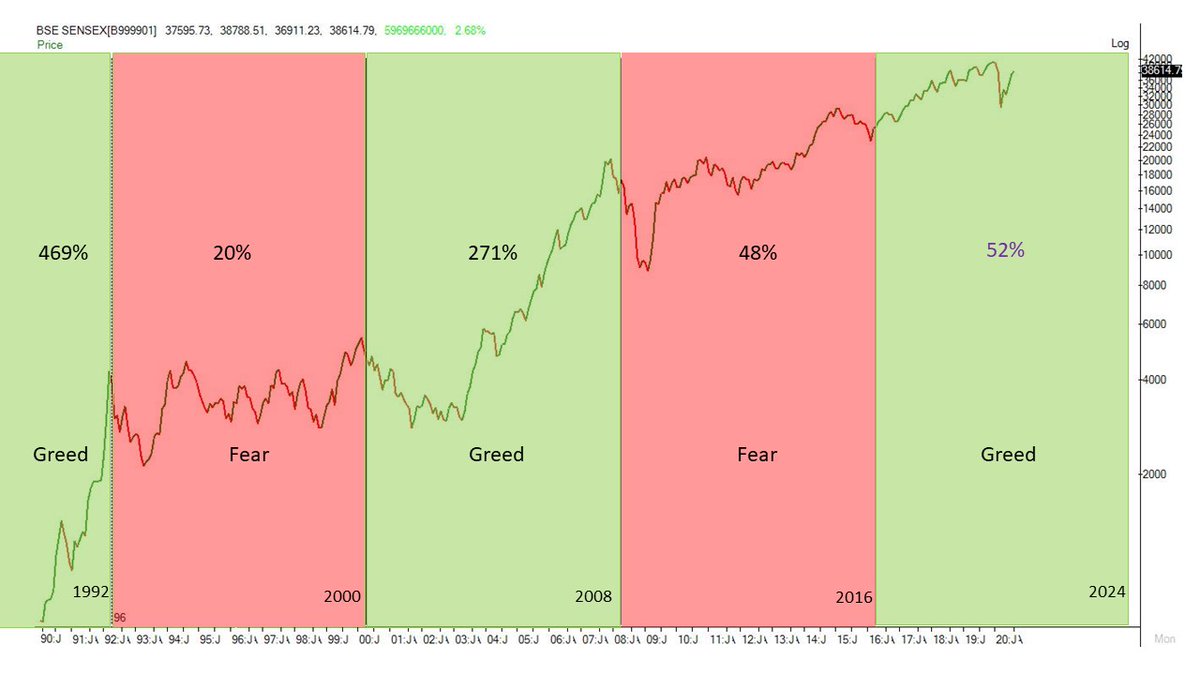

Above is a monthly chart of #Sensex. It goes through an alternating #greedandfear cycle of 8 years. Sensex moves up in greed phase and consolidates in fear phase. It was up 469% in greed phase of 1992. was up only 20% from 1992 to 2000. From 2000 to 2008 it was up 271%.

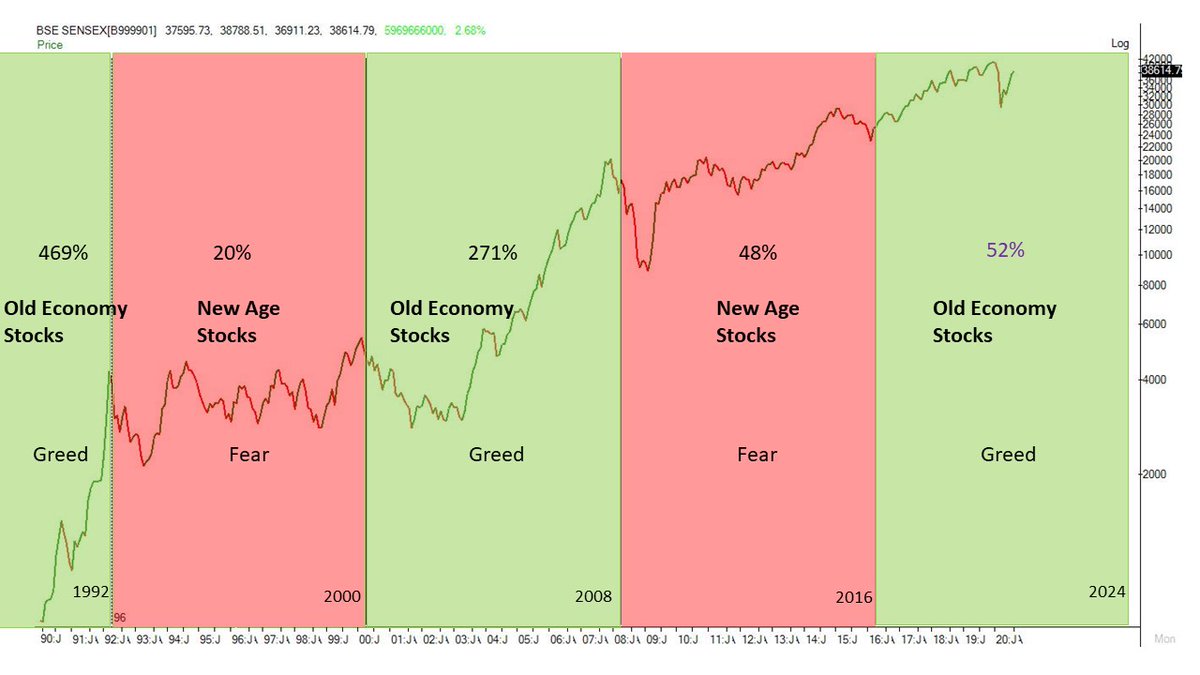

In fear phase of 2008 to 2016 it was up only 48%. #Sensex has entered greed phase in 2016 and will stay there till 2024. So far its up more than 50%. But the story doesnt end there. The sectors which move up during these phases also go through a cycle.

Old economy stocks move up in greed phase. These are companies catering to the basic needs of #Roti, #Kapda aur #Makaan.

New Age stocks move up in fear phase. These are technology related companies. Here's a list of stocks which moved up the most during these phases.

New Age stocks move up in fear phase. These are technology related companies. Here's a list of stocks which moved up the most during these phases.

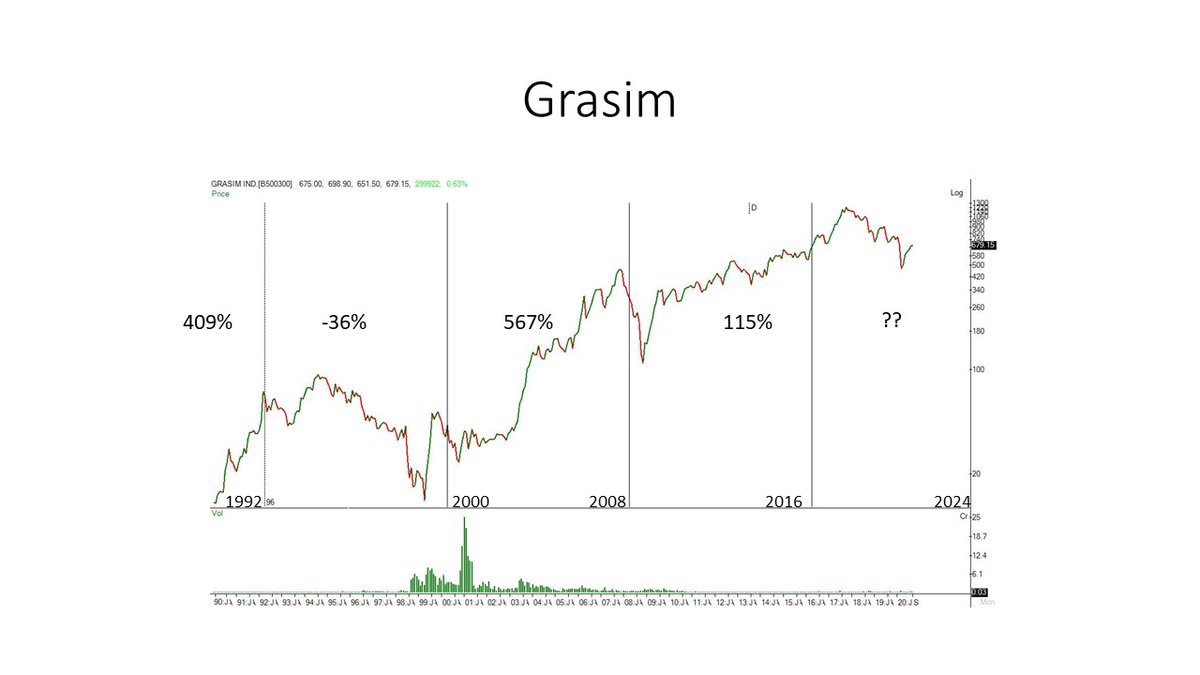

1992 – #Cement and #Textile

2000 – #IT, #Media and #Telecom

2008 – #Power, #Realty and #Infra

2016 – #HousingFinance, #Pharma, #Consumptionstocks, #PrivateBanks

2024 – Its back again to the old economy, #brick and #mortar businesses

Have you started seeing a pattern yet?

No?

2000 – #IT, #Media and #Telecom

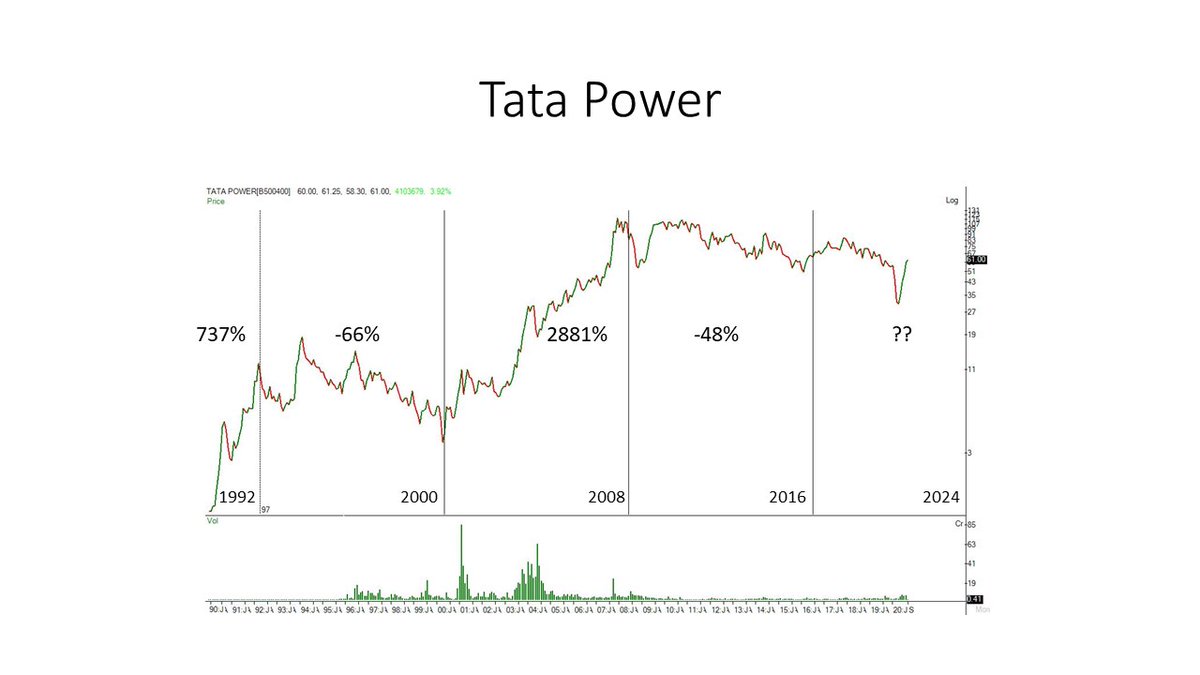

2008 – #Power, #Realty and #Infra

2016 – #HousingFinance, #Pharma, #Consumptionstocks, #PrivateBanks

2024 – Its back again to the old economy, #brick and #mortar businesses

Have you started seeing a pattern yet?

No?

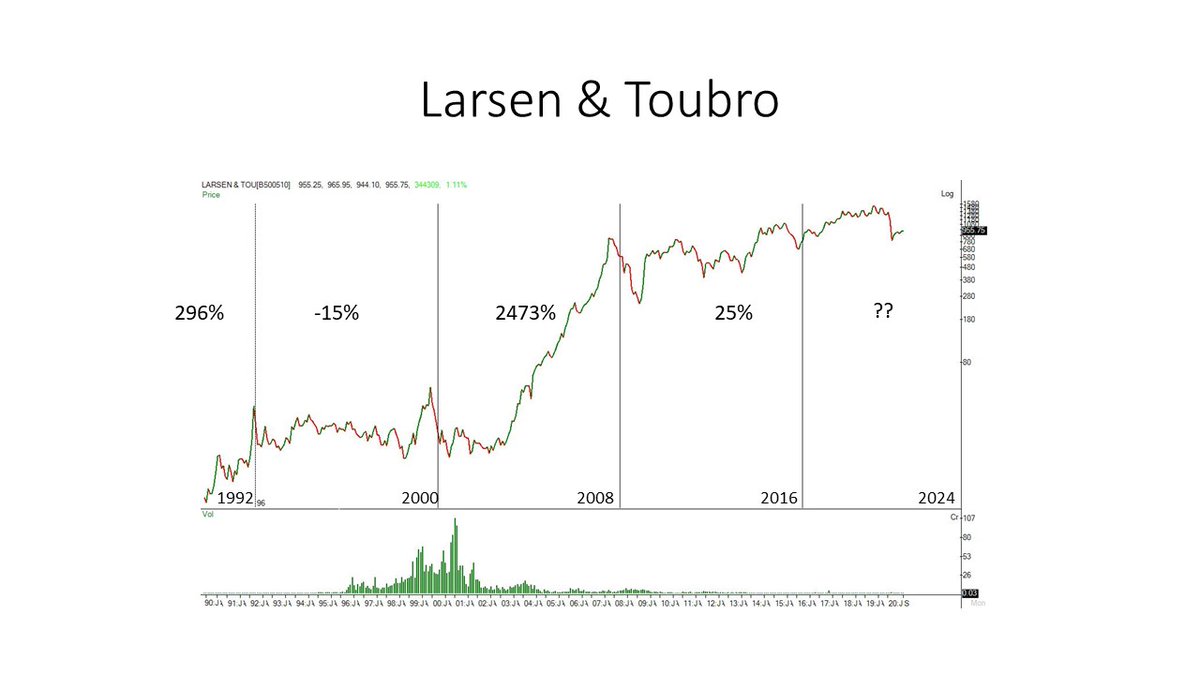

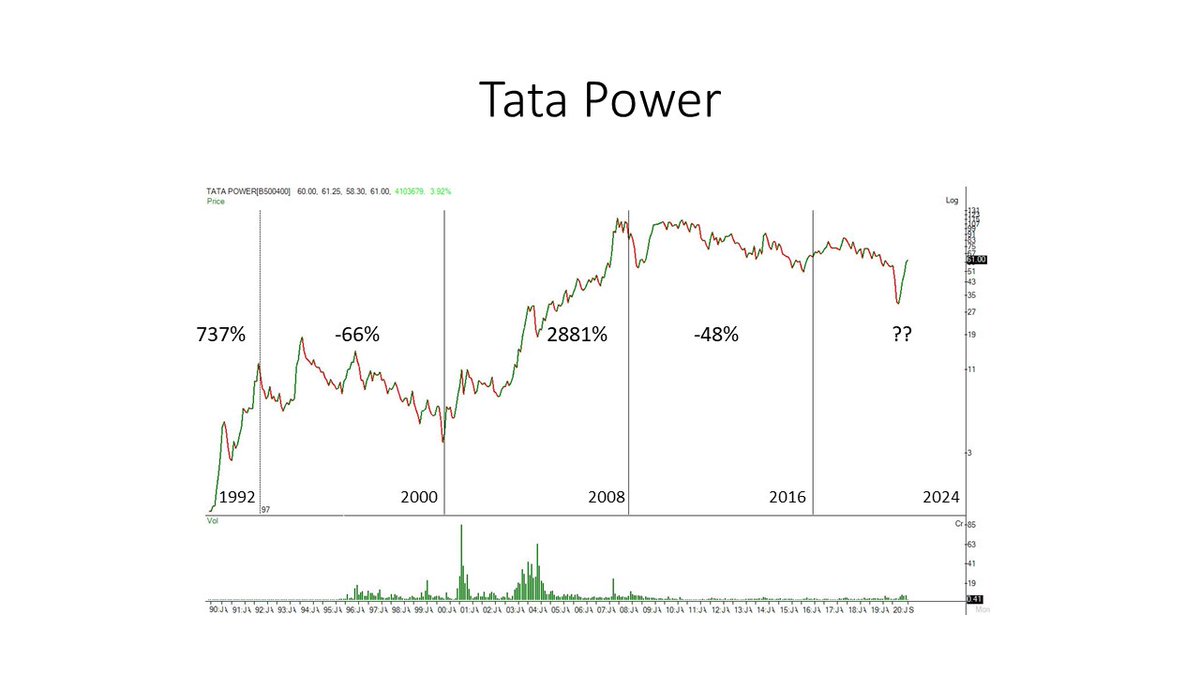

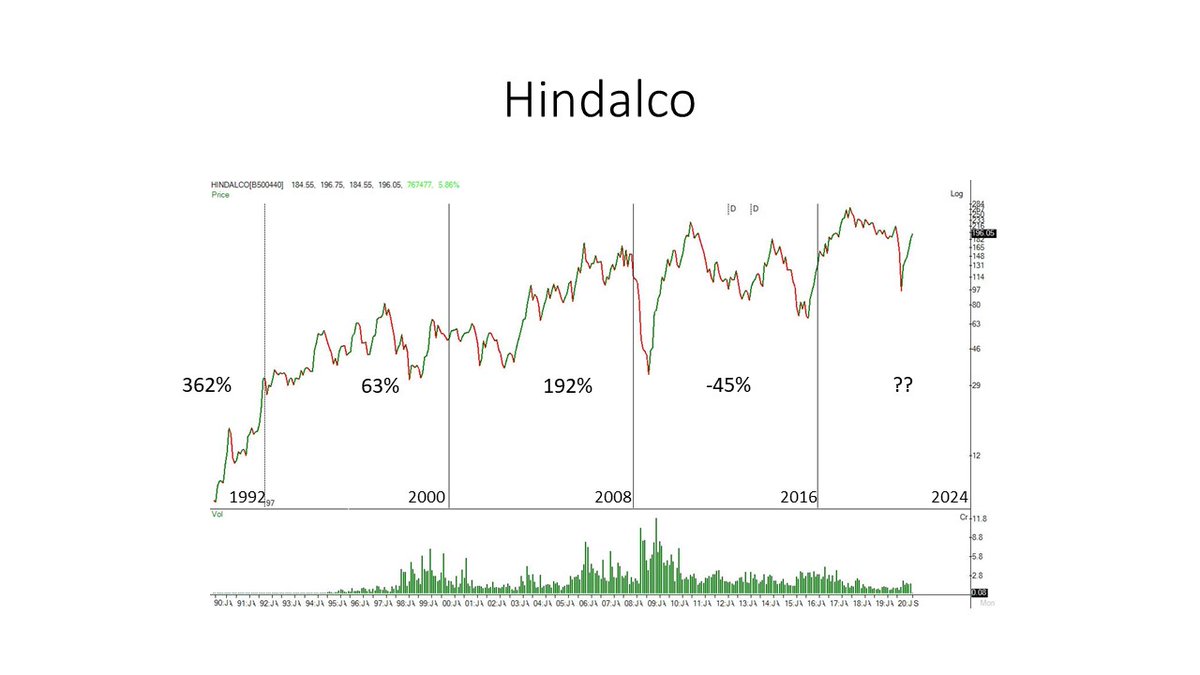

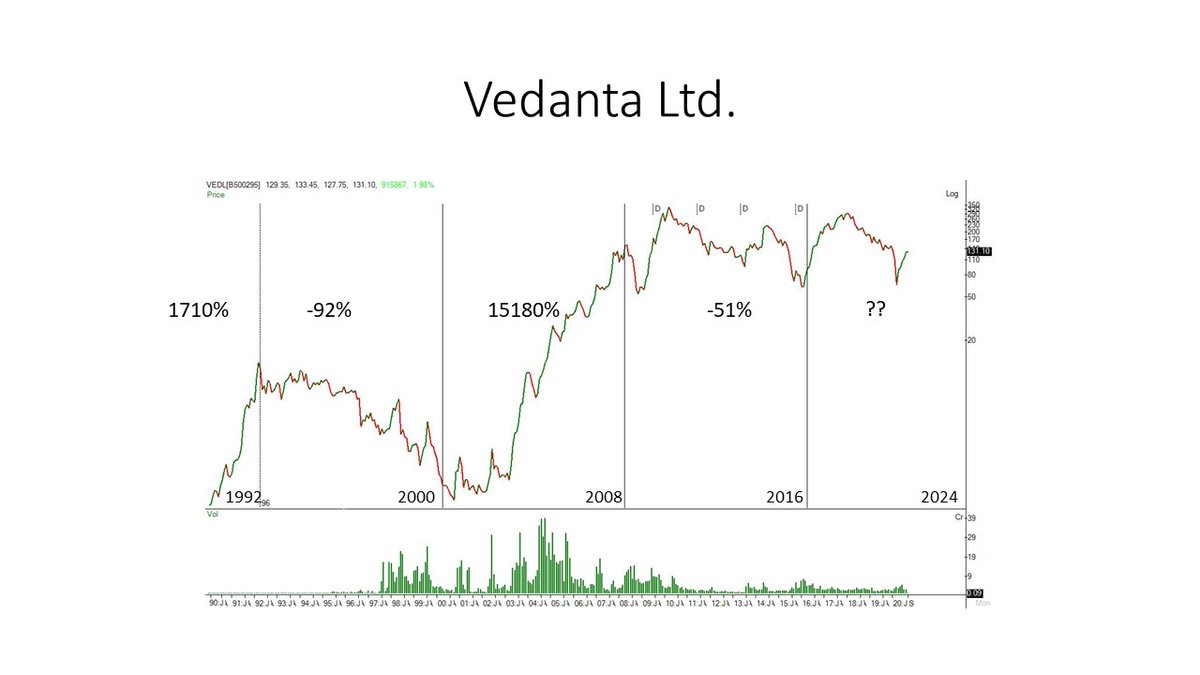

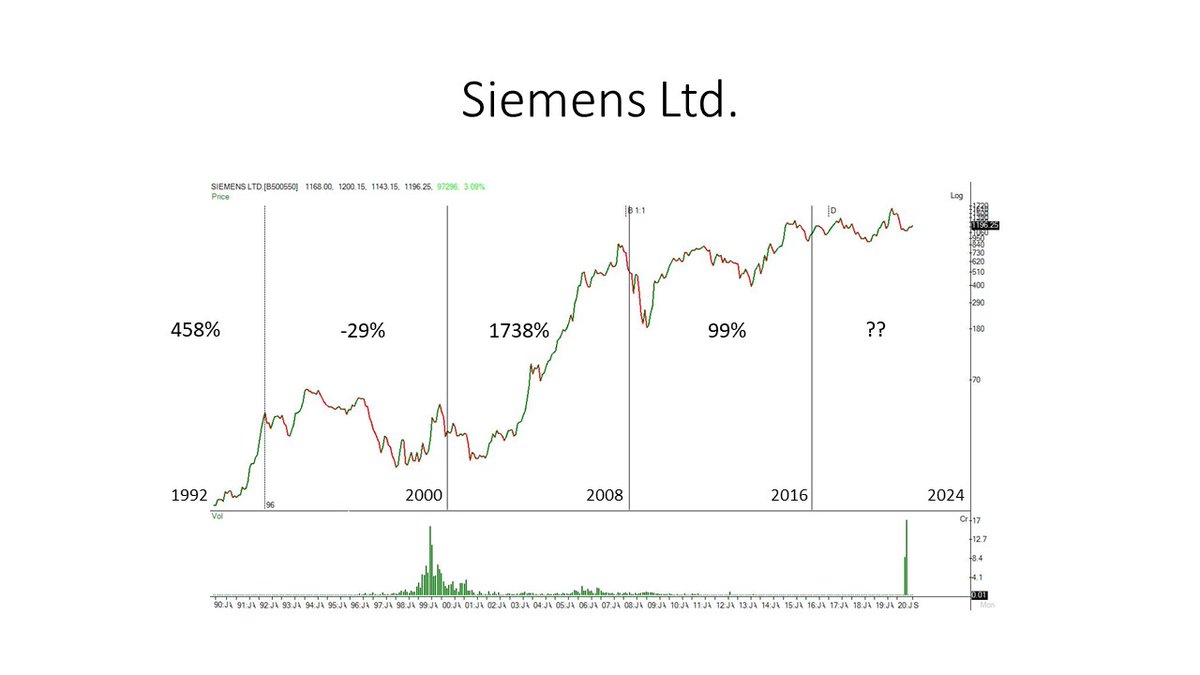

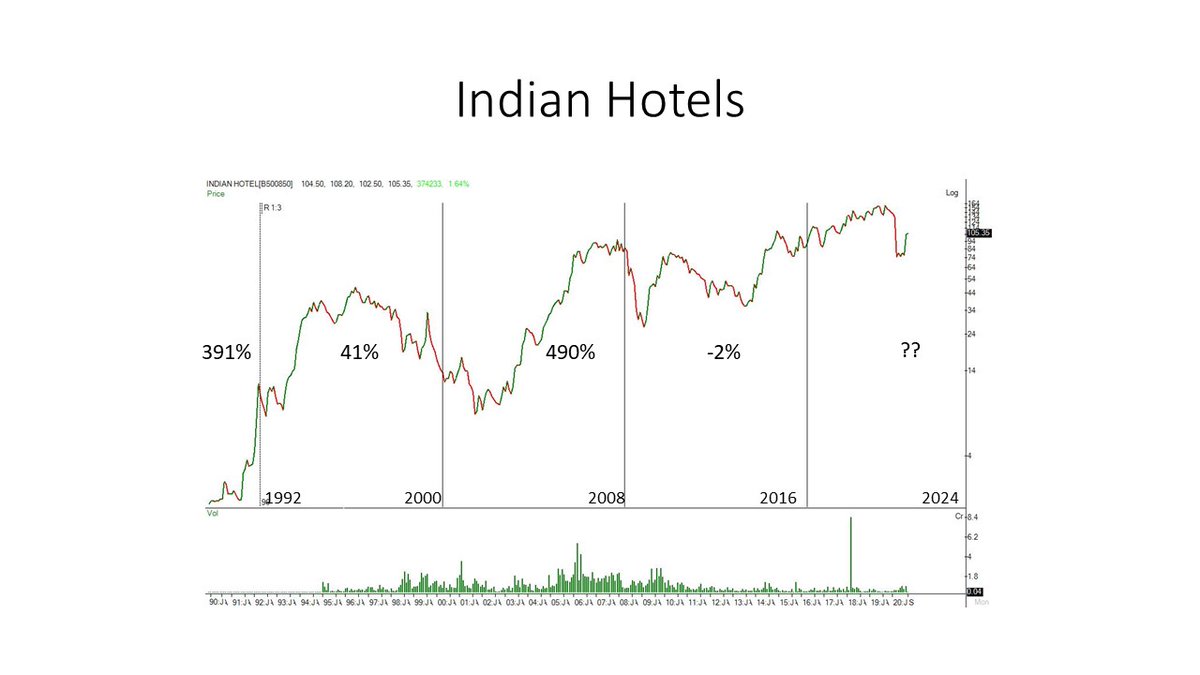

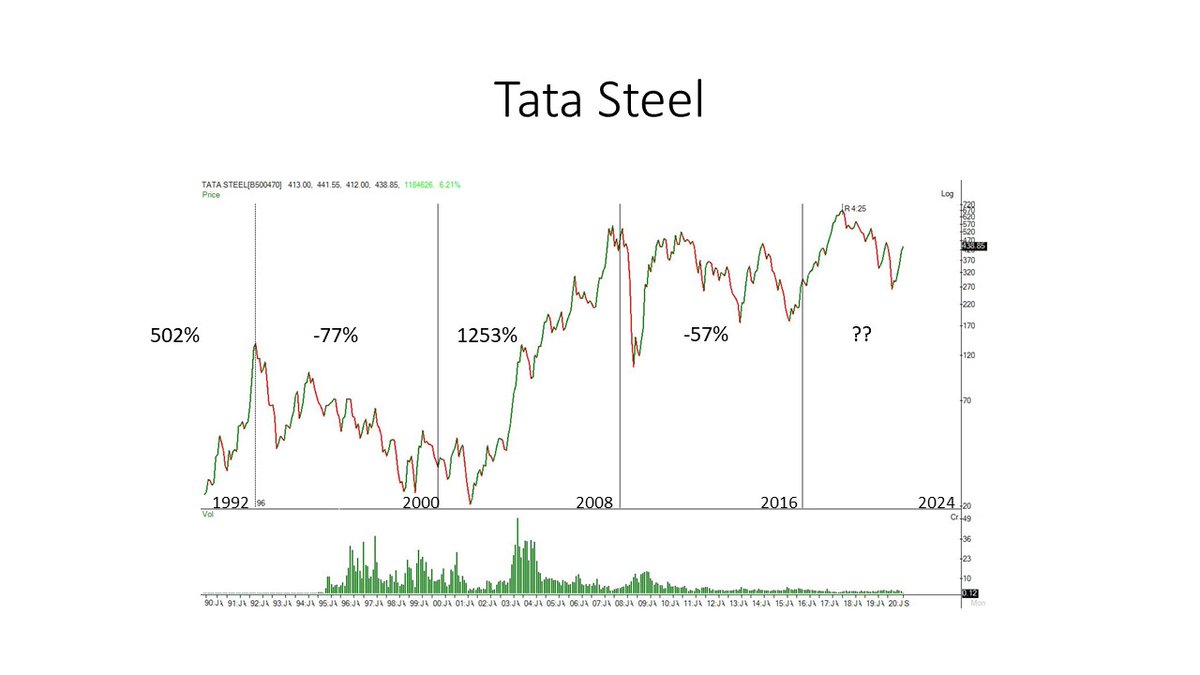

Check these charts and decide for yourself. I have plotted them just like #Sensex chart above. The returns are point to point returns over 8 year period.

#TataSteel

#TataSteel

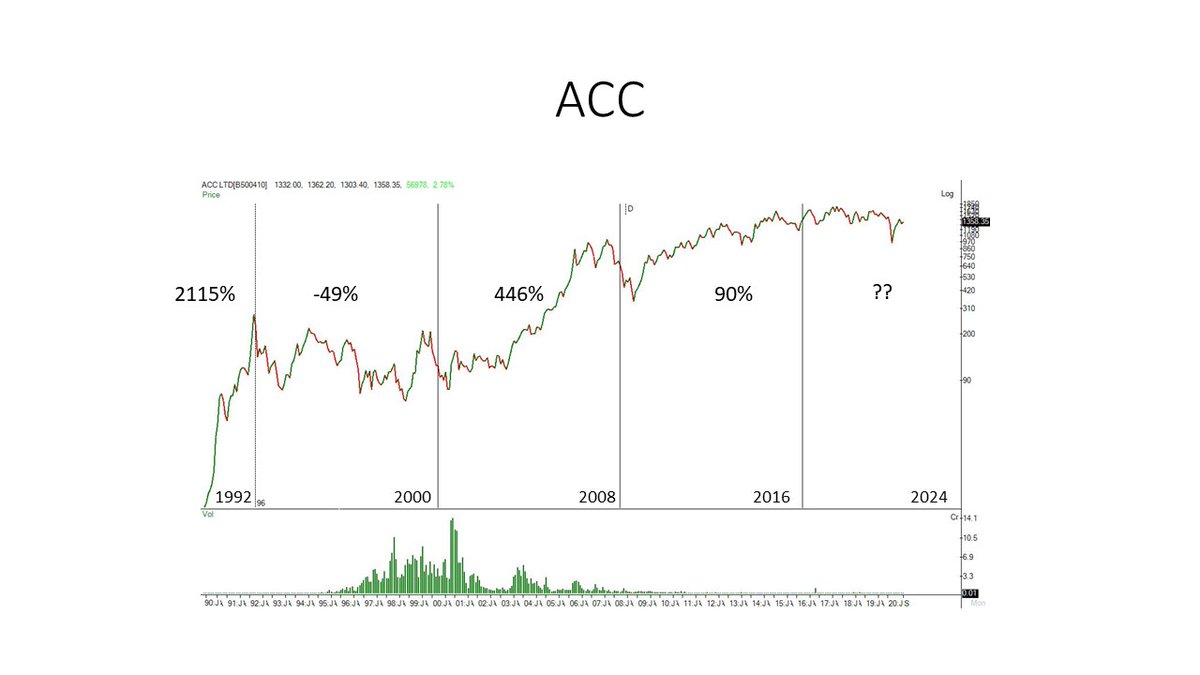

#HarshadMehtas Favourite - #ACC

The returns calculated for greed phase of 1992 are from 1990 since earlier data is not readily available. But look at the way it moved. Mind boggling isn't it?

The returns calculated for greed phase of 1992 are from 1990 since earlier data is not readily available. But look at the way it moved. Mind boggling isn't it?

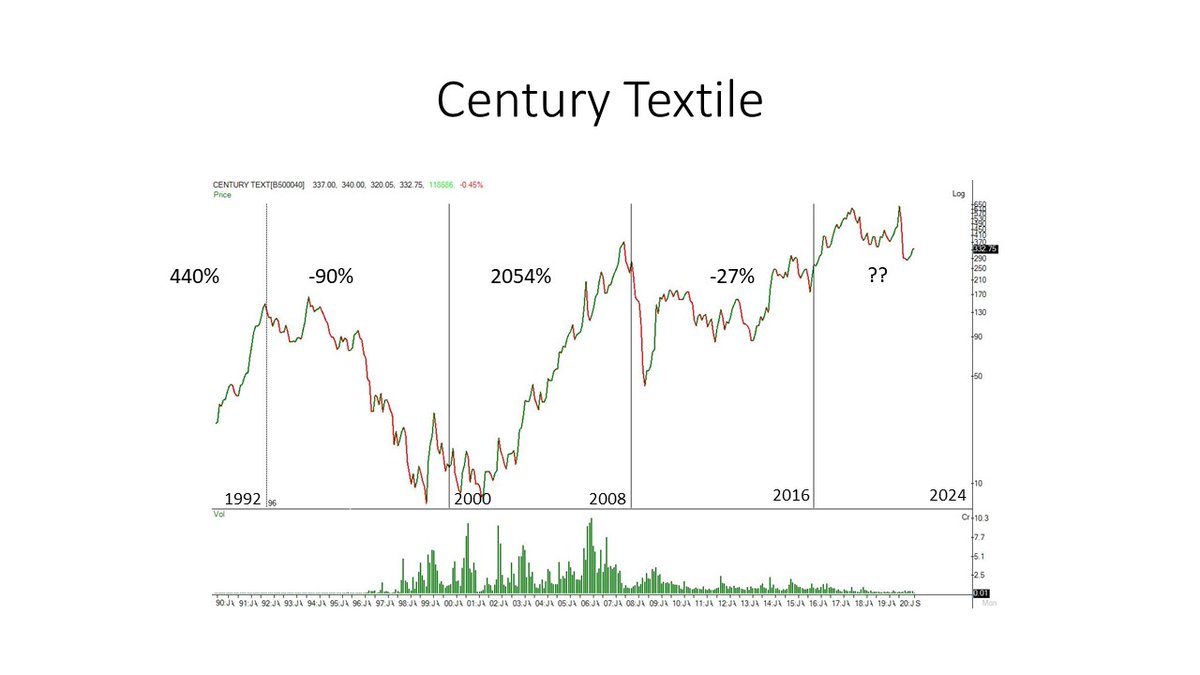

Here's another favourite from #1992 - #Centurytextile

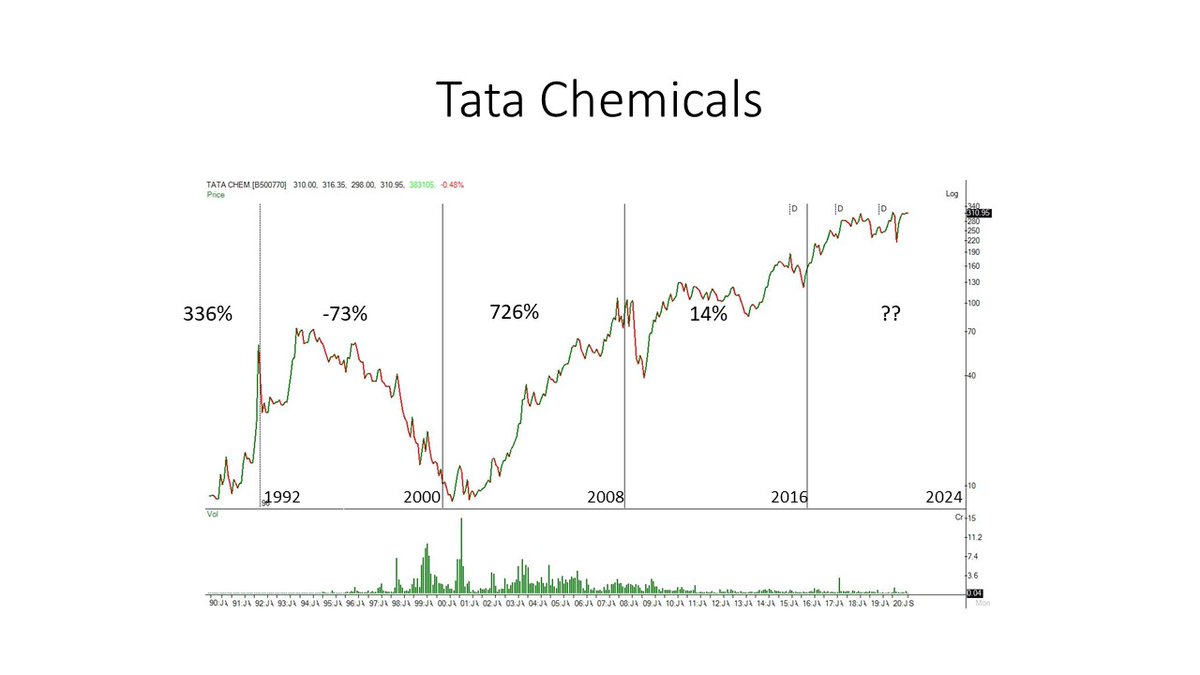

#TataChemicals If you have not noticed so far then all the above companies are or once were a part of #Sensex

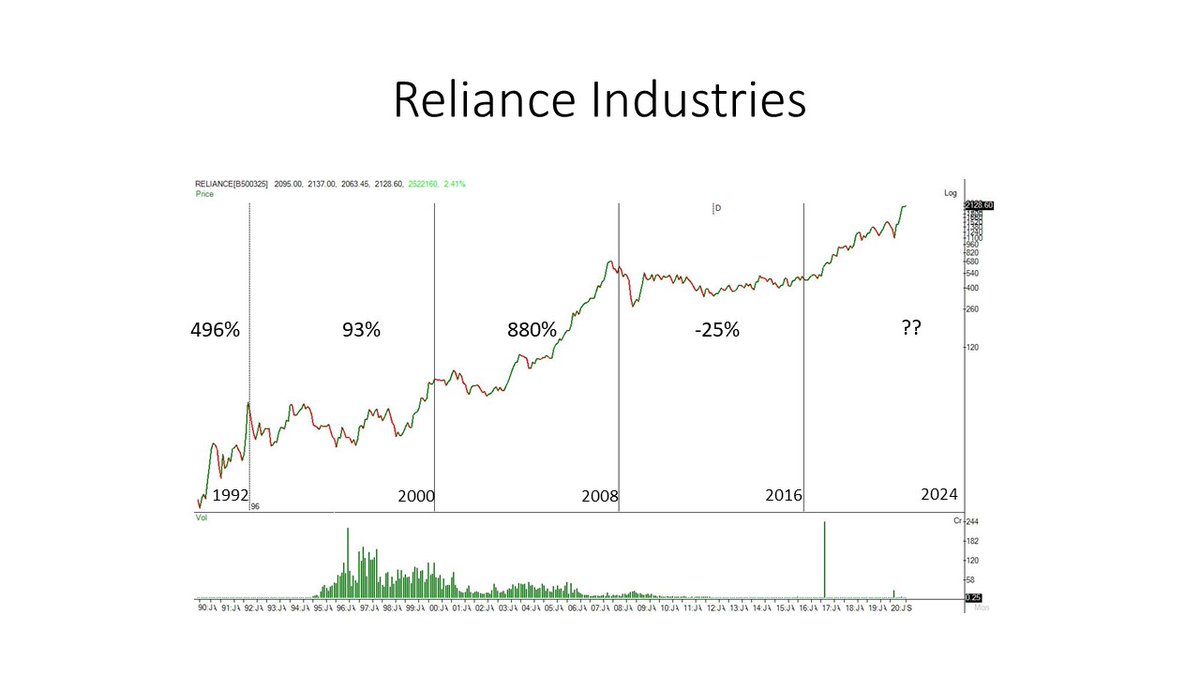

#Reliance #RelianceIndustries #RIL is a company which has transformed over the years...always changing and adapting with the changing times. During 1992 it was a #textile company, in 2008 it was an #OilnGas company and in 2024 its more of a #tech or #data company.

The 8-Year #Greed and #Fear #Cycle could helps you identify what stocks to buy when. But its not as simple as buying any old economy stock in greed phase. Here are some companies which are probably failures.

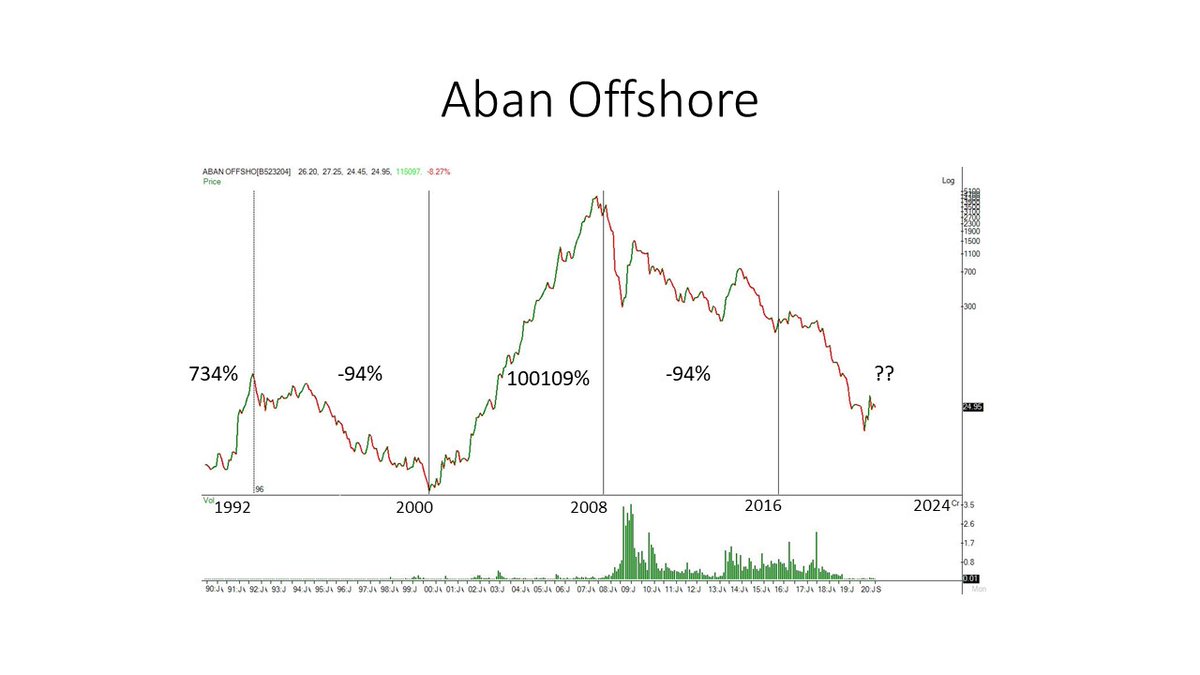

Look at #AbanOffshore. It gained a whooping 100109% between 2000-2008.

Look at #AbanOffshore. It gained a whooping 100109% between 2000-2008.

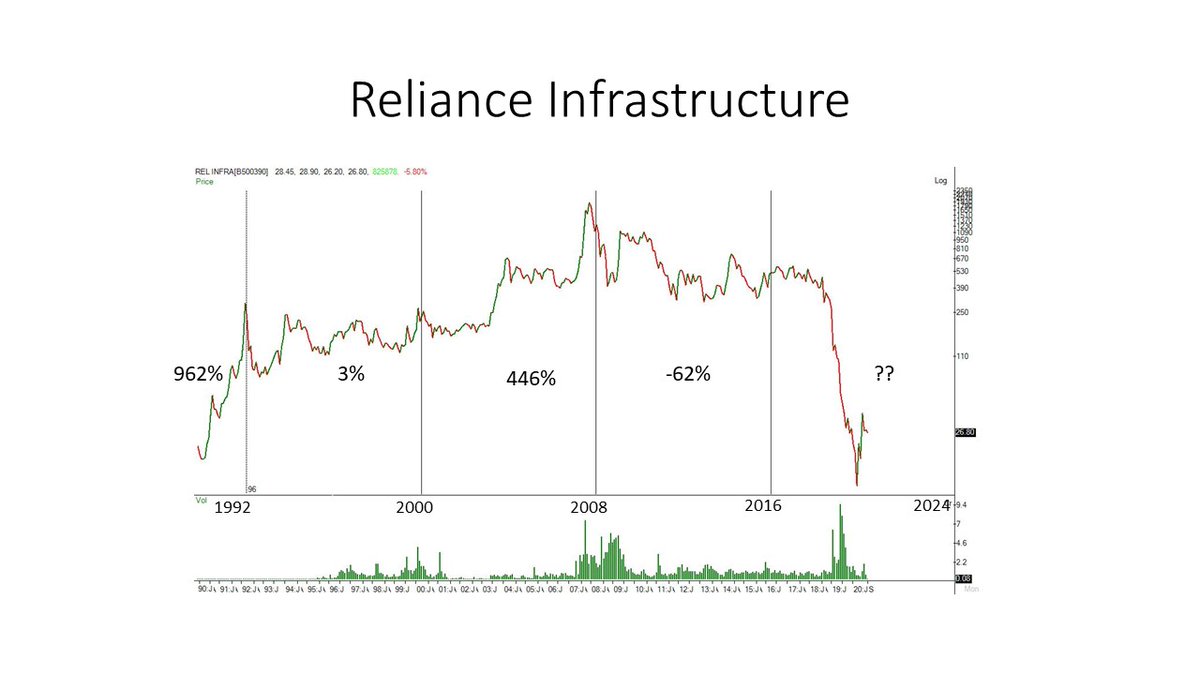

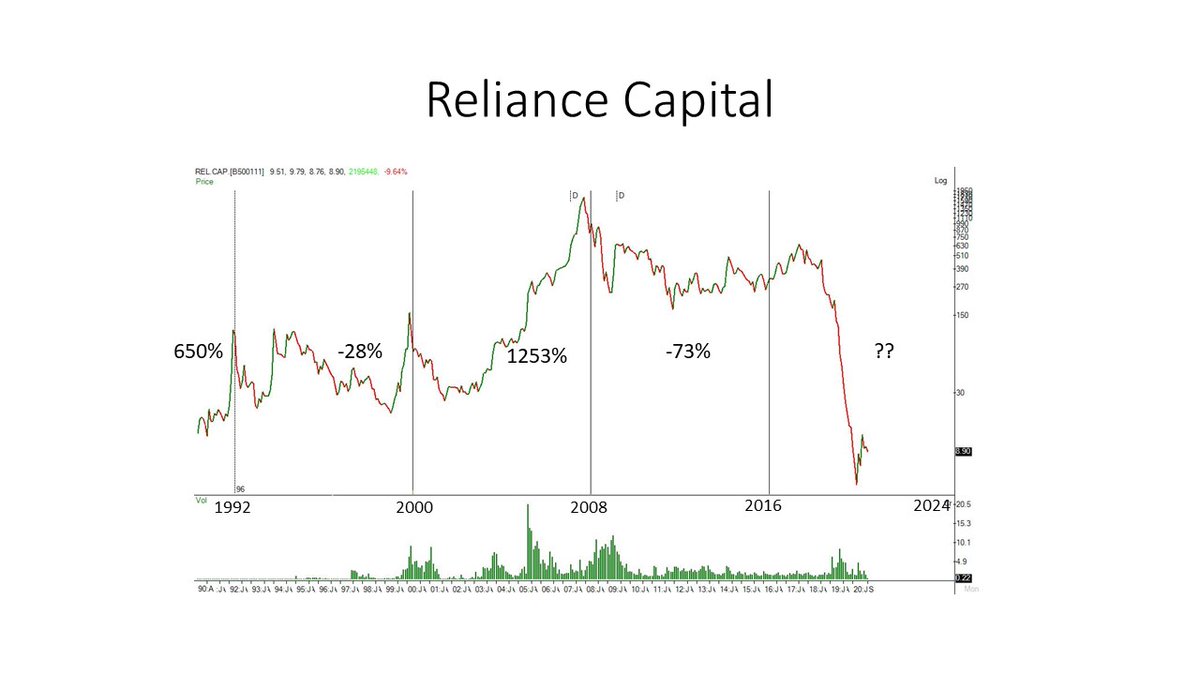

Aban was a dream stock in previous greed phases but it seems like a forgotten story now. Its the same with #Relinfra and #Relcapital.

There are two things which one must note

1. Companies fail over time due to ineffective management, poor finances, failure to adapt etc.

There are two things which one must note

1. Companies fail over time due to ineffective management, poor finances, failure to adapt etc.

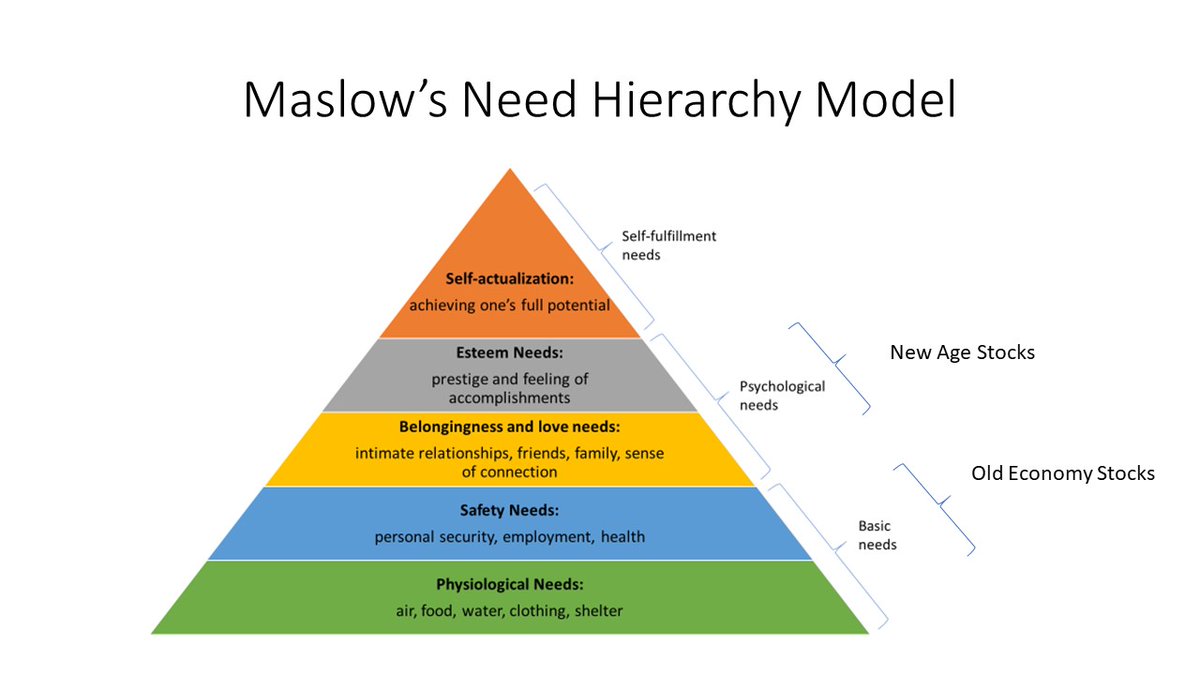

2. Human needs change over time.

Old economy stocks generally cater to basic needs.

New Age stocks tend to cater to psychological needs.

These needs evolve over time. Mobile phones were a status symbol back in the 1990's. Its a basic necessity now.

Old economy stocks generally cater to basic needs.

New Age stocks tend to cater to psychological needs.

These needs evolve over time. Mobile phones were a status symbol back in the 1990's. Its a basic necessity now.

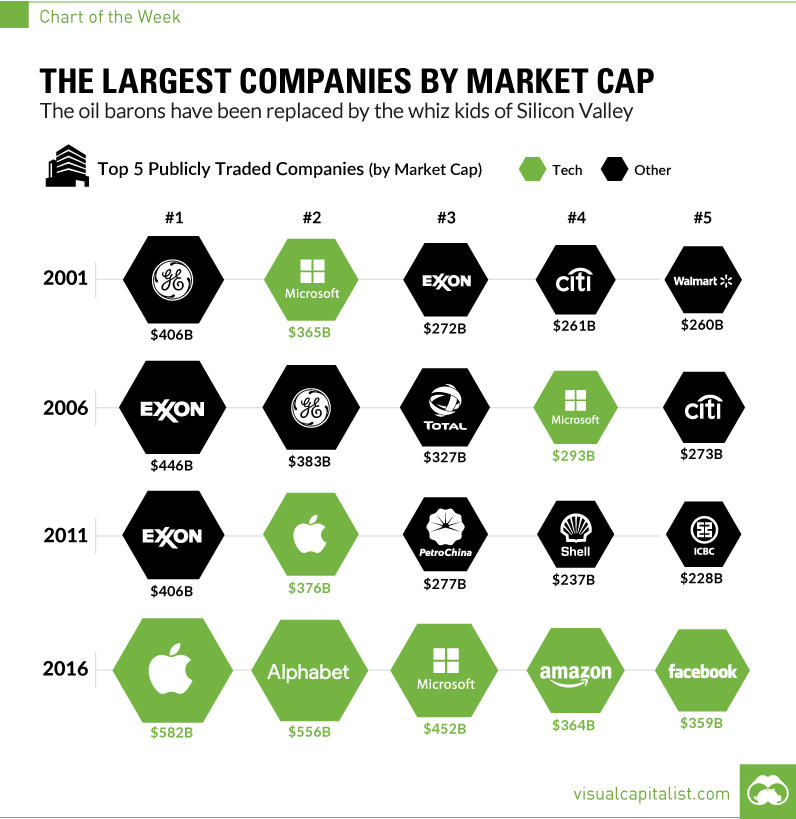

#Oil was the fuel which kept economies running but now its slowly being replaced with #data. Companies like #Google #Facebook and #Amazon are the kings in the market today.

So start looking at sectors which are fulfilling the basic human needs right now to identify multibaggers.

So start looking at sectors which are fulfilling the basic human needs right now to identify multibaggers.

Thats how u could use the #greedandfear cycle to identify multibaggers. You can watch my detailed videos on the same and even read transcripts on this link. tinyurl.com/y6yulpwl

Hope you enjoyed this thread. Thanks

Hope you enjoyed this thread. Thanks

• • •

Missing some Tweet in this thread? You can try to

force a refresh