#RealInvestmentReport is out!

Despite the expected #surge in #inflation early in the week, #bulls picked themselves up to rally #stocks into Friday. We discuss the potential for a short-term #bounce, why the #Fed will make a #mistake, and #postioning now.

realinvestmentadvice.com/despite-surgin…

Despite the expected #surge in #inflation early in the week, #bulls picked themselves up to rally #stocks into Friday. We discuss the potential for a short-term #bounce, why the #Fed will make a #mistake, and #postioning now.

realinvestmentadvice.com/despite-surgin…

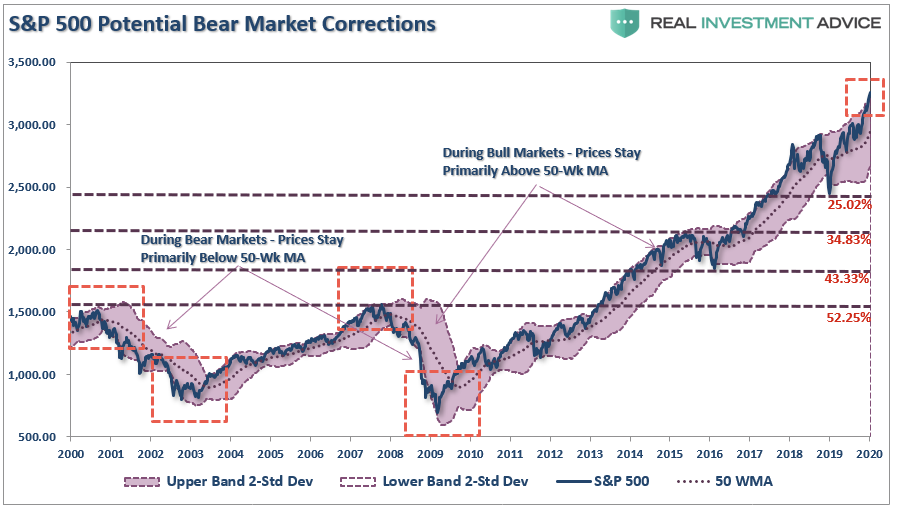

#LessonLearned - don't anticipate the turn in your #technicalsignals. As noted last week, it "seemed" the signal had turned, but it didn't. The #signal is very #oversold, so set up for a short-term #bounce is likely. Caution is still advised for now.

realinvestmentadvice.com/despite-surgin…

realinvestmentadvice.com/despite-surgin…

If we are #correct in our assessment about the roll-off #effect of #stimulus and #liquidity, we could well see #bonds outperform #stocks in 2022. We are watching very closely as we currently hold minimal duration in our fixed-income #portfolios.

realinvestmentadvice.com/despite-surgin…

realinvestmentadvice.com/despite-surgin…

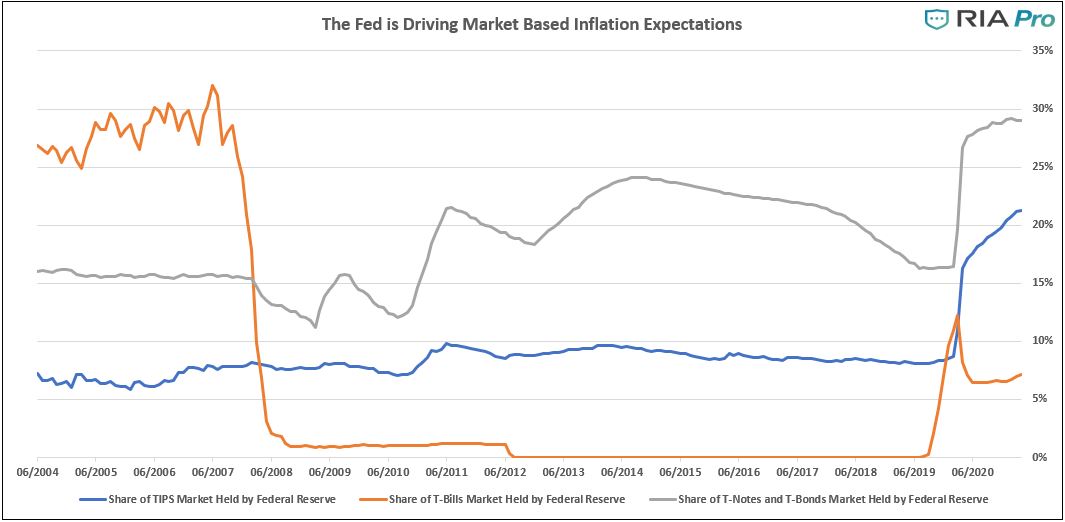

As noted by @thevaluereport, the #Fed has been causing the surge in #inflation expectations which may become problematic in managing #policy.

realinvestmentadvice.com/despite-surgin…

realinvestmentadvice.com/despite-surgin…

The #Fed is in a difficult position with #inflationary “#expectations” rising, caused by their actions.

Historically, there have been ZERO times the Federal Reserve hiked rates that did not negatively affect outcomes. #policymistake

realinvestmentadvice.com/despite-surgin…

Historically, there have been ZERO times the Federal Reserve hiked rates that did not negatively affect outcomes. #policymistake

realinvestmentadvice.com/despite-surgin…

• • •

Missing some Tweet in this thread? You can try to

force a refresh