A significant #bond #buying opportunity is approaching.

As bond yields surge, history and #techncial analysis suggest that we should look at bonds for both #capital appreciation and a #risk hedge.

realinvestmentadvice.com/surge-in-bond-…

As bond yields surge, history and #techncial analysis suggest that we should look at bonds for both #capital appreciation and a #risk hedge.

realinvestmentadvice.com/surge-in-bond-…

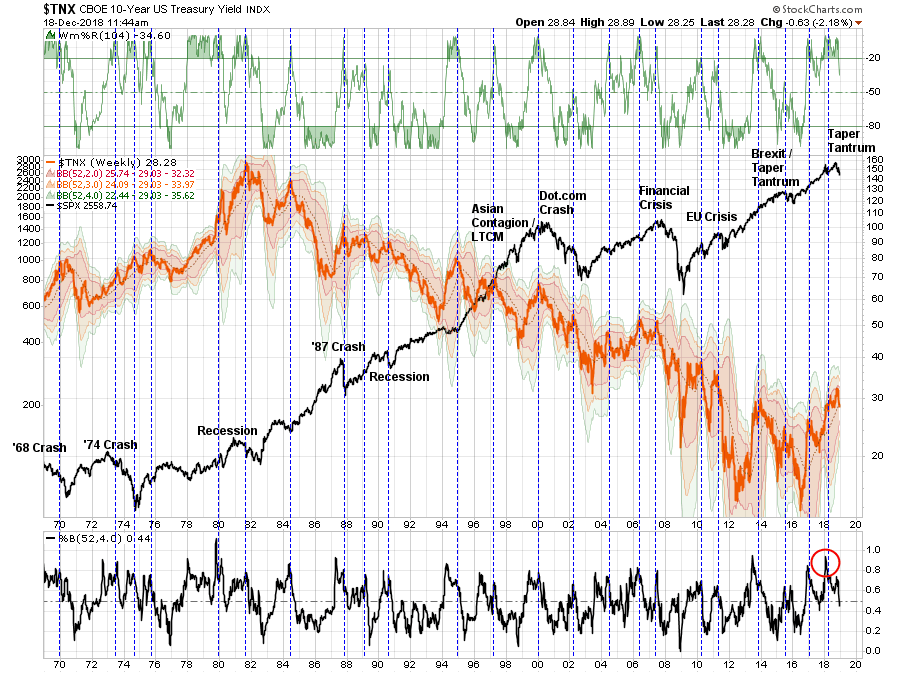

In Dec 2018, we wrote why Jeff Gundlach was likely incorrect about 6% yields.

“Rates are at levels that historically led to some sort of event either economic, financial, or both, When that occurs, rates will go to 1.5% and closer to Zero.“

We got to 0.5%

realinvestmentadvice.com/surge-in-bond-…

“Rates are at levels that historically led to some sort of event either economic, financial, or both, When that occurs, rates will go to 1.5% and closer to Zero.“

We got to 0.5%

realinvestmentadvice.com/surge-in-bond-…

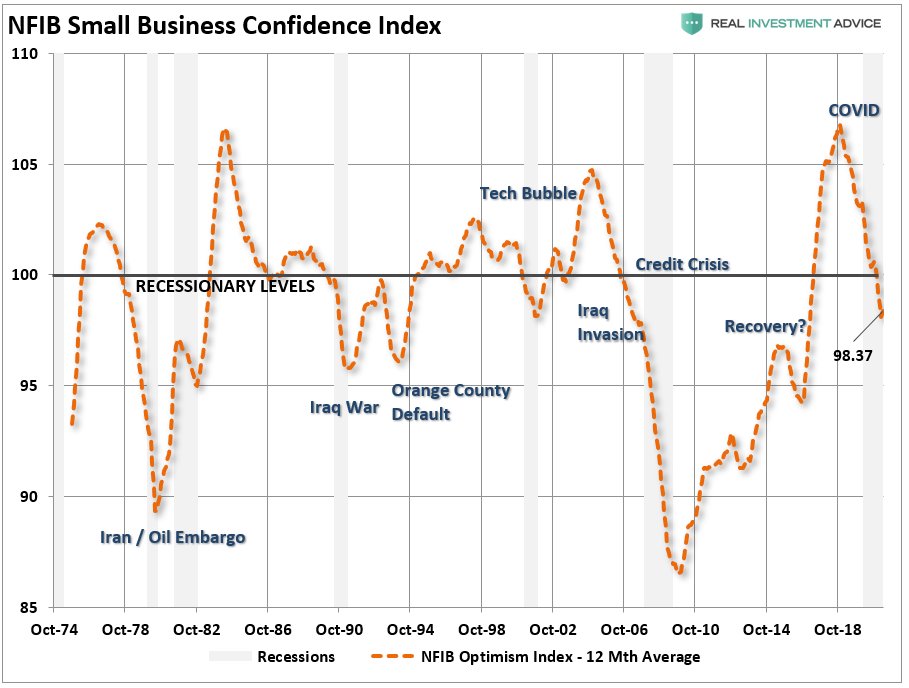

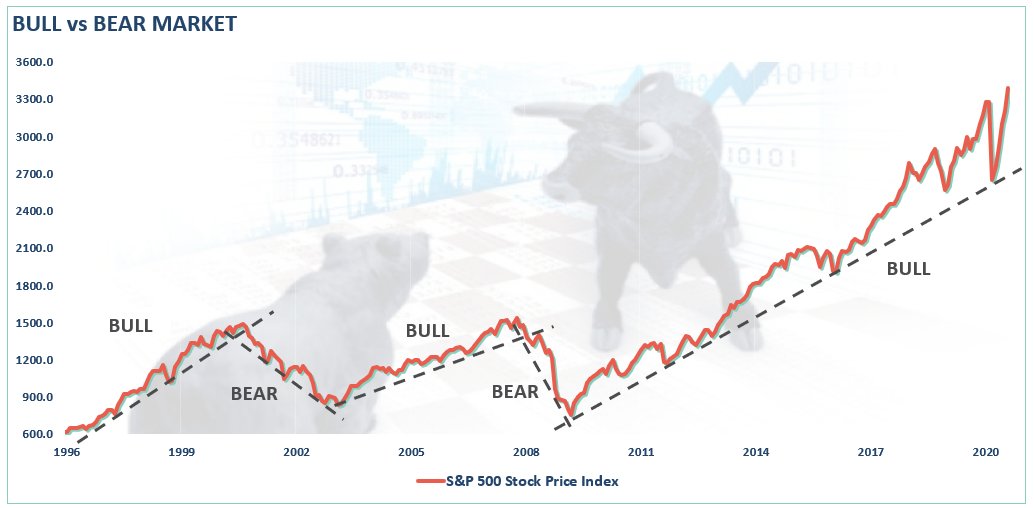

The surge in 2-year #bond #yields is unprecedented. Historically, such a surge in short-term yields coincides with either #recessions or #market events. With yields now 4-std deviations above its 52-week moving average, such has denoted peaks previously.

realinvestmentadvice.com/surge-in-bond-…

realinvestmentadvice.com/surge-in-bond-…

The current surge in bond yields has taken the 10-year #bond to extreme oversold levels. The 10-year rate is now 4-std dev above its 52-week moving average. It is also approaching the top of the long-term downtrend channel from 1980.

realinvestmentadvice.com/surge-in-bond-…

realinvestmentadvice.com/surge-in-bond-…

Notably, people don’t buy #houses or #cars. They buy #payments. Payments are a function of interest rates.

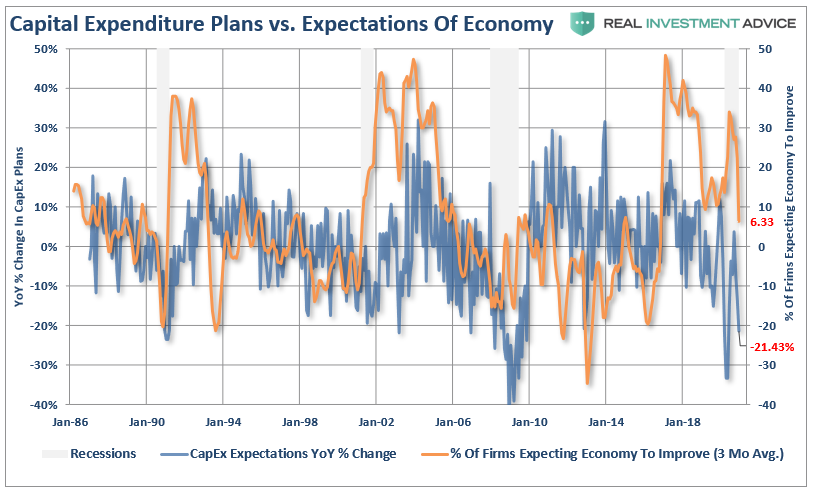

Higher #rates create “demand destruction.” Therefore, as rates increase the deflationary impact will quickly show in commodity prices.

realinvestmentadvice.com/surge-in-bond-…

Higher #rates create “demand destruction.” Therefore, as rates increase the deflationary impact will quickly show in commodity prices.

realinvestmentadvice.com/surge-in-bond-…

Also, when the #Fed tapers their balance sheet, money moves into #bonds for the #safety trade. The Fed will announce their #taper schedule in May.

realinvestmentadvice.com/surge-in-bond-…

realinvestmentadvice.com/surge-in-bond-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh