[1/🧵] @Ripple's Green ♻️ Agenda 2030 — Part 1/2

@Ripple as a significant actor in the achievement of the most critical goal of:

🌱 „Goal 13 Climate Action“

In part 1 of this series, I will break it ALL down for you in regards to #Ripple 🧵👇

@Ripple as a significant actor in the achievement of the most critical goal of:

🌱 „Goal 13 Climate Action“

In part 1 of this series, I will break it ALL down for you in regards to #Ripple 🧵👇

[2/33] ⚠️ IMPORTANT NOTICE!

This is typically a heated topic. That is why I will do my best to be neutral, clear, and factual. Expect no guesstimates or personal opinions on this subject.

Everything is stated exactly as it is!

This is typically a heated topic. That is why I will do my best to be neutral, clear, and factual. Expect no guesstimates or personal opinions on this subject.

Everything is stated exactly as it is!

[3/33] Before I get any farther into the intricacies of #Ripple, we must first build the groundwork:

❓ What is the primary goal ❓

The purpose is to combat #climate change by enacting the "Paris Agreement" and meeting the "#UN Sustainable Development Goals [13]."

❓ What is the primary goal ❓

The purpose is to combat #climate change by enacting the "Paris Agreement" and meeting the "#UN Sustainable Development Goals [13]."

[4/33] 👉 #UN Paris 2015 Climate Agreement

This agreement was signed by ALL 196 parties to the #UN Framework Convention on Climate Change at #COP21 in Paris.

. . .

This agreement was signed by ALL 196 parties to the #UN Framework Convention on Climate Change at #COP21 in Paris.

. . .

[5/33] . . .

All countries committed in the agreement to endeavor to keep global temperature rise well below 2 degrees #celsius, and given the serious hazards, to aim for 1.5°C.

Who cares? Absolutely everyone!👇

All countries committed in the agreement to endeavor to keep global temperature rise well below 2 degrees #celsius, and given the serious hazards, to aim for 1.5°C.

Who cares? Absolutely everyone!👇

[6/33] 👉 Goal 13 — #Climate Action — Objectives

✅ Increase resilience to climate-related catastrophes

✅ Integrate #climate change measures into policy

✅ Develop knowledge to deal with #climatechange

✅ Implement the #UN framework convention

✅ Promote mechanisms for planning

✅ Increase resilience to climate-related catastrophes

✅ Integrate #climate change measures into policy

✅ Develop knowledge to deal with #climatechange

✅ Implement the #UN framework convention

✅ Promote mechanisms for planning

[7/33] @Ripple issued multiple press releases and #insights regarding the present status of #crypto sustainability and #Ripples objective of reaching #carbon neutrality by 2030/40.

By summing them all, we should be able to understand more clearly where we are going. 🧐

By summing them all, we should be able to understand more clearly where we are going. 🧐

[8/33] 1⃣ Press Release [Sep 30, 2020] — "#Ripple Leads Sustainability Agenda to Achieve #Carbon Neutrality By 2030"

• #Ripple has pledged to be carbon-neutral by 2030, making it the first firm in the #blockchain sector to achieve so.

ripple.com/ripple-press/r…

. . .

• #Ripple has pledged to be carbon-neutral by 2030, making it the first firm in the #blockchain sector to achieve so.

ripple.com/ripple-press/r…

. . .

[9/33] . . .

• #Blockchain and #crypto are ideally positioned to spearhead global finance's commitment to a more sustainable future.

• #Ripple has committed to leading this endeavor in collaboration with strategic organizations such as #REBA/#CEBI and @RockyMtnInst/#RMI

. . .

• #Blockchain and #crypto are ideally positioned to spearhead global finance's commitment to a more sustainable future.

• #Ripple has committed to leading this endeavor in collaboration with strategic organizations such as #REBA/#CEBI and @RockyMtnInst/#RMI

. . .

[10/33] . . .

• In collaboration with @energywebx, #Ripple has co-created #EW-Zero, a new open-source technology that will allow any #blockchain to #decarbonize by purchasing #renewable energy in local marketplaces throughout the world.

. . .

• In collaboration with @energywebx, #Ripple has co-created #EW-Zero, a new open-source technology that will allow any #blockchain to #decarbonize by purchasing #renewable energy in local marketplaces throughout the world.

. . .

[11/33] . . .

• Following the release, any #blockchain developer will be able to access and use the tool.

• The @XRPLF will be the first to employ #EW-Zero to guarantee offsets are acquired for #XRPLedger use.

energy-web-foundation.gitbook.io/energy-web/how…

• Following the release, any #blockchain developer will be able to access and use the tool.

• The @XRPLF will be the first to employ #EW-Zero to guarantee offsets are acquired for #XRPLedger use.

energy-web-foundation.gitbook.io/energy-web/how…

[12/33] 2⃣ Insight [Apr 8, 2021] — "#Cryptocurrency #Sustainability: The Path Forward"

• Ripple has signed up to the #CryptoClimateAccord [#CCA]

• Ripple joins 20 Supporters, including #UN, @CoinSharesCo, Compass #Mining, the @XRPLF & @ConsenSys

ripple.com/insights/crypt…

. . .

• Ripple has signed up to the #CryptoClimateAccord [#CCA]

• Ripple joins 20 Supporters, including #UN, @CoinSharesCo, Compass #Mining, the @XRPLF & @ConsenSys

ripple.com/insights/crypt…

. . .

[13/33] . . .

• Globally, the costs of #climatechange will equal to about 3% of #GDP by 2060.

The Accord's key objectives include:

✅ Enabling all #blockchains to be powered by 100% #renewables by the 2025 #UNFCCC #COP Conference

. . .

• Globally, the costs of #climatechange will equal to about 3% of #GDP by 2060.

The Accord's key objectives include:

✅ Enabling all #blockchains to be powered by 100% #renewables by the 2025 #UNFCCC #COP Conference

. . .

[14/33] . . .

✅ Developing an open-source accounting standard for measuring #emissions from the #crypto industry

✅ Achieving net-zero #emissions for the entire #crypto industry, including all business operations beyond #blockchain and retroactive emissions, by 2040.

. . .

✅ Developing an open-source accounting standard for measuring #emissions from the #crypto industry

✅ Achieving net-zero #emissions for the entire #crypto industry, including all business operations beyond #blockchain and retroactive emissions, by 2040.

. . .

[15/33] . . .

Partners include 🫱 🫲:

• Alliance for Innovative Regulation (#AIR)

• Rocky Mountain Institute (#RMI)

• Energy Web (#EWF)

Partners include 🫱 🫲:

• Alliance for Innovative Regulation (#AIR)

• Rocky Mountain Institute (#RMI)

• Energy Web (#EWF)

https://twitter.com/Ripple/status/1474418844735356930?s=20&t=gWBy_TMAa5BEbCQkDNNHag

[16/33] 3⃣ Insight [May 19, 2022] — "The Catalytic Role of #Crypto and #Blockchain in #Climate Change"

• Remove more than 50B tons of #carbon from the earth’s atmosphere

• Increase #liquidity and #traceability in a fragmented, complicated market

ripple.com/insights/the-c…

. . .

• Remove more than 50B tons of #carbon from the earth’s atmosphere

• Increase #liquidity and #traceability in a fragmented, complicated market

ripple.com/insights/the-c…

. . .

[17/33] . . .

• #Ripple's $100 million climate promise

• #Carbon offsets are likely to reach $550B by 2050

• Supply bottlenecks, slow time to market, opacity, a lack of fair price discovery, and fraud plague existing #carbon infrastructure.

. . .

• #Ripple's $100 million climate promise

• #Carbon offsets are likely to reach $550B by 2050

• Supply bottlenecks, slow time to market, opacity, a lack of fair price discovery, and fraud plague existing #carbon infrastructure.

. . .

[18/33] . . .

• Allow for new types of value that are more #scalable, #transparent, #traceable, and #verifiable.

• Suppliers may benefit from #blockchain's #tokenization capabilities and open, #decentralized governance.

. . .

• Allow for new types of value that are more #scalable, #transparent, #traceable, and #verifiable.

• Suppliers may benefit from #blockchain's #tokenization capabilities and open, #decentralized governance.

. . .

[19/33] . . .

@Ripple's $100 million investment will fund initiatives such as:

✅ Building an inventory of high-quality #carbon credits

✅ Investing in #carbon-removal technology companies and market makers (#Xange, #CarbonCure and #Invert)

. . .

@Ripple's $100 million investment will fund initiatives such as:

✅ Building an inventory of high-quality #carbon credits

✅ Investing in #carbon-removal technology companies and market makers (#Xange, #CarbonCure and #Invert)

. . .

[20/33] . . .

✅ Supporting new functionality and #developer tools focused on certified #carbon credit #NFTs

✅ Continuing to collaborate with the world's premier climate and conservation groups

. . .

✅ Supporting new functionality and #developer tools focused on certified #carbon credit #NFTs

✅ Continuing to collaborate with the world's premier climate and conservation groups

. . .

[21/33] . . .

• Additionally, @Ripple is a founding member of the World Economic Forum's [@wef/#WEF] Crypto Impact and Sustainability Accelerator (#CISA).

• Additionally, @Ripple is a founding member of the World Economic Forum's [@wef/#WEF] Crypto Impact and Sustainability Accelerator (#CISA).

[22/33] 4⃣ Insight [Oct 27, 2022] — "How #Blockchain-Powered #Carbon Markets Combat #Climate Change"

• Nearly 4,000 organizations have signed net-zero pledges.

• Businesses must cut their own #emissions to the greatest extent practicable.

ripple.com/insights/how-b…

. . .

• Nearly 4,000 organizations have signed net-zero pledges.

• Businesses must cut their own #emissions to the greatest extent practicable.

ripple.com/insights/how-b…

. . .

[23/33] . . .

• Many businesses are turning to #carbon credits, which are certificates that represent #greenhouse #emissions eliminated from the #atmosphere or #carbon trapped in soil.

• New #regulations require firms to be more transparent.

. . .

• Many businesses are turning to #carbon credits, which are certificates that represent #greenhouse #emissions eliminated from the #atmosphere or #carbon trapped in soil.

• New #regulations require firms to be more transparent.

. . .

[24/33] . . .

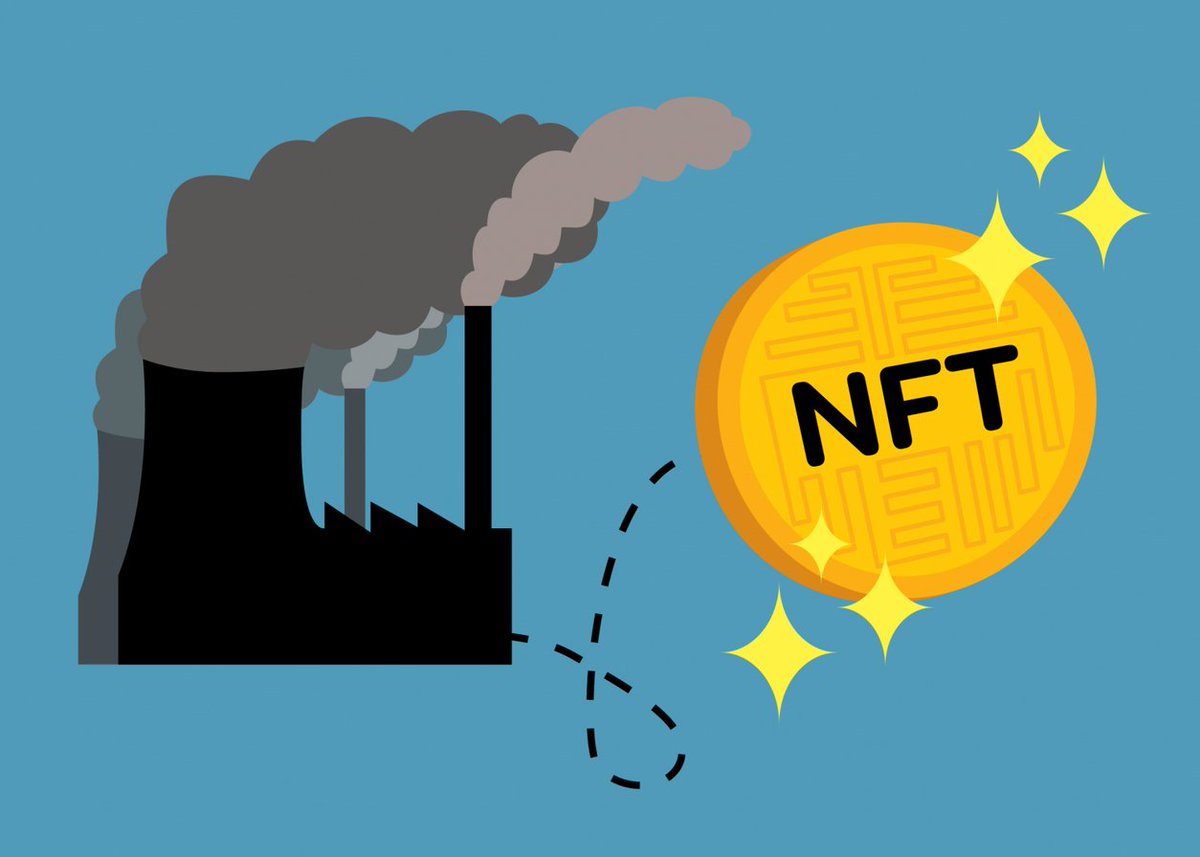

• #NFTs are increasingly being employed for functional #climate change use cases, such as #tokenizing carbon credits.

• #Minting, #transacting and #tracing these climate-themed #NFTs on a sustainable, #carbon-neutral #Blockchain.

. . .

• #NFTs are increasingly being employed for functional #climate change use cases, such as #tokenizing carbon credits.

• #Minting, #transacting and #tracing these climate-themed #NFTs on a sustainable, #carbon-neutral #Blockchain.

. . .

[25/33] . . .

• For purchasers, #carbon is increasingly being handled as a diverse #asset class, whether for corporate net zero obligations, strategic #ESG, or financial #ROI.

• For purchasers, #carbon is increasingly being handled as a diverse #asset class, whether for corporate net zero obligations, strategic #ESG, or financial #ROI.

[26/33] 👉 @Ripple Signed The #Climate Pledge

• It's all about fulfilling the Paris #Agreement target of limiting global warming to 1.5 degrees #Celsius or less.

. . .

• It's all about fulfilling the Paris #Agreement target of limiting global warming to 1.5 degrees #Celsius or less.

https://twitter.com/Ripple/status/1572265526931628037?s=20&t=AlRcLB_lFMNKyDkKQqdakg

. . .

[27/33] . . .

• Nearly 400 firms, including #Ripple, have joined The #Climate Pledge's promise to achieve net-zero #carbon emissions by 2040

• #Ripple helps initiatives by giving funding necessary to growing their operations and reaching the Paris Accord #climate targets

. . .

• Nearly 400 firms, including #Ripple, have joined The #Climate Pledge's promise to achieve net-zero #carbon emissions by 2040

• #Ripple helps initiatives by giving funding necessary to growing their operations and reaching the Paris Accord #climate targets

. . .

[28/33] . . .

The "#Climate Pledge Fund," in addition to "The #Climate Pledge," exists.

👉 A venture capital #fund that invests in firms that can help #Amazon fulfill The #Climate Pledge's objective of net-zero carbon emissions by 2040.

. . .

The "#Climate Pledge Fund," in addition to "The #Climate Pledge," exists.

👉 A venture capital #fund that invests in firms that can help #Amazon fulfill The #Climate Pledge's objective of net-zero carbon emissions by 2040.

. . .

[29/33] . . .

As they state:

👉 "Once a recipient receives #funding, they will be connected with the [...] success team to determine how #Amazon’s resources and expertise can help the company and its technology scale for success."

@CarbonCure (@Ripple Partner / #XRPL Usecase)

As they state:

👉 "Once a recipient receives #funding, they will be connected with the [...] success team to determine how #Amazon’s resources and expertise can help the company and its technology scale for success."

@CarbonCure (@Ripple Partner / #XRPL Usecase)

[30/33] Another noteworthy detail is that @chrislarsensf, through the Larsen Lam Climate Change Foundation, acquired 300 tons of #carbon dioxide removal from @Climeworks [01.06.2021]

climeworks.com/news/chris-lar…

climeworks.com/news/chris-lar…

[31/33] 👉 What are the distinctions between "#carbon offset" and "#carbon removal"?

• By permanently eliminating the #CO2 one emitted from the air (removal of previous or unavoidable #emissions), #Climeworks can bring genuine, quantifiable effect.

• By permanently eliminating the #CO2 one emitted from the air (removal of previous or unavoidable #emissions), #Climeworks can bring genuine, quantifiable effect.

[32/33] Finally, @Ripple has partnered with @NelnetSolar to spend $44 million in #solar energy to reduce #CO2 #emissions.

• According to data from @Nelnet, the group has more than $20 billion in assets and services more than $500 billion in loan assets.

cryptonews.com/news/ripple-an…

• According to data from @Nelnet, the group has more than $20 billion in assets and services more than $500 billion in loan assets.

cryptonews.com/news/ripple-an…

[33/33] Thank you to everyone who took the time to read this lengthy topic ❤️

⚠️ The 2nd edition of this series will focus on the role of #XRPL

If you enjoyed the thread, please follow me: @krippenreiter

Please feel free to contribute by sharing here 👇

⚠️ The 2nd edition of this series will focus on the role of #XRPL

If you enjoyed the thread, please follow me: @krippenreiter

Please feel free to contribute by sharing here 👇

https://twitter.com/krippenreiter/status/1604662605737611267?s=20&t=CePHj7eYYpD-xO-Sjucf-g

@threadreaderapp unroll

@WKahneman @digitalassetbuy @Fame21Moore @sentosumosaba @BCBacker @XRPcryptowolf @X__Anderson @stedas 👋

— My most recent article [Part 1/2 🧵] covering Ripples' green strategy, insights, investments, and objectives to achieve net-zero by 2040.

— My most recent article [Part 1/2 🧵] covering Ripples' green strategy, insights, investments, and objectives to achieve net-zero by 2040.

• • •

Missing some Tweet in this thread? You can try to

force a refresh