By Yalman Onaran (Bloomberg)

The tech-race:

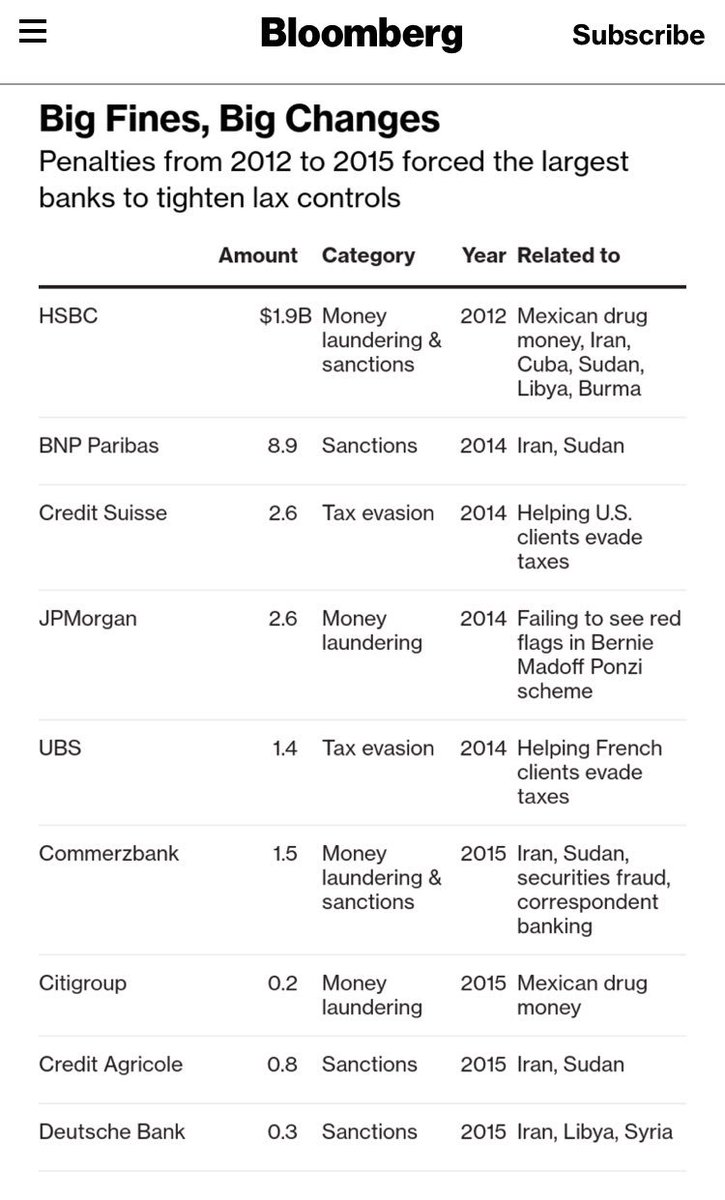

☝️New tech allow regulators better AML detection but then forces banks to use even better tech to detect before the regulators

Thread👇

bloomberg.com/amp/news/artic…

HR👉 HSBC quintupled the number of AML employees to 5,000 (2012-2016)

Tech👉upgraded its #Fintech #technology (#MachineLearning scanning transaction data)

Lobby&learn👉in 2016, hired Jennifer Calvery, the U.S. Treas.Dpt’s top #AML official who fined HSBC in 2012.

👉 clients evade taxes or violate U.S. sanctions

👉most of the settlements came with deferred-prosecution agreements and outside monitors

👉 pressure on banks forced countries to overhaul their regulations&practices as the loss of correspondent ties threatened their ability to transfer funds internationally

👉Mexico&Argentina both established official dialogues with the U.S. Treasury

👉it’s easy to create a shell company in the states without disclosing beneficial ownership.

👉not possible anymore anywhere in Europe

👉Battle between US Treasury and EU Commission (remember Google VS DeutschBank)