A quick rundown since this history is buried under the ensuing financial crisis

Hank Paulson: "The short-term risks are clearly to the downside, and the potential cost of not acting has become too high."

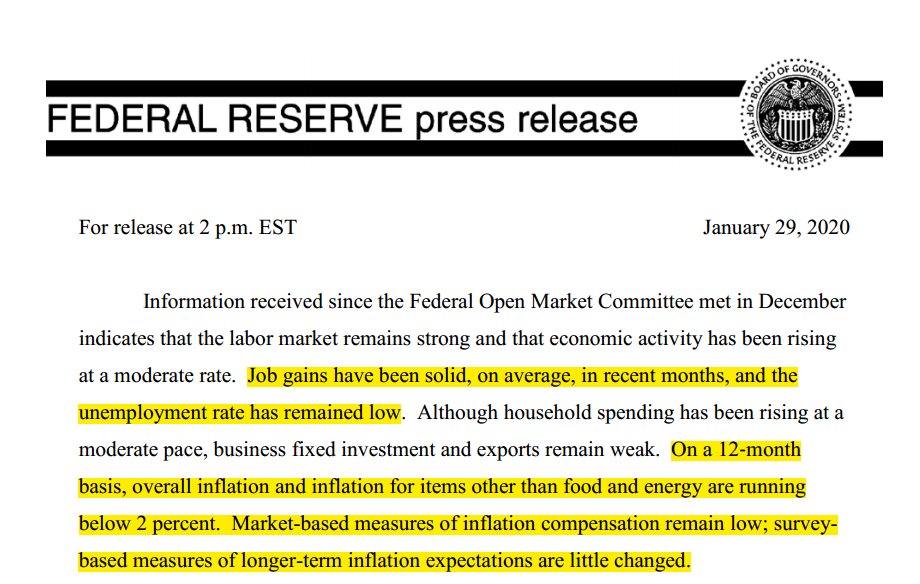

federalreserve.gov/newsevents/pre…

By Jan 22, Bernanke had seen enough: "There are times when events are just moving too fast for us to wait for the regular meeting. I know it is only a week away but seven trading days is a long time in financial markets."

The Senate and House passed a reconciled version of a fiscal stimulus plan on Feb. 7, sending rebate checks of $300-$600 to individual taxpayers.