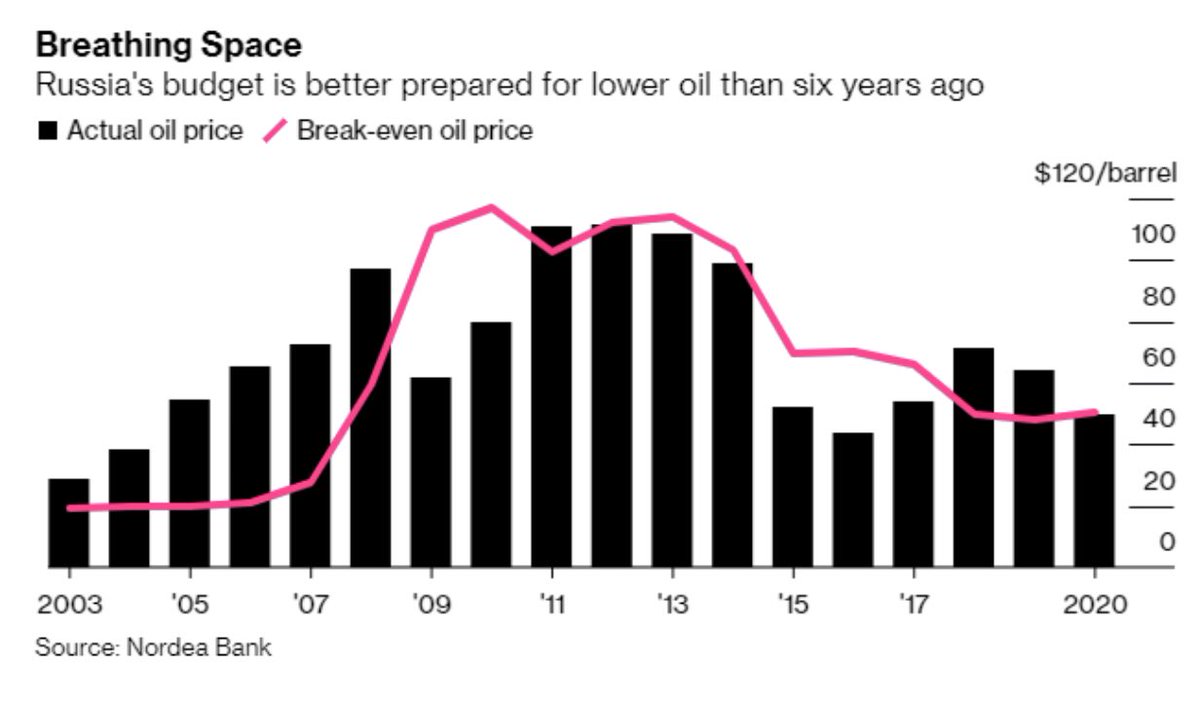

The oil-price crash from mid-2014 to early 2015 *bottomed* at $26, as I recall.

Granted, we started from a much higher price, but...

bloomberg.com/news/articles/…

And then gone past it.

bloomberg.com/energy

The US military during the Obama Adminstration already proved you can finance many renewable installations at a *negative* cost.

Renewables get cheaper and more productive *every* year.

But demand destruction is an *immediate* tsunami.

If production dramatically exceeds demand, then even cutting prices doesn't help sales if no one wants to go anywhere or buy anything and there's nowhere *to* go and nothing *to* buy.

At least oil is consumed.

Radically suppressed demand for consumer goods for a year to a year-and-a-half?

And every bankruptcy dumps new items on the market.

If this reaches millions of deaths in the US, that won't just change many people's priorities...

Millions of deaths means millions of estates liquidated.

Millions of *tons* of high-quality goods, many of which won't even be sold, but given away.

It will likely be terminal for them if it's not.