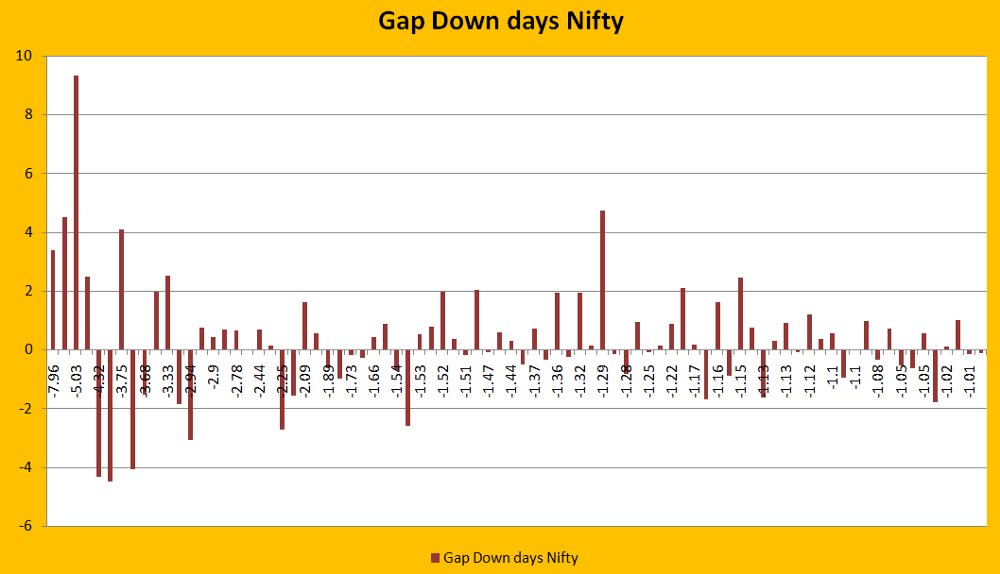

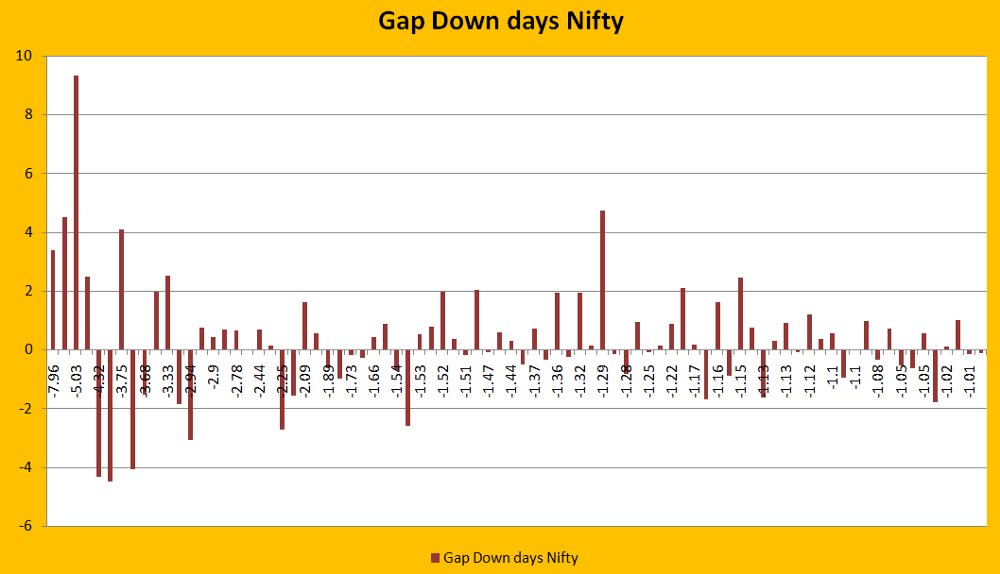

List of gap down days, more than -1% on Nifty & Bank Nifty

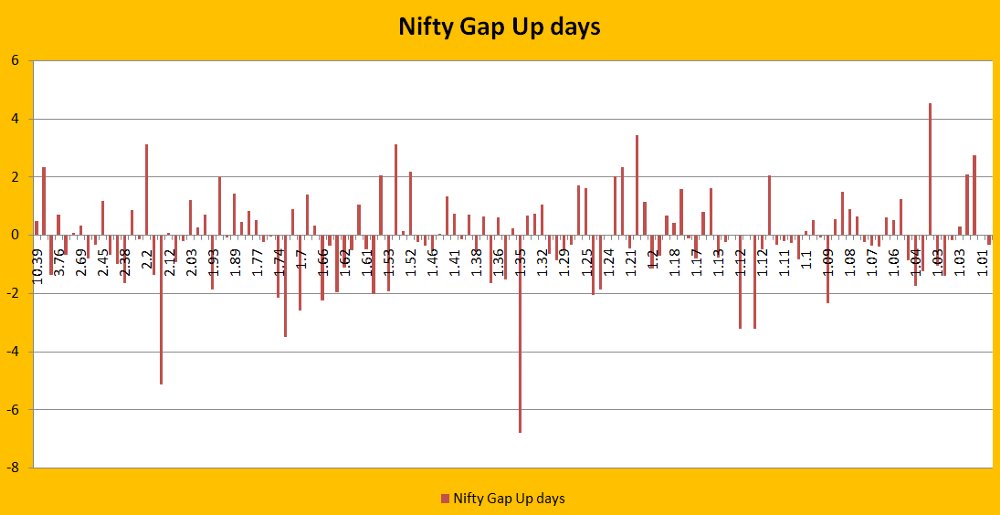

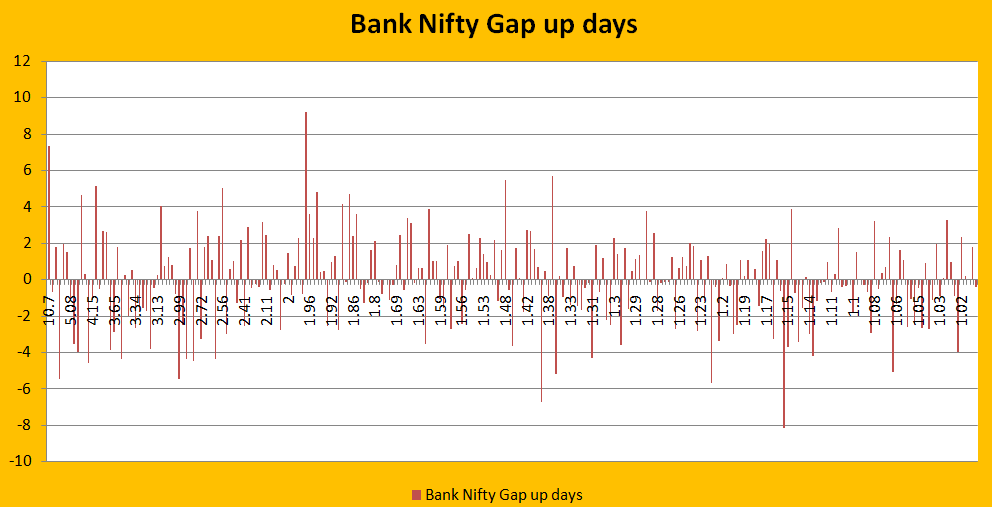

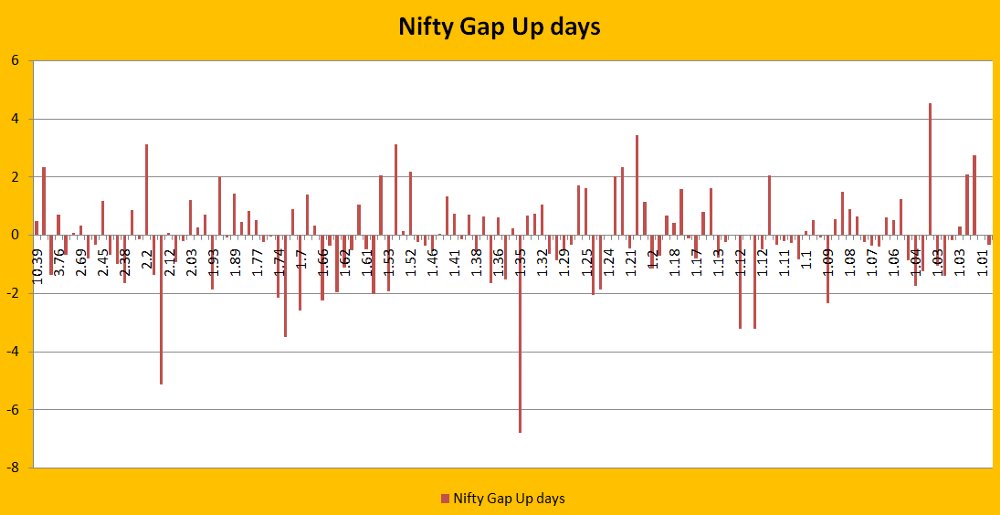

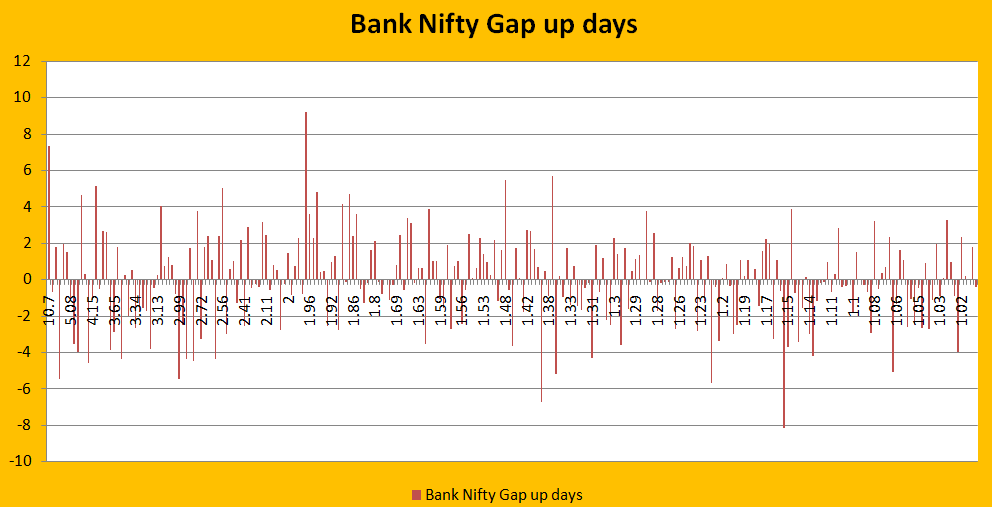

List of Gap up days, more than +1% on Nifty and Bank Nifty

What is the % movement during gap down days, i.e from Open to close on such days.

What is the % movement during gap up days

Keep Current with Kirubakaran Rajendran

This Thread may be Removed Anytime!

Twitter may remove this content at anytime, convert it as a PDF, save and print for later use!

1) Follow Thread Reader App on Twitter so you can easily mention us!

2) Go to a Twitter thread (series of Tweets by the same owner) and mention us with a keyword "unroll"

@threadreaderapp unroll

You can practice here first or read more on our help page!