DoubleLine founder and CEO Jeffrey Gundlach presents:

Just Markets 2022 - I Feel Young Again

Today at 1:15pm PT, register here: event.webcasts.com/starthere.jsp?…

#macro #markets #stocks #FX #bonds #commodities #rates #inflation #Fed #QE #bitcoin

Live recap thread⬇️

Just Markets 2022 - I Feel Young Again

Today at 1:15pm PT, register here: event.webcasts.com/starthere.jsp?…

#macro #markets #stocks #FX #bonds #commodities #rates #inflation #Fed #QE #bitcoin

Live recap thread⬇️

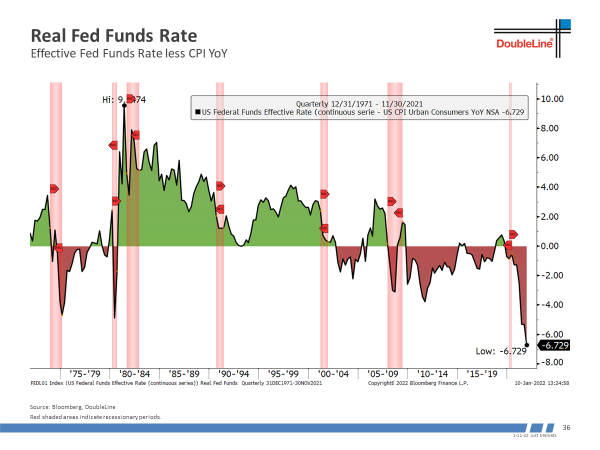

Jeffrey Gundlach: 2021 might end up running 7% year on the CPI

#inflation #QE #Powell #fed #hikes #rates

#inflation #QE #Powell #fed #hikes #rates

Jeffrey Gundlach: Low interest rates coupled with inflation generating negative interest rate.

#JustMarkets2022 #CPI #QE #Fed

#JustMarkets2022 #CPI #QE #Fed

Jeffrey Gundlach: Jay Powell seems to be getting more and more hawkish every time he speaks.

#rates #Fed #FOMC #QE #JustMarkets2022

#rates #Fed #FOMC #QE #JustMarkets2022

Gundlach: Kamela Harris even said the malaise word, reminiscent of Jimmy Carter’s “crisis in confidence” phrase.

#JustMarkets2022 #inflation

#JustMarkets2022 #inflation

Gundlach: S&P 500 chart by JP Morgan pretty well done. Notice the huge run from 1998 to 2018. Now a vertical type movement.

#JustMarkets2022 #QE #value #growth #PE

#JustMarkets2022 #QE #value #growth #PE

Gundlach: “Warp speed” – almost the same growth in goods spending the past two years as in the prior 10 years.

#JustMarkets2022 #stimulus #QE #Fed

#JustMarkets2022 #stimulus #QE #Fed

Jeffrey Gundlach: Today sounds like Jay Powell repeating the 2018 formula: end QE and raise official short-term interest rates.

#JustMarkets2022 #inflation #rates #hikes #Fed

#JustMarkets2022 #inflation #rates #hikes #Fed

Gundlach: Undeniable that the stock market has been supported by QE. So expect headwinds for the stock market with Fed tapering.

Not predicting a recession yet, but expect recessionary pressures to build.

#JustMarkets2022 #rates #value #growth #QE #yieldcurve #banks

Not predicting a recession yet, but expect recessionary pressures to build.

#JustMarkets2022 #rates #value #growth #QE #yieldcurve #banks

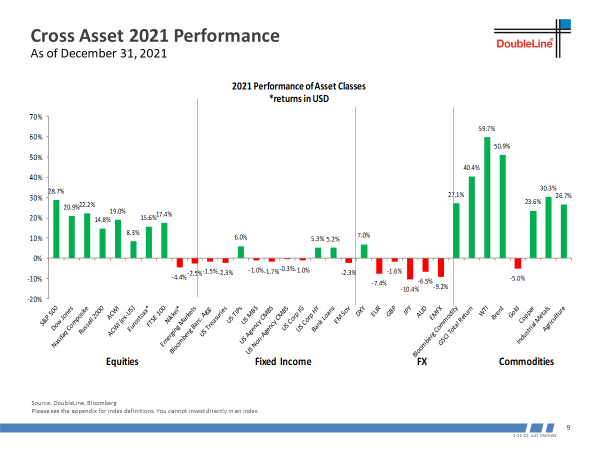

Gundlach: High quality bonds underperformed in 2021, and exception being TIPS.

The dollar went up in 2021. Expect over a multi-year framework the dollar to move lower.

Commodities were the best performers of all in 2021. Crude oil up about 60%.

#JustMarkets2022

The dollar went up in 2021. Expect over a multi-year framework the dollar to move lower.

Commodities were the best performers of all in 2021. Crude oil up about 60%.

#JustMarkets2022

Jeffrey Gundlach - Credit performance: again IG negative last year. Triple CCC loans did really. CLOs did well as did CMBS thanks to easing in delinquency data.

#JustMarkets2022 #HY #IG #credit #yield

#JustMarkets2022 #HY #IG #credit #yield

Gundlach: Over the fullness of time, commodities tend to get cheaper thanks to improvements in technology to extract them, at least in dollar terms.

#JustMarkets2022 #USD #gold #oil #gas #energy

#JustMarkets2022 #USD #gold #oil #gas #energy

Gundlach: @EconguyRosie of Rosenberg Research made a good point during DoubleLine's Round Table Prime on the underappreciated fiscal drag that is coming.

#JustMarkets2022 #stimulus #QE #Fed

#JustMarkets2022 #stimulus #QE #Fed

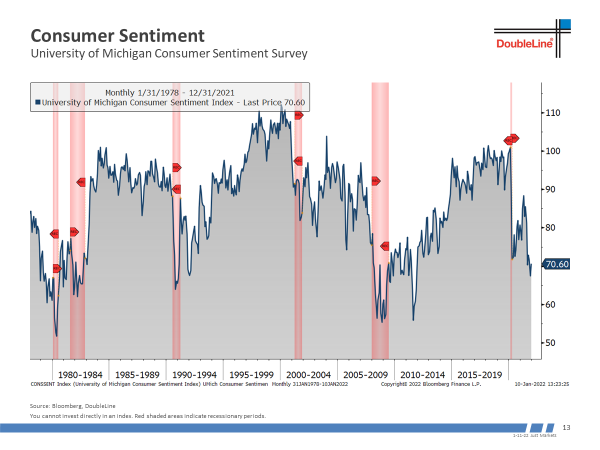

Gundlach: Consumer Sentiment has completely given up the ghost.

Freefalling.

Looks somewhat recessionary.

#JustMarkets2022 #consumer #retail #inflation

Freefalling.

Looks somewhat recessionary.

#JustMarkets2022 #consumer #retail #inflation

Gundlach: What is driving this falloff in consumer sentiment?

Car prices up so much, people don't think this is a good time to buy a car if they can find one.

#JustMarkets2022 #autos #housing #prices #consumption #inflation

Car prices up so much, people don't think this is a good time to buy a car if they can find one.

#JustMarkets2022 #autos #housing #prices #consumption #inflation

Gundlach: Mannheim Used Vehicle Prices up 46%.

Unbelievable.

People can actually make money by buying cars and flipping them.

#JustMarkets2022 #inflation #prices #consumer #demand #supply

Unbelievable.

People can actually make money by buying cars and flipping them.

#JustMarkets2022 #inflation #prices #consumer #demand #supply

Gundlach: Homes prices are still going up a lot with mortgage rates way below the pace of price gains in housing, it's not surprising people have been anxious to get involved in the housing market, perhaps using government transfer payments to help make downpayments.

Gundlach: Existing home supply very low.

As long as mortgage rates remain low, supportive of housing market.

#JustMarkets2022 #homes #prices #inflation #demand #rates

As long as mortgage rates remain low, supportive of housing market.

#JustMarkets2022 #homes #prices #inflation #demand #rates

Gundlach: Atlanta Fed Wage Growth Tracker outpacing move in mortgage rates.

#JustMarkets2022 #rates #inflation #housing #wages #labor #income #housing

#JustMarkets2022 #rates #inflation #housing #wages #labor #income #housing

Gundlach: For now, looks like inflation will remain elevated in the first part of the year.

#CPI #PCE #goods #services #demand #housing #autos #energy #rates

#CPI #PCE #goods #services #demand #housing #autos #energy #rates

Gundlach: Export and import prices (year over year) up a lot.

18% on exports. 11% on imports.

It's a volatile series, but bears watching.

#JustMarkets2022 #inflation #rates #QE #trade

18% on exports. 11% on imports.

It's a volatile series, but bears watching.

#JustMarkets2022 #inflation #rates #QE #trade

Jeffrey Gundlach: Manufacturing Prices Paid is the best exhibit for those who think inflation is headed lower.

#PMI #prices #demand #supply #rates

#PMI #prices #demand #supply #rates

Gundlach: Younger workers wages up the most.

Now wage growth is spreading slightly to the older age cohorts. It will be interesting to see if these trends bleed up into cost structures.

#JustMarkets2022 #wages #workforce #labor #jobs

Now wage growth is spreading slightly to the older age cohorts. It will be interesting to see if these trends bleed up into cost structures.

#JustMarkets2022 #wages #workforce #labor #jobs

Gundlach: Every single region followed by Citi Global is surprising on inflation to the upside.

#CPI #global #rates #hikes #inflation

#CPI #global #rates #hikes #inflation

Gundlach: Remains to be seen if Powell will follow through on promises to do everything it takes to get inflation under control.

#JustMarkets2022 #Fed #QE #rates #FOMC

#JustMarkets2022 #Fed #QE #rates #FOMC

Gundlach: Bond market breakevens is not sending an inflation "fear signal"

#rates #hikes #QE #Fed #JustMarkets2022

#rates #hikes #QE #Fed #JustMarkets2022

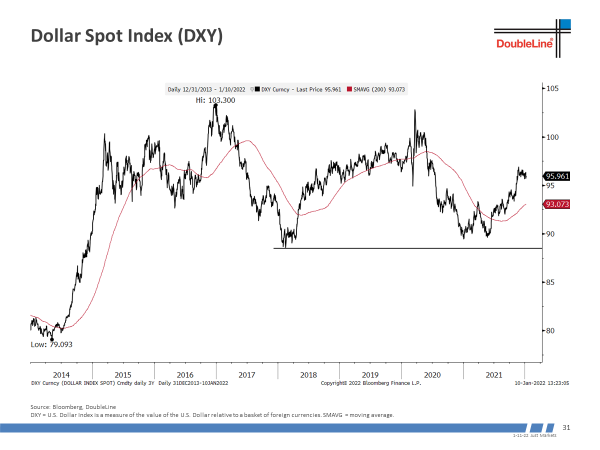

Gundlach - Dollar Spot Index (DXY): was bullish on the dollar in the second half of 2021.

Bearish dollar long term.

#JustMarkets2022 #FX #rates #EM #commodities #USD #fiat #bitcoin #crypto

Bearish dollar long term.

#JustMarkets2022 #FX #rates #EM #commodities #USD #fiat #bitcoin #crypto

Gundlach: The dollar tends to be broadly correlated with the twin deficits as a percentage of GDP.

#JustMarkets2022 #USD #trade #budget #deficit #debt

#JustMarkets2022 #USD #trade #budget #deficit #debt

Gundlach: Pretty powerful flattening. Yield curve is approaching point where it signals economic weakening.

At this stage, the yield curve is no longer sending a "don't worry be happy" signal. It's sending a "pay attention" signal.

#JustMarkets2022 #recession #rates #Fed

At this stage, the yield curve is no longer sending a "don't worry be happy" signal. It's sending a "pay attention" signal.

#JustMarkets2022 #recession #rates #Fed

Gundlach: Weirdly today even gold went up $20 -- in the face of tightening.

Neutral on gold.

Let the market break out one way or the other.

On a multi-year outlook, bullish on gold because negative on the dollar.

#JustMarkets2022 #gold #USD #rates

Neutral on gold.

Let the market break out one way or the other.

On a multi-year outlook, bullish on gold because negative on the dollar.

#JustMarkets2022 #gold #USD #rates

Gundlach: Fed Funds Rate kind of follows Wage Growth. Until now. Wage growth line is screaming for the Fed to raise Fed Funds. Probably played a role in causing Jay Powell to trash the dovish talk.

Fed's behind the curve. They seem to be waking up to that now.

#JustMarkets2022

Fed's behind the curve. They seem to be waking up to that now.

#JustMarkets2022

Gundlach: Copper/Gold ratio gap to 10-year yield. historically, that gap closes. It looks like the 10-year yield is being suppressed.

Copper-gold says the 10-year should be at about 3%.

#JustMarkets2022 #rates #UST #growth #metals

Copper-gold says the 10-year should be at about 3%.

#JustMarkets2022 #rates #UST #growth #metals

Jeffrey Gundlach: 5s30s is sending a classic recessionary signal.

Bona fide flattening of the yield curve.

Remains to be seen what other parts of the yield curve do.

#JustMarkets2022 #2s10s #rates #inflation #Fed

Bona fide flattening of the yield curve.

Remains to be seen what other parts of the yield curve do.

#JustMarkets2022 #2s10s #rates #inflation #Fed

Gundlach: One- and two-year yields up.

Got the Fed to take notice.

#rates #Fed #FOMC #inflation #Powell

Got the Fed to take notice.

#rates #Fed #FOMC #inflation #Powell

Gundlach: Fed just follows the message of the two-year Treasury yield. You can see that on a chart of the fed funds target rate and the 2-year yield.

So who needs the Fed?

Why not replace it with the two-year Treasury yield?

#JustMarkets2022 #FOMC #rates #market #inflation

So who needs the Fed?

Why not replace it with the two-year Treasury yield?

#JustMarkets2022 #FOMC #rates #market #inflation

Gundlach: The economy has broken at an ever-lower terminal Fed Funds rate.

Last time took only 2.5 on the fed funds to break stocks and the economy. Maybe 1.5 might be the breaking point the next time. We might get there in the next 12 to 18 months.

#JustMarkets2022 #Fed #FOMC

Last time took only 2.5 on the fed funds to break stocks and the economy. Maybe 1.5 might be the breaking point the next time. We might get there in the next 12 to 18 months.

#JustMarkets2022 #Fed #FOMC

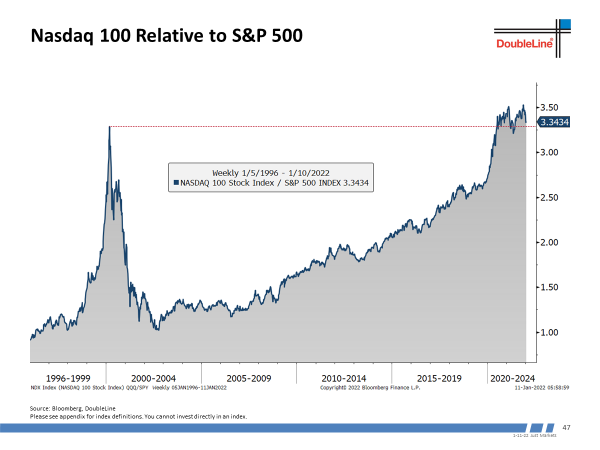

Gundlach: Nasdaq 100 outperformed the S&P 500 more than during than in the dotcom bubble, until about a year and a half ago.

The Nasdaq has stopped outperforming.

#JustMarkets2022 #technology #stocks #QE

The Nasdaq has stopped outperforming.

#JustMarkets2022 #technology #stocks #QE

Gundlach: Since March of 2021, the breadth of the gainers in the market has declined.

#JustMarkets2022 #tech #value #growth #mutliples #earnings

#JustMarkets2022 #tech #value #growth #mutliples #earnings

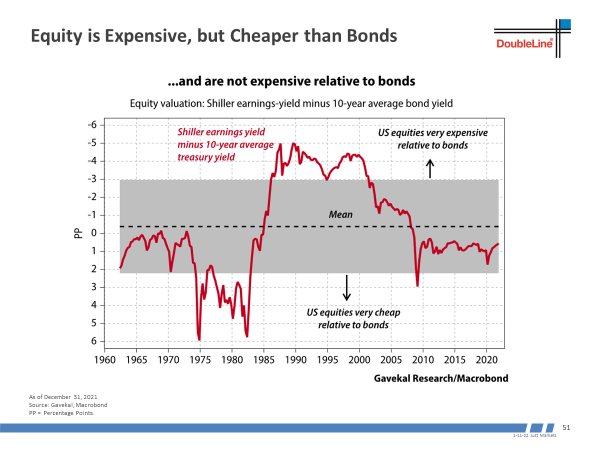

Gundlach: As expensive as stocks are, they're cheap relative to bonds.

The culprit: most negative interest rates in the history of the series.

#JustMarkets2022 #rates #stocks #bonds #valuation #growth #UST

The culprit: most negative interest rates in the history of the series.

#JustMarkets2022 #rates #stocks #bonds #valuation #growth #UST

Gundlach: 3x U.S. stock outperformances versus rest of the world.

One of the reasons bought European stocks in 2021.

#JustMarkets2022 #stocks #equity #QE #Fed

One of the reasons bought European stocks in 2021.

#JustMarkets2022 #stocks #equity #QE #Fed

Gundlach: The rest of the world is significantly cheaper than the U.S. stock market.

#JustMarkets2022 #valuation #earnings #PE

#JustMarkets2022 #valuation #earnings #PE

Gundlach - S&P 500/MSCI Europe relative P/E ratio: It's at the level where European stocks in the past have started to outperform.

#JustMarkets2022 #valuation #PE #rates #value #growth

#JustMarkets2022 #valuation #PE #rates #value #growth

Gundlach: S&P 500 also very expense relative to emerging markets.

#JustMarkets2022 #valuation #earnings #PE #USD #EM

#JustMarkets2022 #valuation #earnings #PE #USD #EM

Gundlach: Emerging markets tend to move in the same direction though not the same magnitude as world industrial metals prices.

#JustMarkets2022 #EM #industrials #metals #China #growth

#JustMarkets2022 #EM #industrials #metals #China #growth

Gundlach: Euro Stoxx, Japan TOPIX and US KBW bank indices tell an interesting story.

Negative rates are negative for banking systems.

Thankfully the Fed has not talked about negative interest rates, but who knows, especially when the next recession comes.

#JustMarkets2022

Negative rates are negative for banking systems.

Thankfully the Fed has not talked about negative interest rates, but who knows, especially when the next recession comes.

#JustMarkets2022

• • •

Missing some Tweet in this thread? You can try to

force a refresh