In a recent paper, with Alexander Chudik @DallasFed, M Hashem Pesaran @USCDornsife, @mraissi80 @IMFNews & @arebucci1 @JHUCarey, we develop a threshold-augmented dynamic multi-country model (#TGVAR) to quantify the #macroeconomic effects of #Covid19: econ.cam.ac.uk/research/cwpe-… 1/n

Key challenges with the empirical #economic analysis of #Covid19 include the following: how to identify the shock, how to account for its non-linear effects, & how to quantify its effects while accounting for spillovers, common global factors, network effects and uncertainty. 2/n

We contribute to the literature by addressing these issues in a coherent multi-country framework. We offer an identification strategy for the #Covid19 shock considering that a synthetic control method cannot be applied in the context of a global #pandemic. 3/n

Specifically, we use the GDP growth revisions of the International Monetary Fund (IMF) in April and June 2020 compared to their end-2019 forecasts to identify the #Covid19 shock. 4/n

We show that there exist threshold effects in the relationship between global #financial market #volatility and output #growth at individual country levels in a significant majority of advanced economies and in the case of several emerging market countries. 5/n

We develop a threshold-augmented dynamic multi-country model (#TGVAR) to estimate the global as well as country-specific #macroeconomic effects of the identified #Covid19 shock. 6/n

We distinguish common global factors from #trade #network effects and account for sample #uncertainty based on the constellation of disturbances that the global #economy had experienced in the past four decades as well as their #spillovers and #interactions. 7/n

Finally, we show how the model can be used for #counterfactual analysis. This approach is very different from scenario analyses or forecasts that are unconditional statements and need not be model based. 8/n

We employ Generalized Impulse Response Functions (GIRFs) to study the #counterfactual impact of the identified #Covid19 shock on the global #economy as well as on the 33 individual countries in our sample. 9/n

In linear models, GIRFs possess the following key features: (i) proportionality (namely, potential outcomes are linear in the size of the shock); (ii) state independence (that is, the effects of the shocks do not vary in recessions or expansions); & (iii) model invariance... 10/n

...(namely, the underling model is invariant to the shock under consideration). However, none of these features apply to nonlinear dynamic models, which as argued a priori & established empirically, are more likely to be relevant for analysis of large shocks, i.e. #Covid19. 11/n

By using a threshold-augmented dynamic multi-country model (#TGVAR), we are able to allow for (i) non-proportional impacts of large and small shocks; (ii) state-dependency; and (iii) more persistent outcomes. 12/n

Our framework is able to account for various transmission channels, including #trade relationships, as well as #financial & #commodity price linkages. 13/n

This is important at the current juncture, as many countries face a multi-layered shock comprising a #health emergency, domestic economic #disruptions, plummeting external #demand, tighter #financial conditions, and a collapse in #commodity prices. 14/n

Our counterfactual results show that the #pandemic will likely reduce the world real GDP by 3 percent below its model-generated path without the shock by the end of 2021. While #China and other emerging #Asian economies are estimated to be less severely affected... 15/n

... the #US, #UK, and several other advanced economies may experience deeper and longer-lasting effects.

Among non-#Asian #emerging market economies, however, the economic impact of #Covid19 varies substantially, depending on domestic factors (economic structures... 16/n

Among non-#Asian #emerging market economies, however, the economic impact of #Covid19 varies substantially, depending on domestic factors (economic structures... 16/n

... #health preparedness, & #lockdowns) as well as external disturbances (plunging #trade, collapsing #tourism, #capital outflows, falling #commodity prices).

There is a significant degree of #uncertainty around all these counterfactual outcomes which we quantify. 17/n

There is a significant degree of #uncertainty around all these counterfactual outcomes which we quantify. 17/n

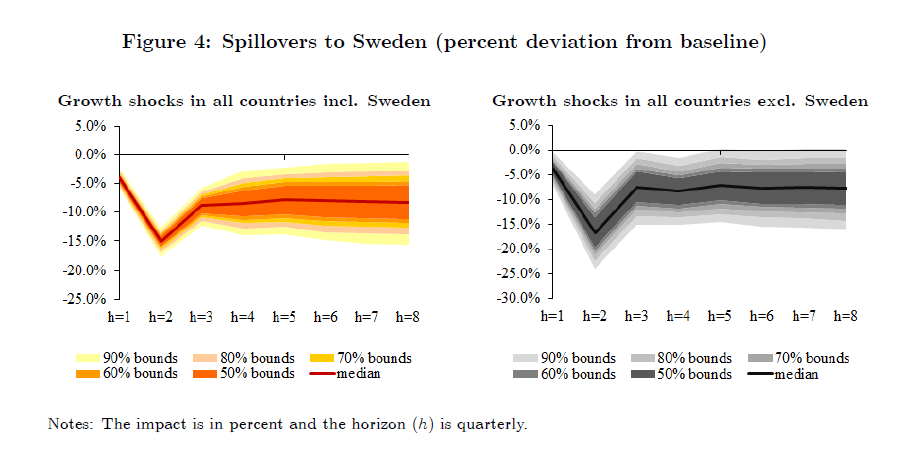

Importantly, our findings underscore the role of spillovers which we quantify for the case of #Sweden considering its different approach toward the #pandemic.

We show that no country is immune to the #economic fallout of the pandemic because of #interconnections. 18/n

We show that no country is immune to the #economic fallout of the pandemic because of #interconnections. 18/n

We also estimate that the #Covid19 pandemic will likely lower long-term interest rates by about 100 basis points below their historical lows in core advanced economies. 19/n

In contrast, the impact on long-term interest rates in #emerging market #economies has a wide range, including significant upside #risks, with implications for #debt servicing costs in these economies. 20/n

Our findings highlight the importance of policy interventions to restore the normal functioning of #financial markets & adopting other measures (fiscal & liquidity) that can limit bankruptcies of viable firms & support incomes of households, limiting the amount of #scarring. 21/n

Note that with every easing of #SocialDistancing restrictions, the #infection rates could rise again, which would require re-imposition of those restrictions, as we have seen in #Europe and parts of the #UnitedStates lately, dampening #economic activity and #confidence. 22/n

In the Appendix of our paper, we show how more up-to-date information about the pathway of the #Covid19 #pandemic (considering its rarity) can affect our predictions.

Bottom line: worse growth outcomes and longer recoveries. 23/n #TGVAR

Bottom line: worse growth outcomes and longer recoveries. 23/n #TGVAR

• • •

Missing some Tweet in this thread? You can try to

force a refresh