What are the implications of excess global financial market volatility on economic growth? Are there threshold effects in the relationship between growth & excess global volatility for individual countries? How should we model the nonlinear effects in a multi-country setting? 1/n

We answer these questions in recent work with Alexander Chudik @DallasFed, M Hashem Pesaran @USCDornsife @TrinCollCam, @mraissi80 @IMFNews & @arebucci1 @JHUCarey @cepr_org @nberpubs: ideas.repec.org/p/cam/camdae/2… #TGVAR 2/n

The #Covid19 #pandemic has been a shock like no other, initiating simultaneous demand and supply disruptions. In addition, it led to a sharp tightening in global #financial market conditions during the first quarter of 2020. 3/n

Using quarterly data over the past four decades, we show that global #financial market volatility (beyond certain thresholds) can adversely affect economic #growth in a significant majority (80%) of advanced countries and for several emerging market economies (see Table 1). 4/n

There are numbers of channels through which excessive global #financial market #volatility can adversely affect economic #growth. They include higher precautionary #savings by households, lower or delayed #investment by firms due to increased #uncertainty & ... 5/n

weaker demand prospects, & a higher cost of raising capital owing to higher funding costs in a #volatile environment.

In normal conditions where global #volatility is low, #financial markets are able to price the volatility #risk, & therefore weaken the relationship between 6/n

In normal conditions where global #volatility is low, #financial markets are able to price the volatility #risk, & therefore weaken the relationship between 6/n

output growth & the volatility factor. But during periods of heightened volatility, that occur very rarely, it is difficult to price the volatility risk properly & it is thus more likely for excess volatility to show up as statistically significant in output growth equations. 7/n

While we manage to detect threshold effects in the output #growth-global #volatility relationship in many advanced economies (80% of cases), similar results for emerging markets are less pervasive (with threshold effects being statistically significant in 30% of cases) for... 8/n

the following reason. Compared to advanced countries, exposure to global #equity markets is lower in emerging market economies (that is, they have less developed #capital markets and rely more on the #banking sector for #credit intermediation). Nonetheless, in these...9/n

countries output growth could well be nonlinearly affected by localized events (e.g., natural disasters; #banking, #currency and sovereign #crises) or external shocks (e.g., #commodity price #volatility and #capital flow reversals), & be exacerbated by country-specific...10/n

characteristics (internal & external imbalances). However, these types of threshold effects wont be captured by our econometric specification that focuses on the global realized #volatility of #equity returns that is more reflective of developments in advanced economies. 11/n

Our findings underscore the importance of allowing for threshold effects in studying the #macroeconomic consequences of #Covid19, which, considering its unprecedented nature, generated a sharp tightening in global #financial conditions. 12/n

Specifically, global #equity markets sold off sharply through mid-March as the #pandemic spread across the world. From end-2019 to trough, the S&P 500 index in the United States fell 30%. #Stock prices in other major economies experienced declines of similar magnitude & ... 13/n

flight to safety resulted in sharp capital outflows from emerging market economies. Notwithstanding the improvement in global risk sentiment since March amid large-scale liquidity injections by major central banks and a gradual relaxation of lockdowns in many countries, ... 14/n

output recovery is expected to be gradual with #GDP growth in many economies expected to be negatively affected by the previous bout of #financial market #volatility (see Figure 2). 15/n

Given the importance of allowing for threshold effects in studying the macroeconomic consequences of #Covid19, in Sections 3 & 4 of our paper we develop a threshold-augmented dynamic multi-country framework (what we call #TGVAR), to study the implications of #Covid19. 16/n

Our counterfactual results show that the #pandemic will likely reduce the world real GDP by 3 percent below its model-generated path without the shock by the end of 2021. While #China and other emerging #Asian economies are estimated to be less severely affected, ... 17/n

the United States, the #UK, and several other advanced economies may experience deeper and longer-lasting effects. Among non-#Asian #emerging market economies, however, the economic impact of #Covid19 varies substantially, depending on domestic factors (economic structures...18/n

... #health preparedness, and #lockdowns) as well as external disturbances (plunging #trade, collapsing #tourism, #capital outflows, falling #commodity prices). There is a significant degree of uncertainty around all these counterfactual outcomes which we quantify. 19/n

Importantly, our findings underscore the role of spillovers which we quantify for the case of #Sweden considering its different approach toward the #pandemic. We show that no country is #immune to the #economic fallout of the pandemic because of #interconnections. 20/n

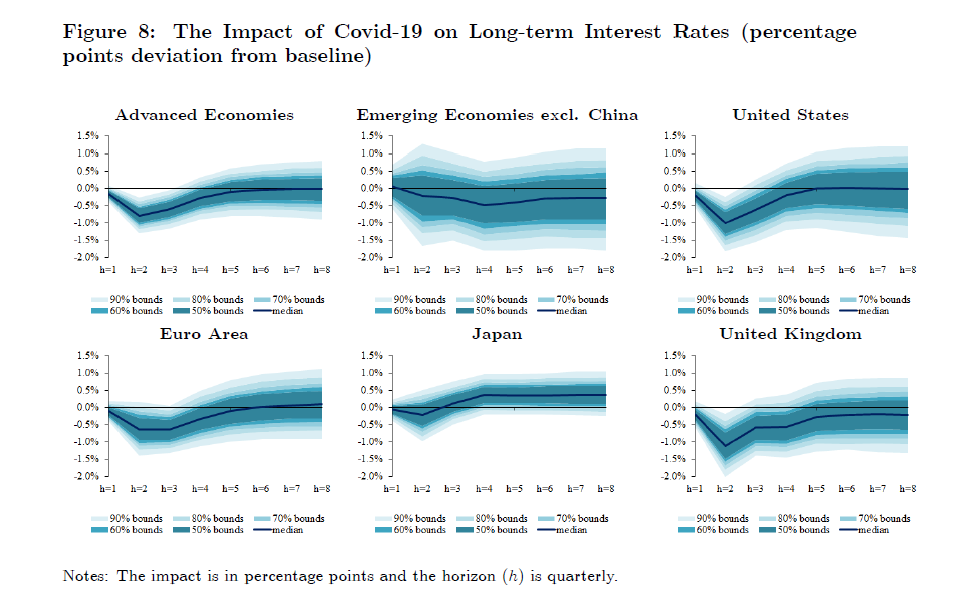

We also estimate that the #Covid19 #pandemic will likely lower long-term interest rates by about 100 basis points below their historical lows in core advanced #economies. 21/n

In contrast, the impact on long-term interest rates in #emerging market #economies has a wide range, including significant upside #risks, with implications for #debt servicing costs in these economies. 22/n

Our findings highlight the importance of policy interventions to restore the normal functioning of #financial markets & adopting other measures (fiscal & liquidity) that can limit bankruptcies of viable firms & support incomes of households, limiting the amount of #scarring. 23/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh