Thanks to @steve_sedgwick & @cnbcKaren for having me on #CNBC #SquawkBox this AM.

What did we discuss? Well, #inflation of course!

I prepared some slides for the show which I'm happy to present in this thread.

1/n

#macro #Fed #Yellen #JeromePowell #bankofengland #QE

What did we discuss? Well, #inflation of course!

I prepared some slides for the show which I'm happy to present in this thread.

1/n

#macro #Fed #Yellen #JeromePowell #bankofengland #QE

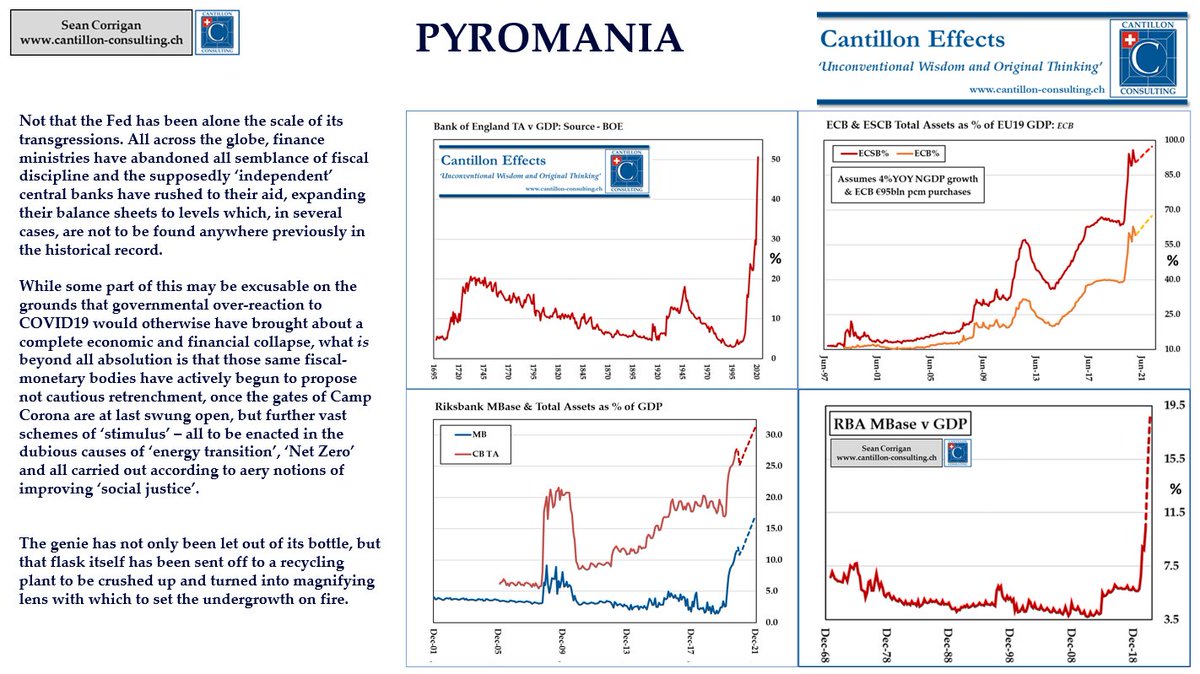

Are people in denial or is the #centralbank money flood just drowning all the signals?

2/n

#inflation

2/n

#inflation

#Commodities, #freight, #carbon - and a whole lot besides - sure do cost a lot more, these days.

3/n

3/n

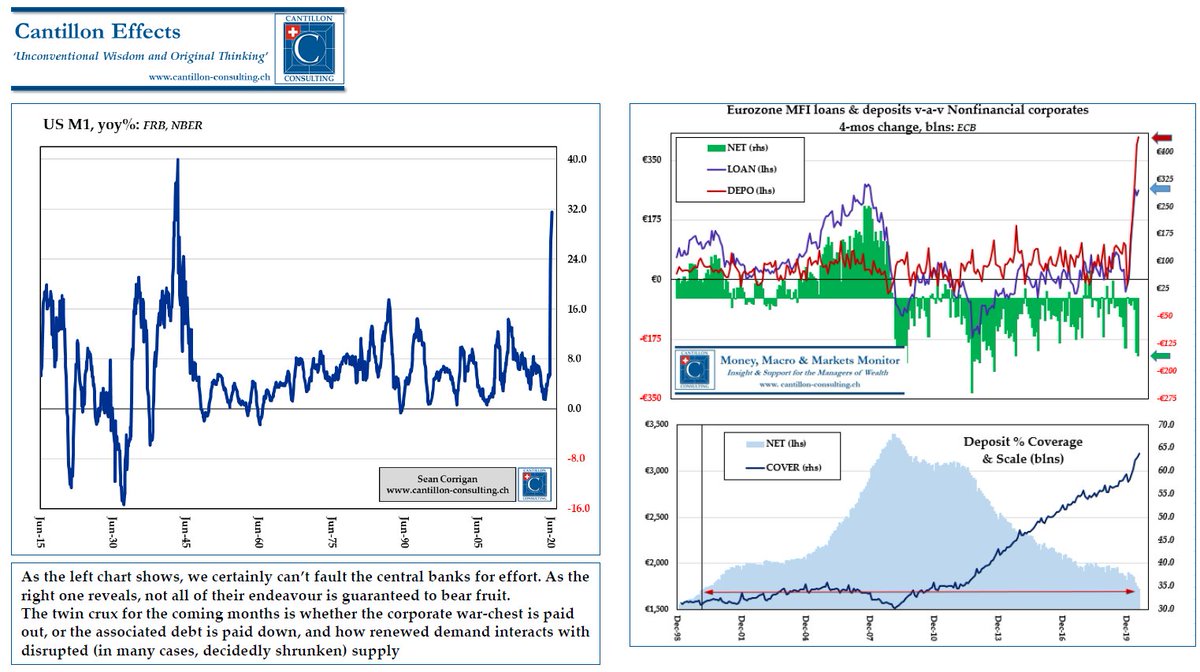

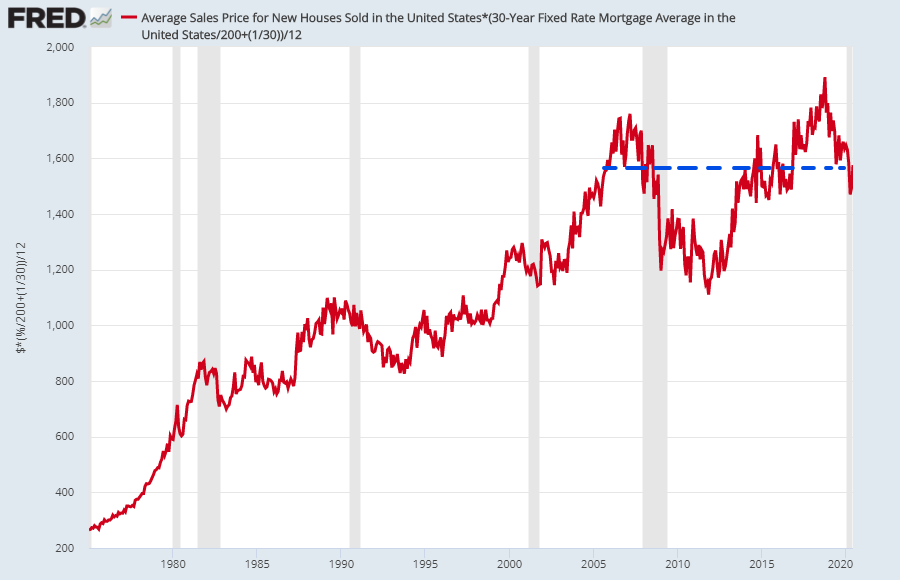

Money burning holes in pockets and supply-side constraints can only mean one thing...

4/n

#cars #autos #housing #RE #MBS

4/n

#cars #autos #housing #RE #MBS

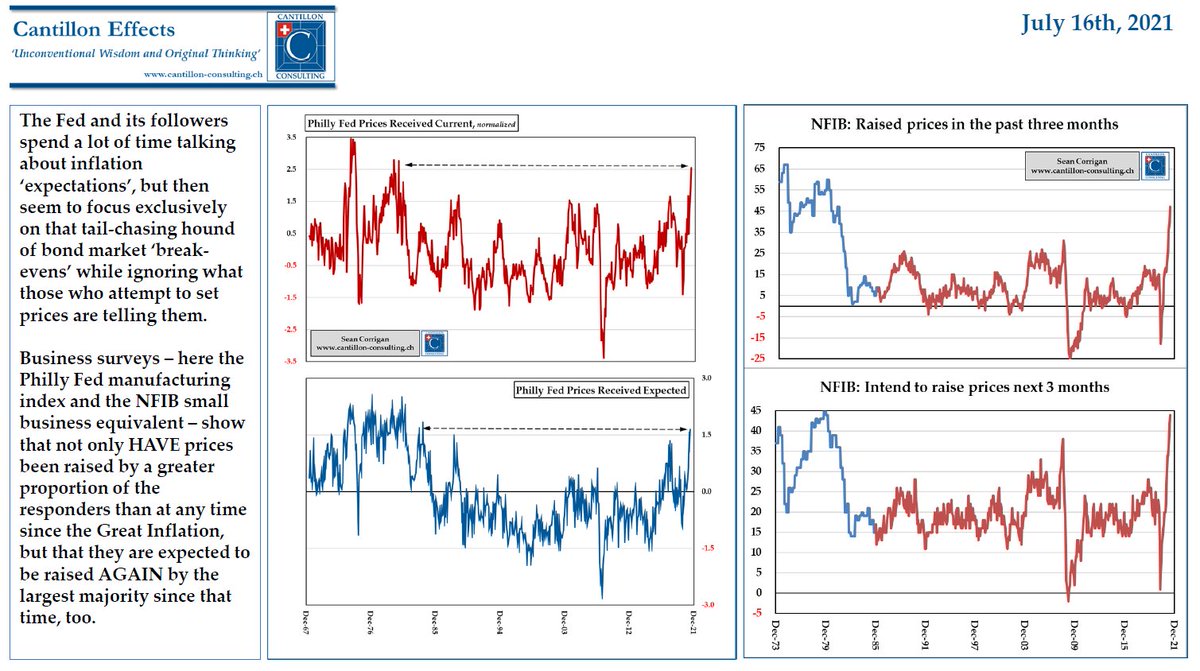

"Expectations drive price setting & are under control, " said #Yellen.

Really? Not what #entrepreneurs are telling us!

#NFIB #ISM #PhillyFed

6/n

Really? Not what #entrepreneurs are telling us!

#NFIB #ISM #PhillyFed

6/n

With #retail outstripping #manufacturing and with #inventories plunging, it would seem the pressure is still on.

7/n

#inflation

7/n

#inflation

Even before the ol' Bridges-to-Nowhere, #Biden Boondoggle gets going on #infrastructure, "soft budget", cost-plus #DC's footprint is larger than ever and the lapdog #Fed looks set to keep it that way.

8/n

#MMT #fiscal #Budget2021

8/n

#MMT #fiscal #Budget2021

"Neither a borrower, nor a lender be - but especially NOT the latter"

#bonds are already bleeding their owners dry. Enjoy your retirement, O, Ye expropriated Middle Classes!

9/n

#realyields #fixedincome #UST #Bunds

#bonds are already bleeding their owners dry. Enjoy your retirement, O, Ye expropriated Middle Classes!

9/n

#realyields #fixedincome #UST #Bunds

And while the #equity part of your portfolio may be keeping you afloat for now, don't count on it always being that way if #inflation really does start to roar.

10/n

#stocks #SPX #PE #dividends #multiples

10/n

#stocks #SPX #PE #dividends #multiples

As and when #inflation starts to disrupt financial markets, drying up longer-term #credit and stretching people's budgets, that's when built-in weakness will matter. Leveraged 'investors' in operationally leveraged companies might become a problem.

11/n

#margindebt #EBITDA

11/n

#margindebt #EBITDA

Pity the poor, old, expanding-#mandate #centralbank Apparatchik: not only "#stimulus" to provide, #jobs to create & prices to guide, but also now to keep #Greta sweet and to please every Leftist professor, baying #NGO, and #WEF propagandist "stakeholder" in building Utopia!

12/n

12/n

@threadreaderapp please unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh