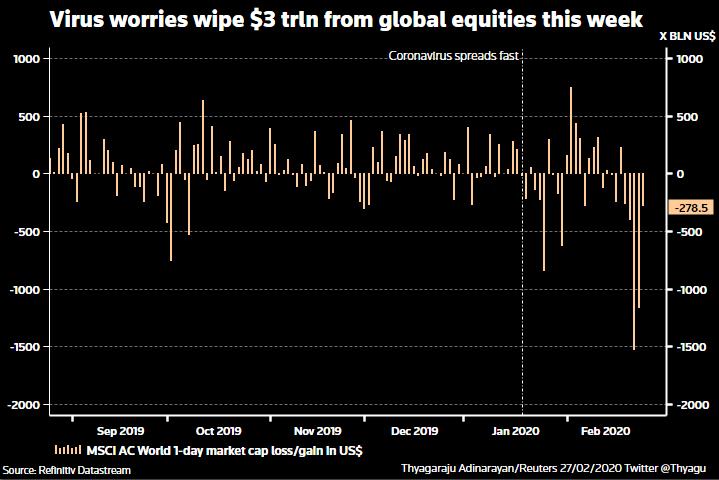

🔹Global equities have now fallen for six straight days.

🔹Spot #gold rose 0.5% to $1,649 per ounce and #silver gained 1% to $18.03 an ounce.

🔹Gold hit a 7-year high at near $1,688 per ounce on Mon (24/2)

reuters.com/article/us-glo…

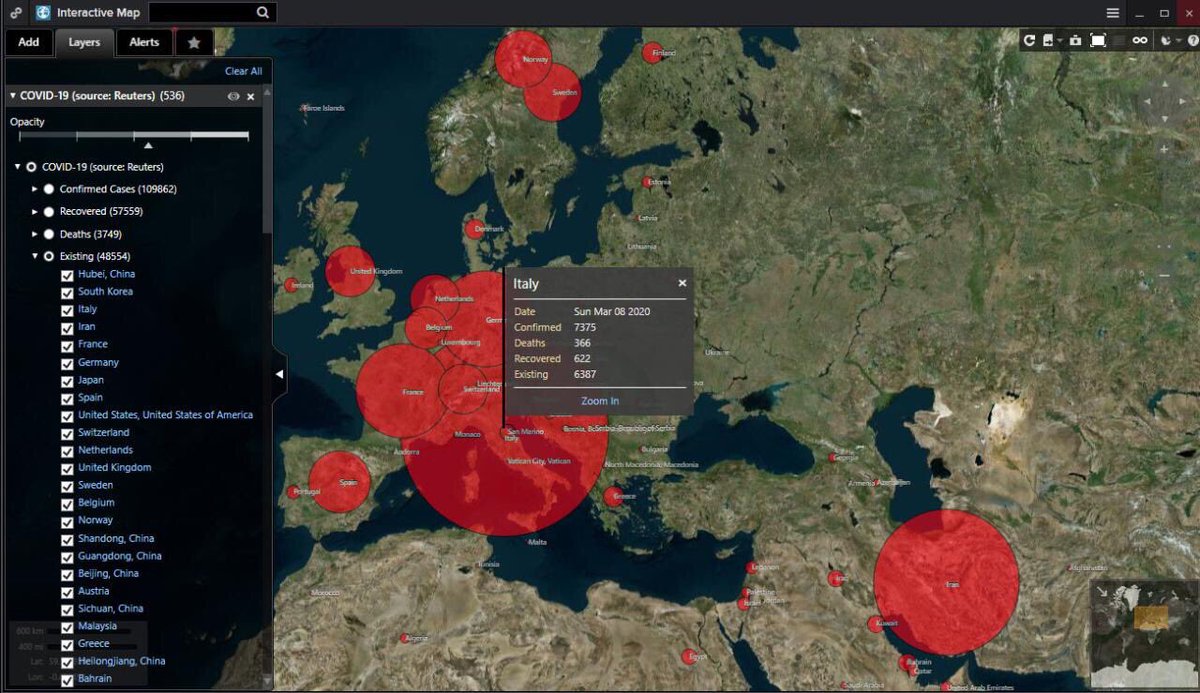

🔹Death toll from #Covid19 tops 5,000

🔹Markets recover, only slightly, after Thursday's collapse.

reuters.com/article/us-hea… #DataNow