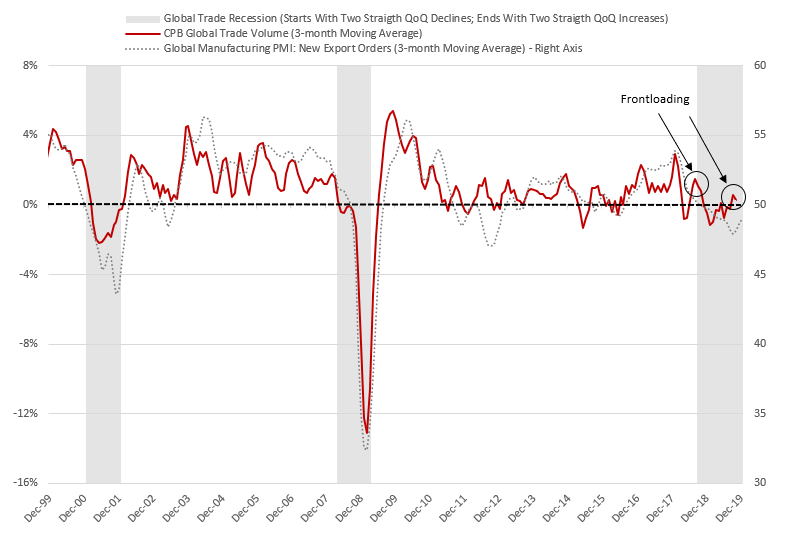

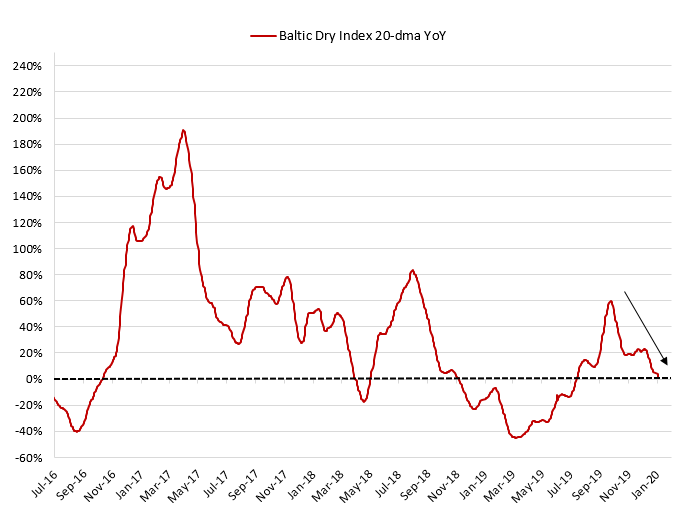

➡ Based on CPB data, after (probably) contracting in 2019, global trade of goods (in volume) will grow again in 2020 ❗ (but at a slower pace than Global GDP)

*Positive base effects

*Combined easing of monetary policy and trade tensions (especially U.S./China) for the first time in 7 quarters.

*Fiscal stimulus (China, Japan, South Korea, Germany, France, etc)

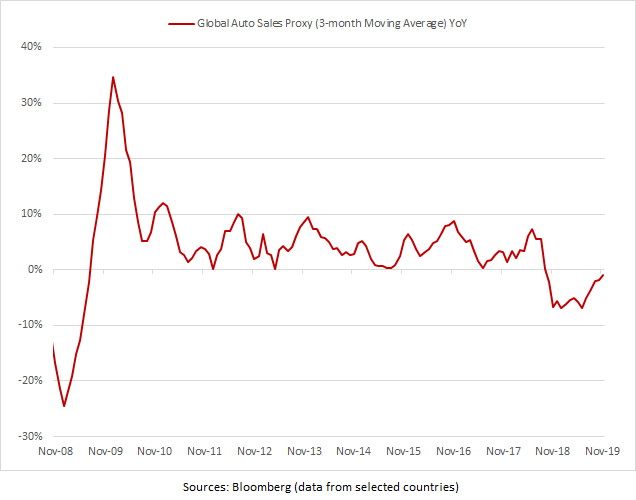

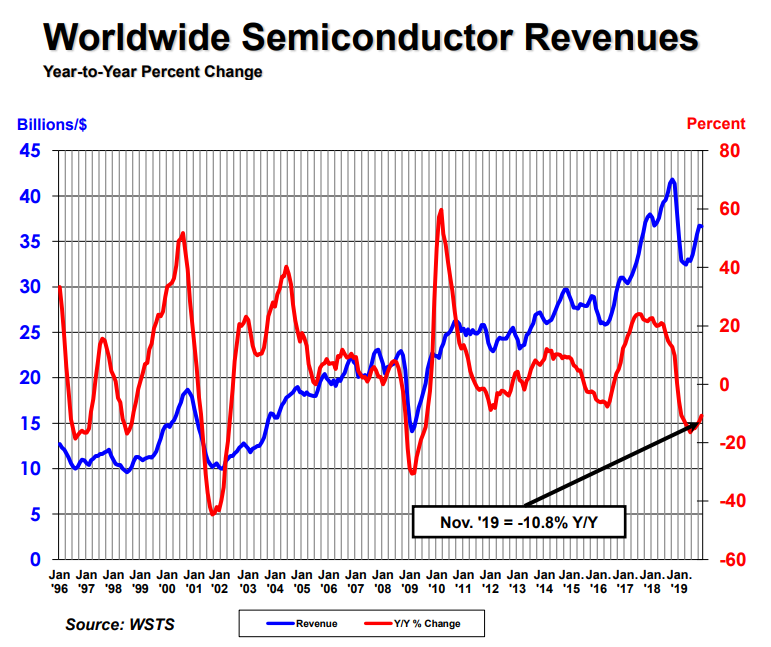

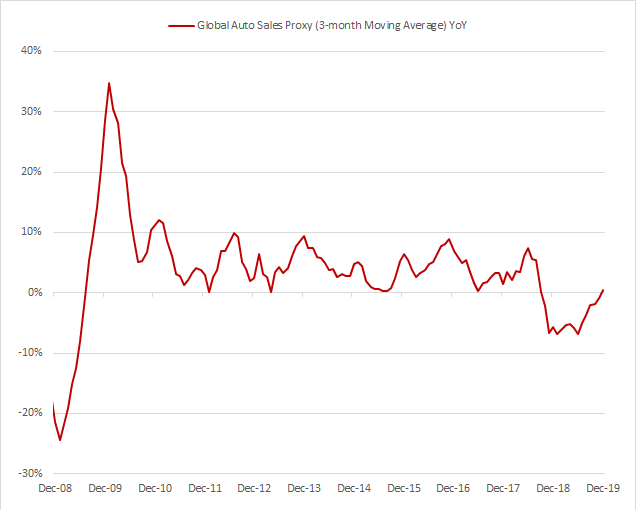

*Worldwide sales (3-month moving average) fell 13.1% YoY In Oct. but it was the smallest drop since April 2019.

*In Oct., global sales ⬆ MoM for the fourth consecutive month (with my proxies suggesting that volumes are leading the charge)

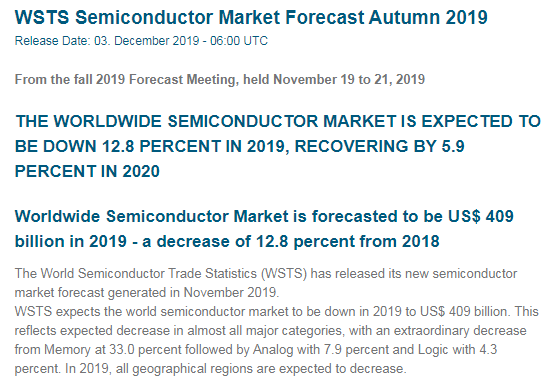

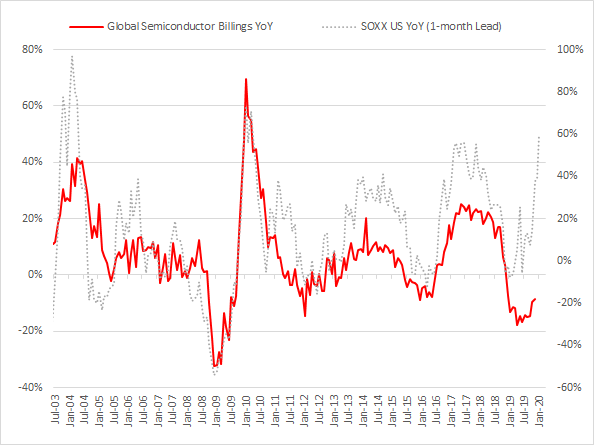

*As a result, WSTS projects annual global sales will ⬆ by 5.9% in 2020 (v -12.8%e this year)

*Link: bit.ly/38q2lww

*A rebound of global sales can also be explained by specific factors:

a/ The normalization of Intel CPU Supply Shortage will be positive

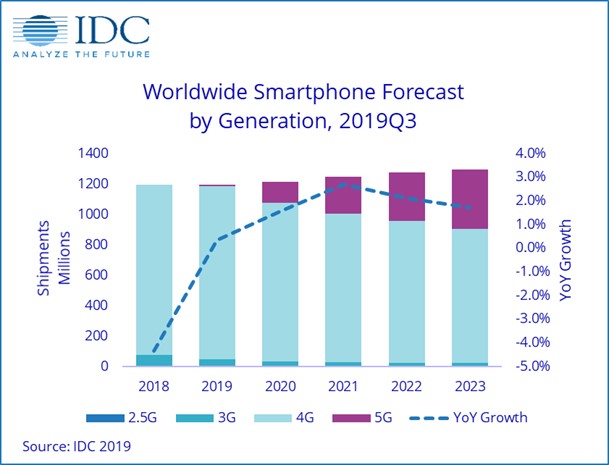

b/ Global smartphone shipments are expected to grow in 2020 (+1.5%) after 3 consecutive years of market contraction, fueled by #5G plans in #China, according to the International Data Corporation (IDC).

*Link: bit.ly/36G0rGA

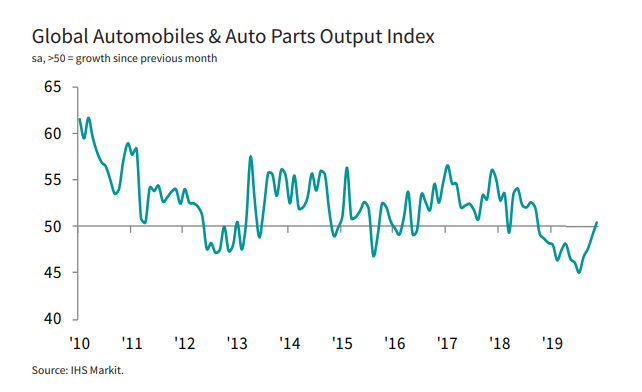

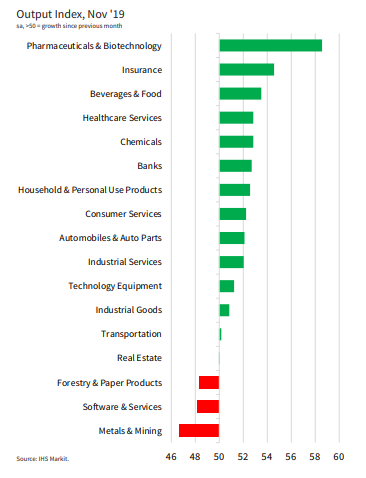

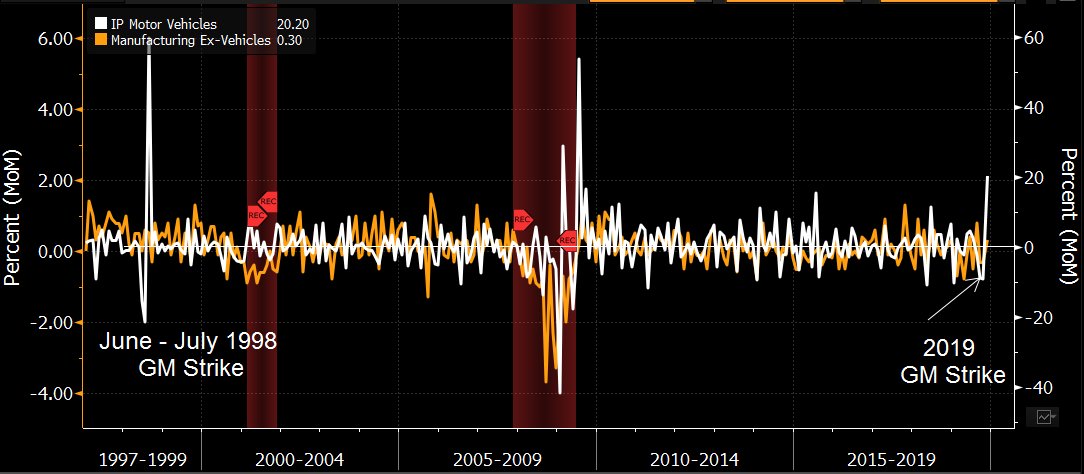

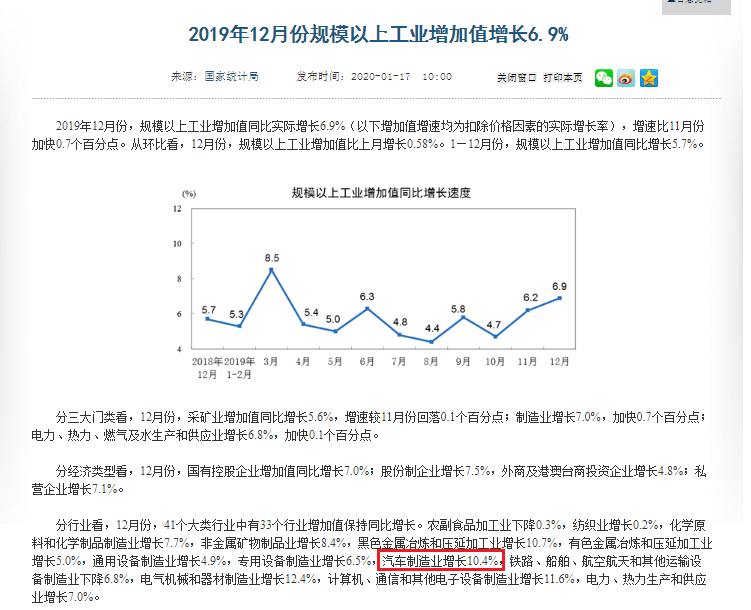

c/ Global auto production (~10% of the semiconductor market) should stabilize in 2020 as suggested by the first sign of recovery in Nov.

*According to Markit, global autos output ⬆ for the 1st time since Sep. 2018.

*Link: bit.ly/35qG93n

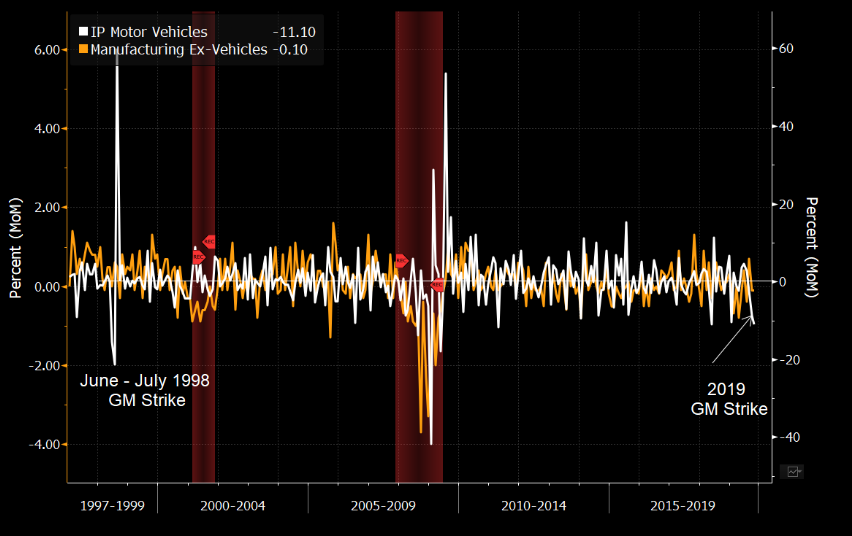

*Figures will also improve in the U.S. from Nov. following the end of GM strike (see 🇺🇸 figures this afternoon).

*Chart from BBG ⬇

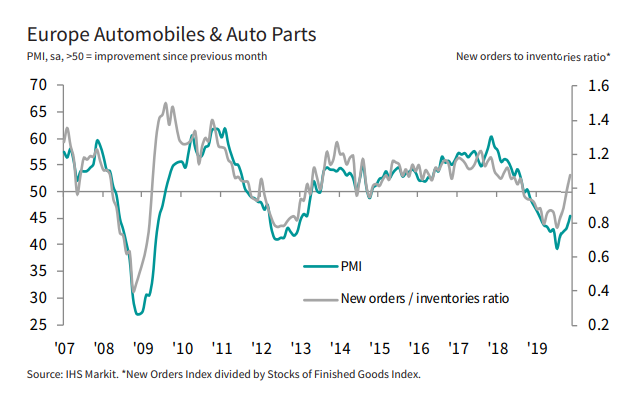

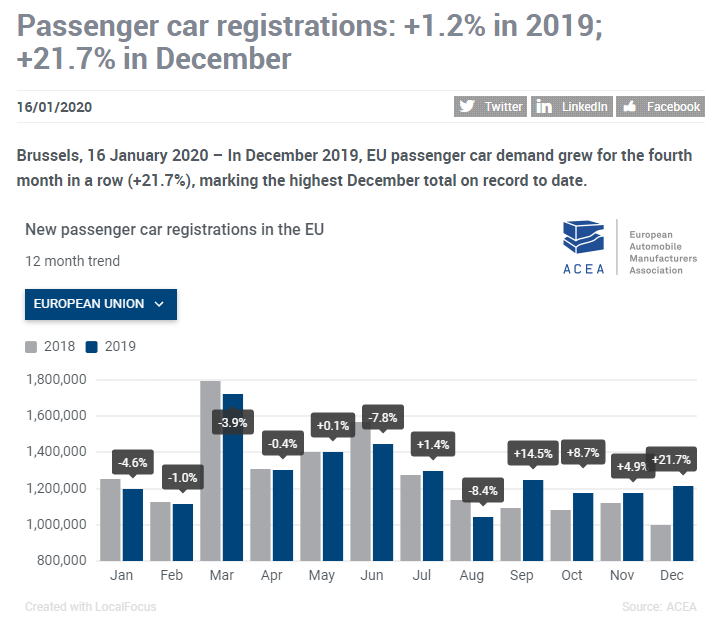

*Leading indicators suggest that auto sector in #Europe could recover in 1H20…

*Link (Markit): bit.ly/2YQO7jS

…while in Asia, “Automobile & Auto Parts producers already recorded a third successive rise in output that was the strongest since April.”

*Link (Markit): bit.ly/2Pq14y3

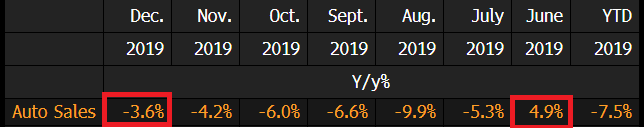

*My proxy confirm that, on YoY basis, global auto sales contracted at a weaker rate in late 2019.

*Chart (updated) from BBG:

bloomberg.com/news/articles/…

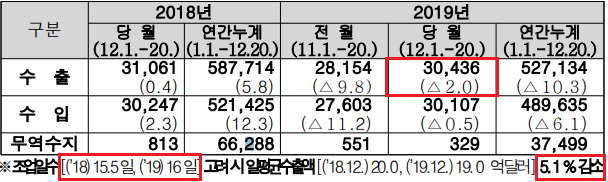

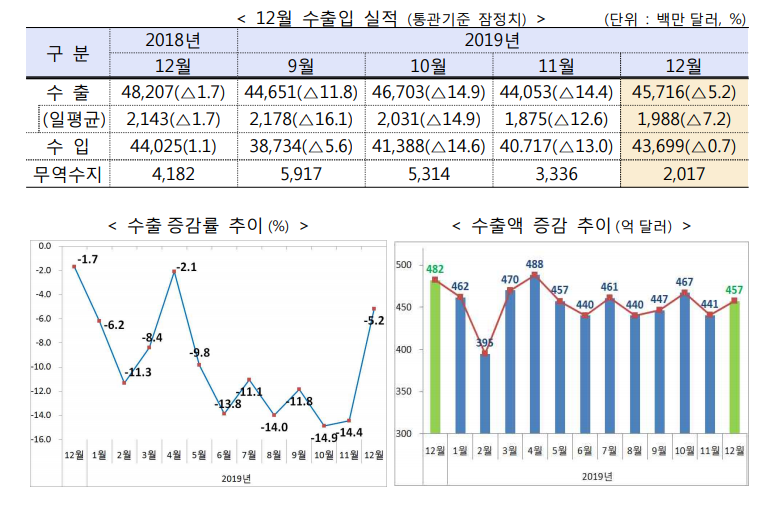

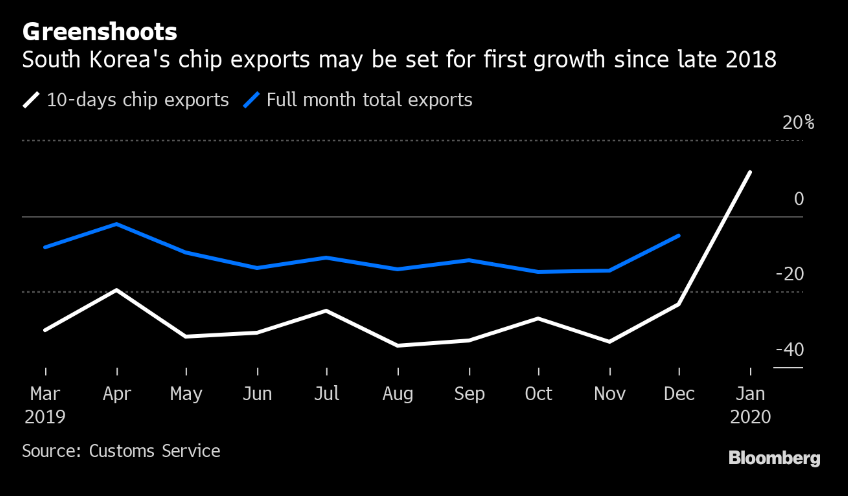

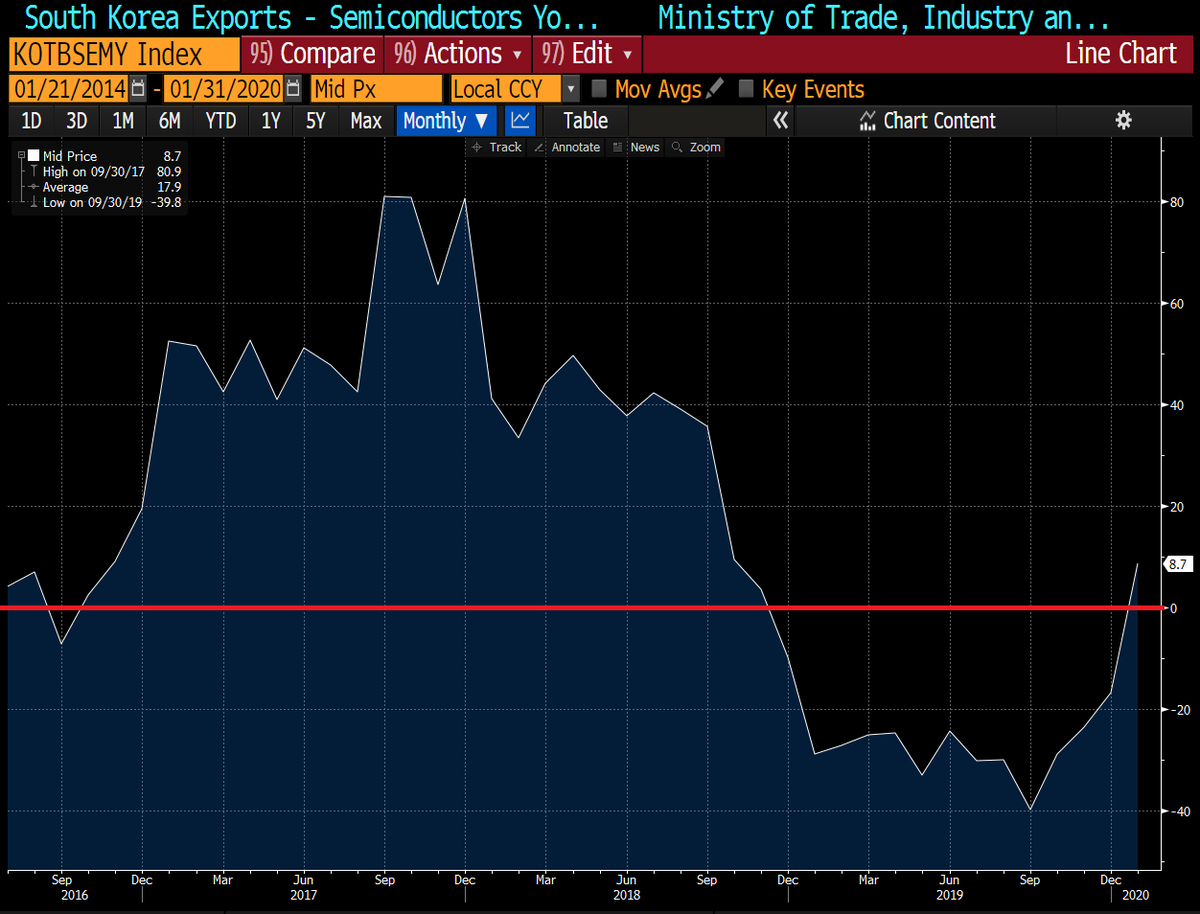

*Daily Average Y/Y: -5.1%❗ v -9.6% in Nov. 1-20

*Exports to #China Y/Y: +5.3% v -8.1% in Nov 1-20

*Semiconductor Exports Y/Y: -16.7% v -23.6% in Nov 1-20

*Link: customs.go.kr/kcshome/

1/ October: Expect a large decline YoY amid negative base effect (next release on Dec. 24th: bit.ly/2Sifylr)

wsj.com/articles/trump…

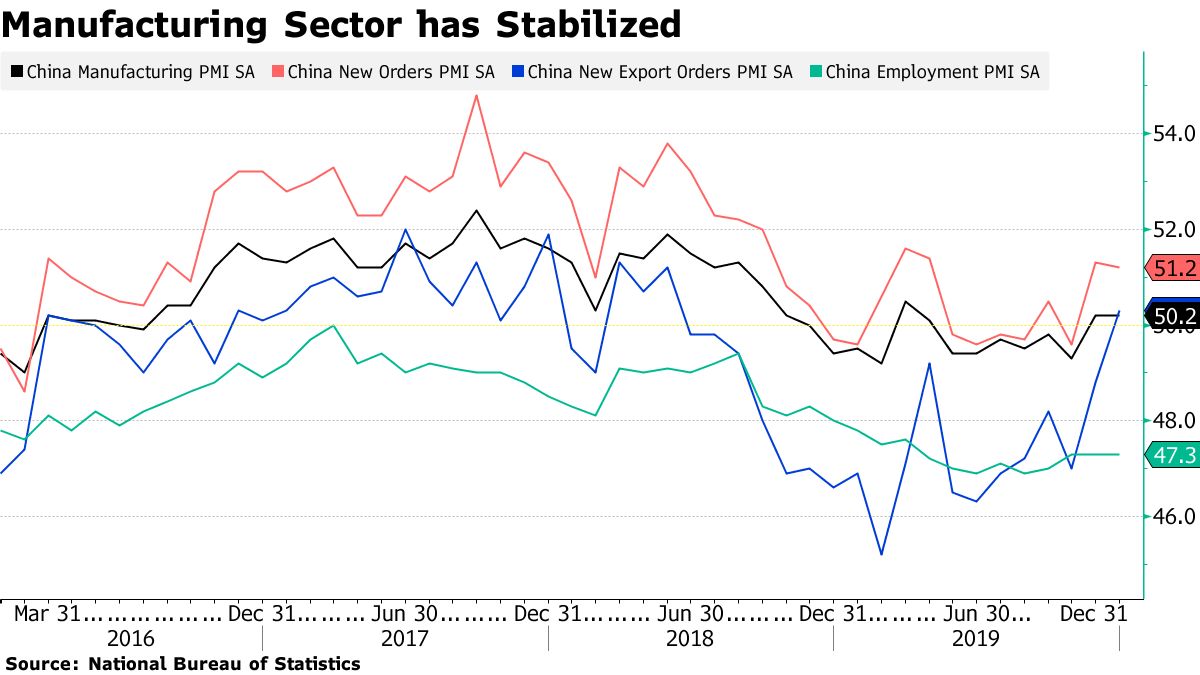

*New export orders expand for first time since May 2018❗

*Link: bloom.bg/36aXDBf

*Exports Daily Average: -7.2% v -12.6% prior

*Exports to #China: +3.3% v -12.3% prior (first gain in 14 months)

*Link: bit.ly/33EQjMa

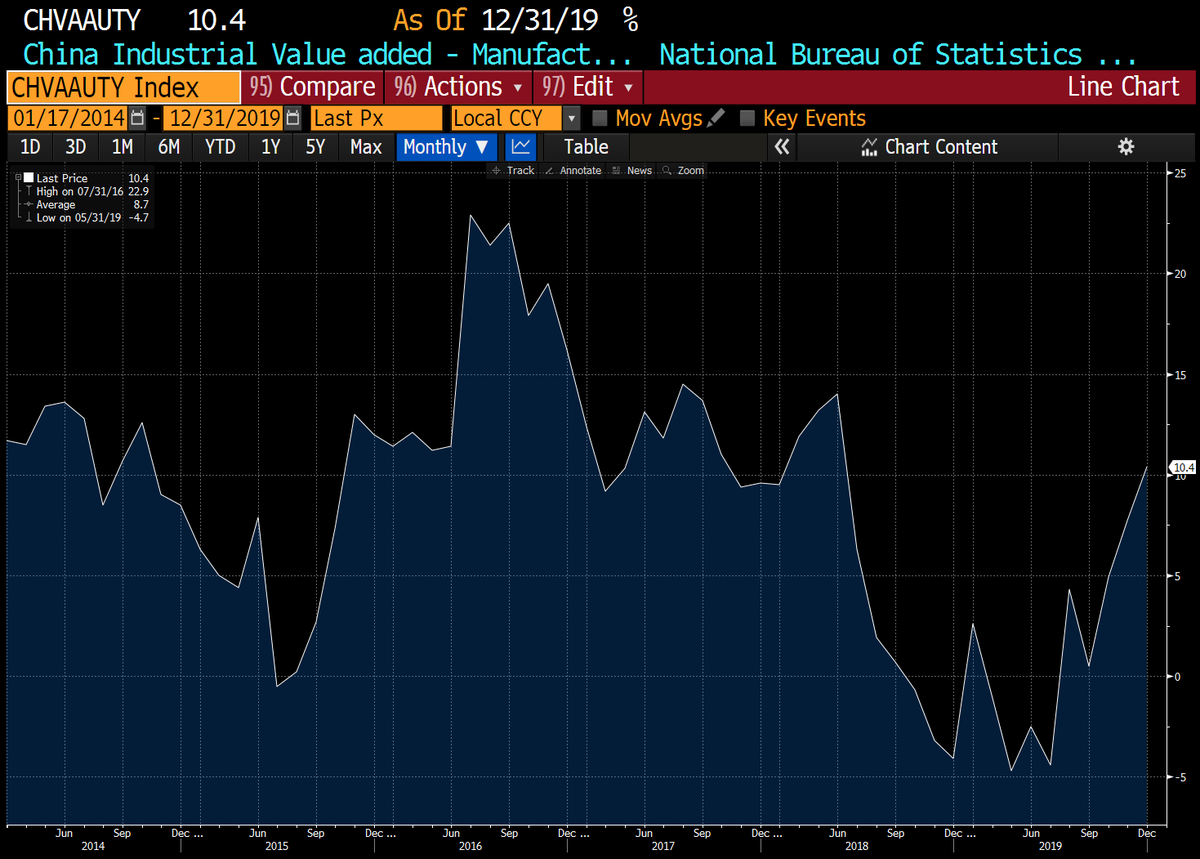

➡ The 3-month average suggests that downward pressures on global trade growth (goods) may have bottomed but persisted in 4Q19.

*Link: bit.ly/2ZHHPDR

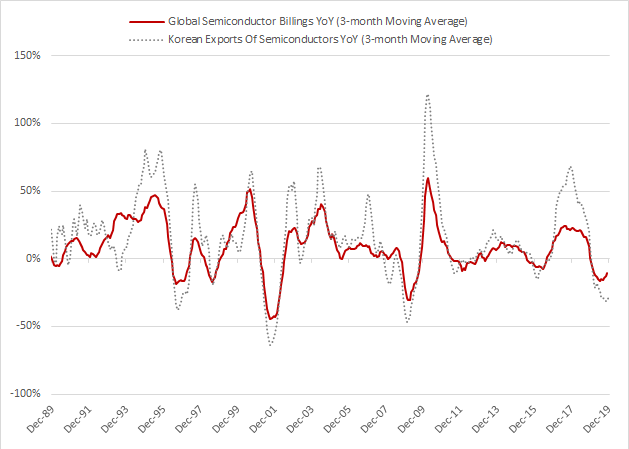

➡ It suggests that Global Billings should keep improving in December and confirms that worst is behind us.

scmp.com/economy/china-…

bloomberg.com/news/articles/…

1/ Mines run by Vale SA (in #Brazil) resumed production. The sudden ⬆ in shipments in 3Q19 has lifted demand for large ships transporting iron ore and other materials to China.

*In Dec., around 90,000 heavy trucks were sold, (9% year on YoY), exceeding industrial expectations.

*The sales rose for six consecutive months in the second half.

*Link: bit.ly/2QOu0iH

reuters.com/article/german…

reuters.com/article/us-sam…

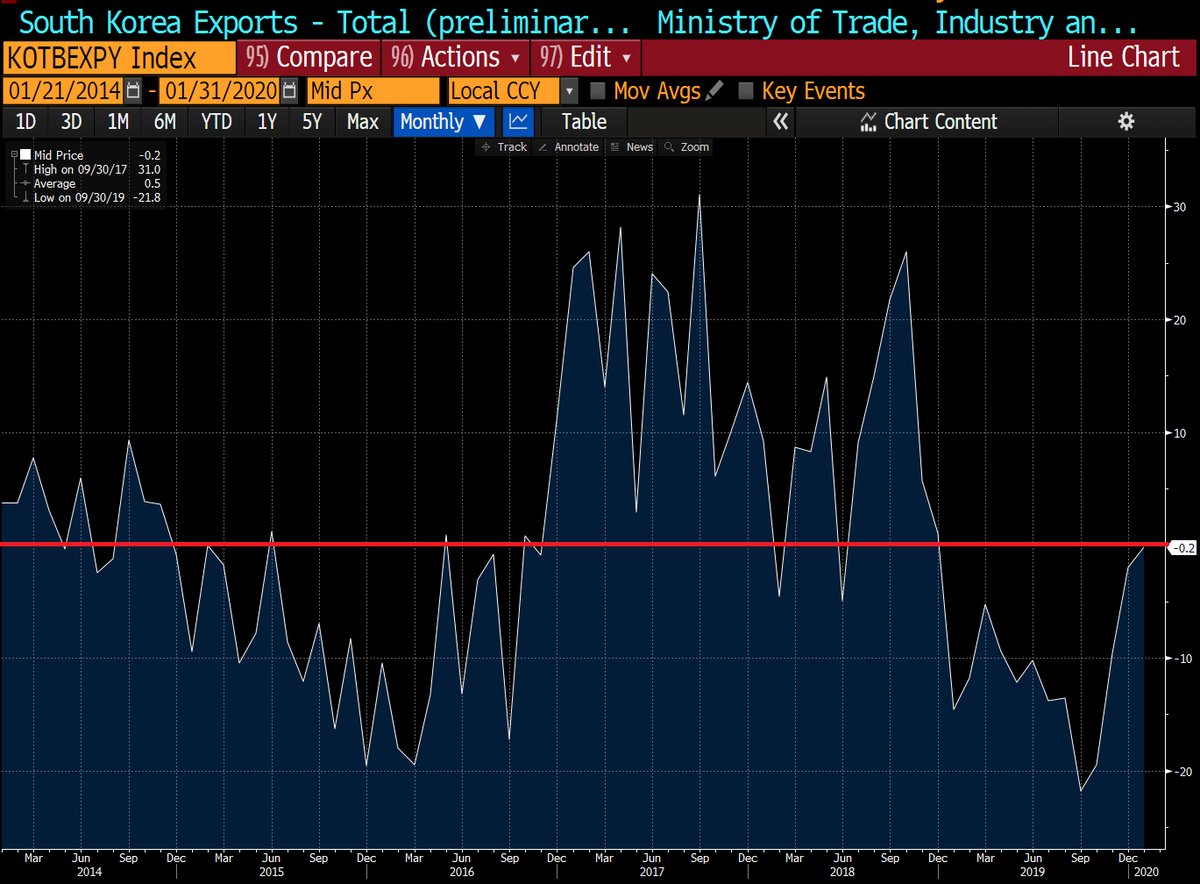

➡ It's up from -4.2% YoY in Nov. and it was the lowest decline since June 2019.

economist.com/business/2020/…

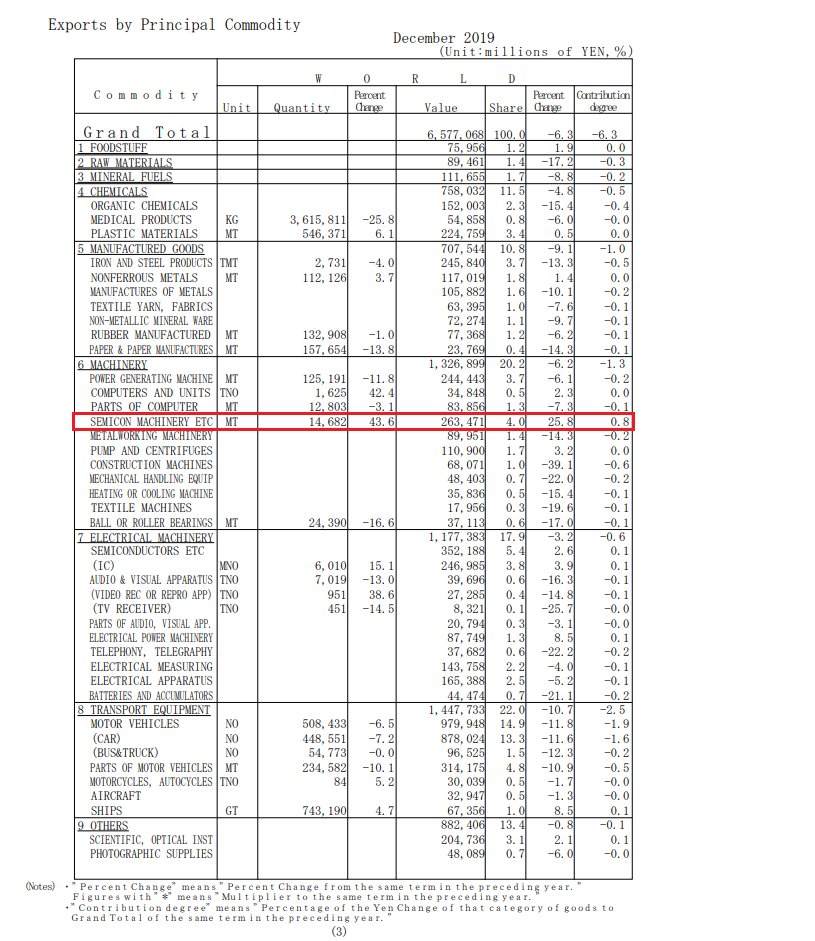

*Average Daily Exports y/y: +5.3%❗ v +0.5% prior

*#Chip Exports y/y: +11.5%❗ v -23.4% prior (1st ⬆ since Oct. 2018)

*Link (Korean): bit.ly/2TiGqlL

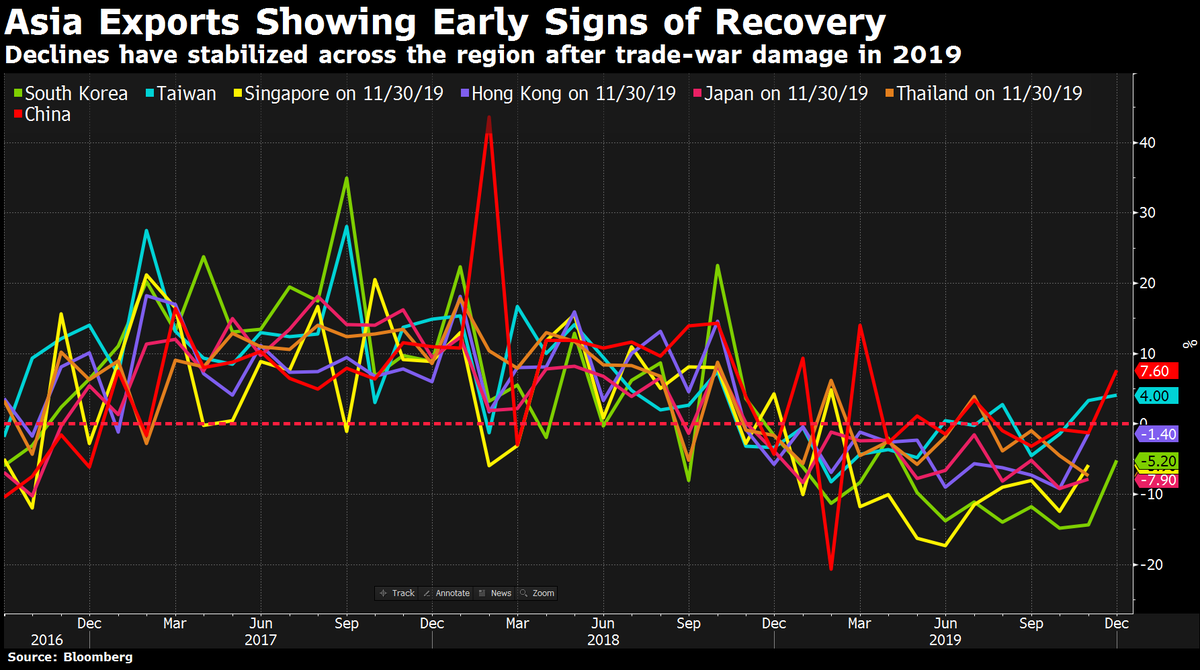

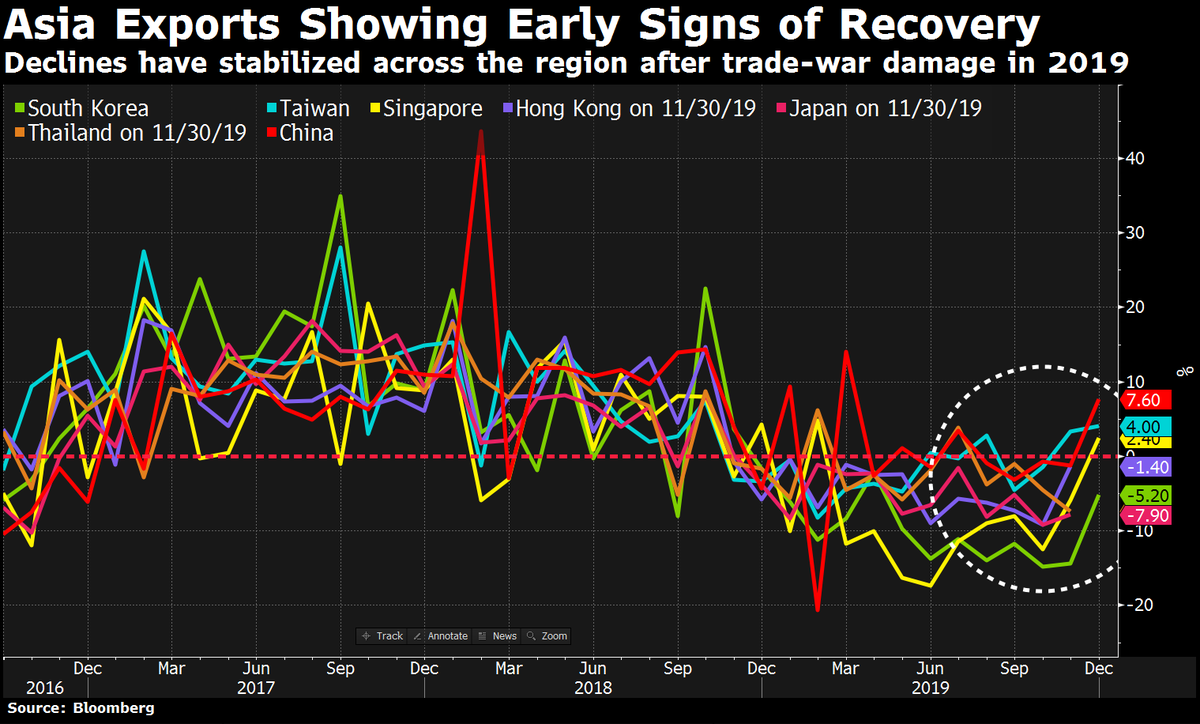

*#Taiwan Dec. exports ⬆ 4.0% Y/Y (largest ⬆ since Oct. 2018

*#SouthKorea Dec. exports ⬇ 5.2% Y/Y (smallest ⬇ since Apr. 2019)

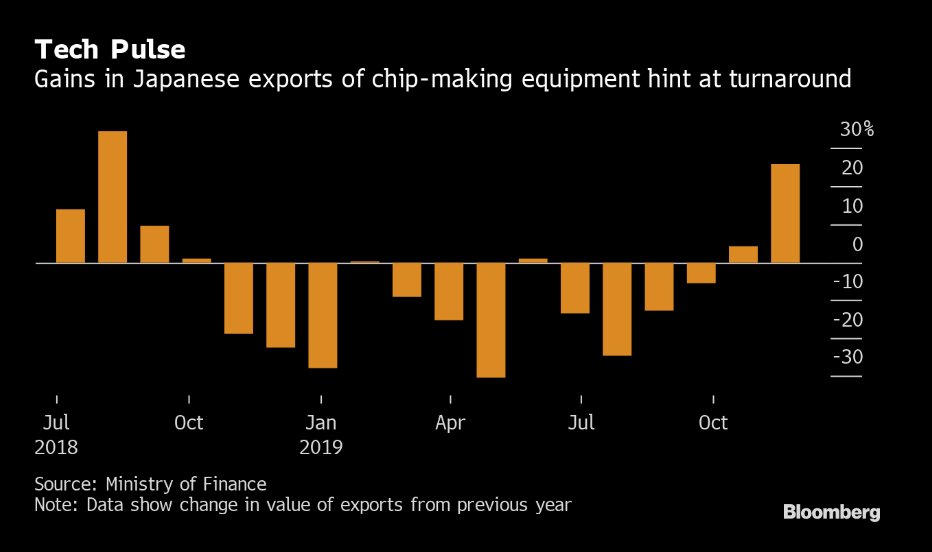

*Chart from BBG

*Link: bit.ly/36XwTod

*Bloomberg link: bloom.bg/2uMoqpI

*Link: bit.ly/36036tX

*Link (Chinese): bit.ly/2THLRLB

*It follows positive reading in #Taiwan and #China in Dec. while #SouthKorea also showed a positive print in the first 10 days of Jan (bit.ly/2R3VzWE).

*Chart from BBG

*Daily Average Y/Y: -0.2%❗ v -5.1% in Dec. 1-20

*Exports to #China Y/Y: -4.7% v +5.3% in Dec. 1-20

*Link (Korean): bit.ly/3ay6waW

*Link (Korean): bit.ly/3ay6waW

*Apple expected to launch the 4.7-inch #phone as early as March.

bloomberg.com/news/articles/…

bloomberg.com/news/articles/…

*Note: #Chip-manufacturing equipment is a leading indicator of semiconductor demand down the line.

*Link: bit.ly/37neMsi

*TI Statement: prn.to/36hsmvW

bloomberg.com/news/articles/…

cnbc.com/2020/01/23/reu…

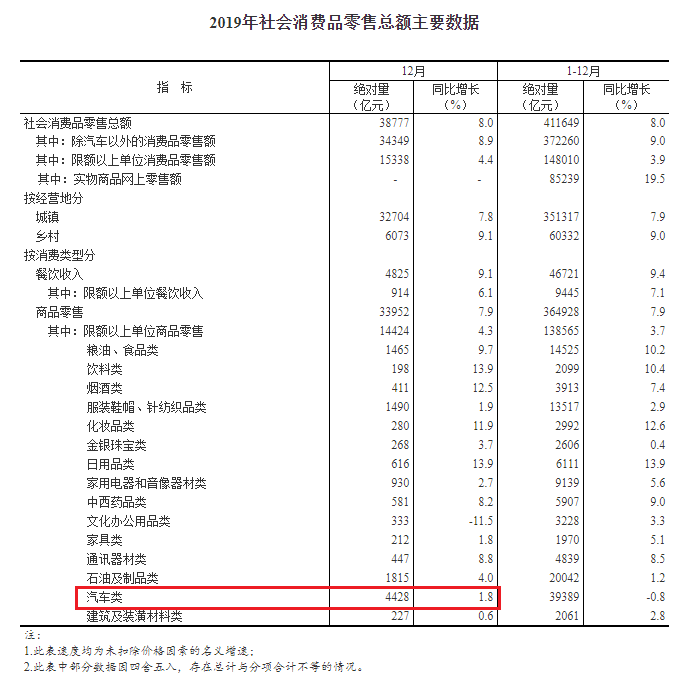

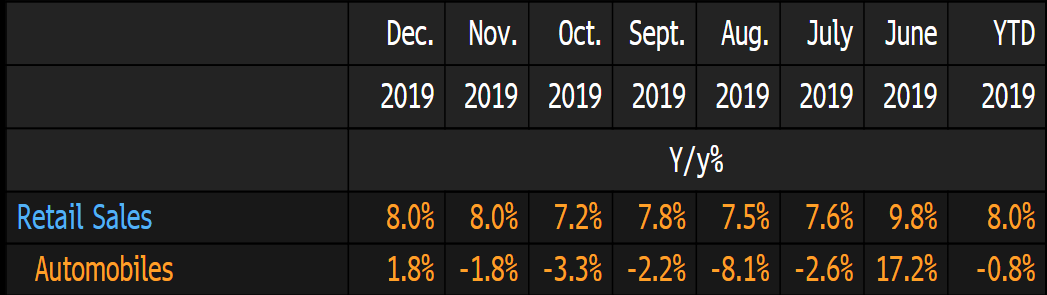

1/ The recent stabilization seen in global auto sales reflected “exceptional” gain in Europe.

*#China's biggest telecoms company asks Asian suppliers for up to a year's inventory ❗

asia.nikkei.com/Spotlight/Huaw…

*I updated the previous chart with latest data from WSTS (bit.ly/2RkEgAP) ⬇

*Link: bloom.bg/3aEEdaI

bloomberg.com/news/articles/…