Super excited to see our paper on #Covid19 #Fiscal Support and its Effectiveness, with Alexander Chudik @DallasFed & @mraissi80 @IMFNews, out in Economics Letters. You can read it (free access) from here: authors.elsevier.com/c/1dDlMbZedt0om #TGVAR 1/n

With new variants/waves & reimposition of restrictions in some regions, governments around the world are calling for a careful assessment of the effectiveness of the adopted #Covid19 #fiscal measures before they embark on further easing or tailoring of measures 2/n

The #Covid19 pandemic led to a sharp tightening of global #financial conditions at the acute phase of the crisis and has inflicted large economic losses across the world (see Figure below) ... 3/n

... with potentially lasting effects as discussed in our @voxeu piece (with Alex Chudik @DallasFed, M. Hashem Pesaran @USC, @mraissi80 @IMFNews & @arebucci1 @JHUCarey): voxeu.org/article/econom… 4/n #TGVAR

In response, govts have offered large #fiscal support packages to save lives & protect households & firms; estimated to reach $13.8 trillion globally by end 2020, $7.8 trillion in additional spending & forgone revenues & $6 trillion in equity injections, #loans & #guarantees. 5/n

The size and form of such support varies across countries depending on the impact of shocks, access to low-cost #borrowing and pre-crisis #fiscal conditions. 6/n

Meanwhile, #debt vulnerabilities are rising (particularly in emerging markets and developing countries) amid new #pandemic waves/variants and reimposition of restrictions in some regions. 7/n

It is therefore no surprise that countries are calling for a careful assessment of the effectiveness of the adopted #fiscal measures before they embark on further easing (or tailoring of measures). 8/n

Assessing effectiveness is particularly important in #emerging markets and #developing countries where limited #fiscal space should be used prudently considering the multiplicity of the shocks they face and generally weaker #institutional quality. 9/n

We contribute to the literature by quantifying the macro effects of countries' discretionary fiscal actions in response to #Covid19 in a coherent multi-country framework augmented with threshold effects to capture the impact of excessive global volatility that arose from C19 10/n

We build on the #TGVAR model (developed w/ Alex Chudik @DallasFed, Hashem Pesaran @USC, @mraissi80 @IMFNews & @arebucci1 @JHUCarey, see ideas.repec.org/p/cam/camdae/2…) & use a novel database of discretionary #fiscal measures by #governments in response to #Covid19, complied by IMF. 11/n

In our approach, we rely on

(i) @IMFNews's database of discretionary #fiscal measures in response to #Covid19 to calibrate the size of fiscal shocks in 2020; ... 12/n

(i) @IMFNews's database of discretionary #fiscal measures in response to #Covid19 to calibrate the size of fiscal shocks in 2020; ... 12/n

(ii) changes in cyclically-adjusted primary balances of countries over the past four decades to inform variations in #fiscal stances; and

(iii) generalized impulse response functions to estimate the growth effects of #Covid19 #fiscal support. 13/n

(iii) generalized impulse response functions to estimate the growth effects of #Covid19 #fiscal support. 13/n

We are concerned about the overall growth impact of #pandemic #fiscal support (while accounting for #policy spillovers) rather than whether historical changes in #budget #deficits were caused by pure discretion, automatic stabilizers, or other effects. 14/n

Our counterfactual results (see Figure below) indicate that the quarter on quarter (QoQ) real #GDP growth effects of discretionary #spending and #revenue measures in response to #Covid19 and its #economic fallout vary across regions and countries, ... 15/n

depending on country-specific factors, cross-border spillovers, and the size and composition of policy support. 16/n

Among advanced economies, we estimate that the effects are particularly large in the #UnitedStates, #Germany, and #Canada with QoQ growth impact in 2020Q2 being 7.1, 7, and 6.2 percentage points, respectively. 17/n

In the #UnitedStates, substantial #assistance to #households, #firms, and state and local #governments is estimated to have prevented worse #economic outcomes in 2020. 18/n

The large and data-dependent #fiscal support in #Canada is estimated to mitigate the negative #growth effects of the #pandemic and facilitate the post-#Covid #recovery. 19/n

#Germany's #fiscal packages, focusing initially on #healthcare #infrastructure, households (through #Kurzarbeit) and #businesses, and subsequently on the #recovery, is estimated to support #growth and contain #job losses. 20/n

While #emerging markets and #developing countries offered smaller #fiscal packages to counter the #health #crisis and support the economy than advanced economies, our results show that the QoQ growth effects of such actions are sizable and magnified by policy spillovers. 21/n

Specifically, #monetary and #financial sector policies in advanced economies have reduced global #financial market #volatility and eased #capital outflow pressures in emerging markets, and synchronized #fiscal actions globally have led to positive #growth spillovers... 22/n

Note that in contrast to single-country analyses, our global (#TGVAR) model is well suited to capture these #financial and third-market effects. 24/n

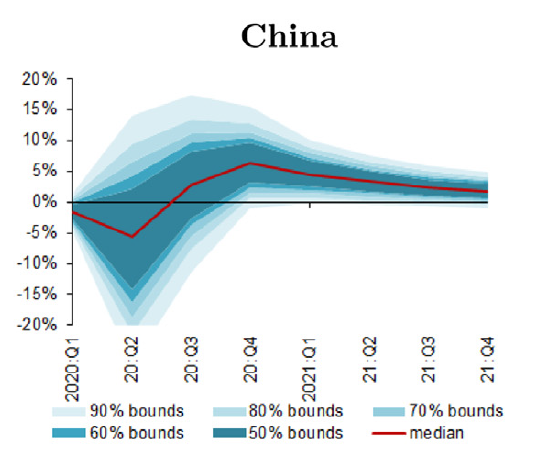

Since #China has been able to largely contain #infections earlier and adopted a forceful #public #investment push to start a #recovery, growth effects are showing up with a lag in our analysis. 25/n

Finally, at the global level, countries #fiscal actions and their spillovers are estimated to have mitigated the collapse in quarter on quarter (QoQ) global #growth in 2020Q2-Q3 by 2.7 to 2.8 percentage points. 26/n

From a policy perspective, continued #fiscal support to the economy is necessary until #vaccination is advanced 𝐠𝐥𝐨𝐛𝐚𝐥𝐥𝐲 and a recovery is underway. 27/n

A #risk management approach to policymaking would also call for activism to insure against tail events that are likely in the absence of #policy support (as depicted by the distribution of likely outcomes in the figure below). Read more here: authors.elsevier.com/c/1dDlMbZedt0om 27/27

• • •

Missing some Tweet in this thread? You can try to

force a refresh